Deducing a Formula for Compound Interest

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Compound Interest

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are going to explore compound interest. Can anyone tell me how compound interest differs from simple interest?

I think compound interest is calculated on the initial principal and also on the interest accumulated from previous periods?

Exactly! Compound interest builds upon itself, whereas simple interest is only calculated on the original principal. Let's visualize how that works.

Could you give us an example?

Of course! If you invest 100 dollars at an interest rate of 10% compounded annually, the amount after the first year is 110 dollars. But in the second year, you earn interest on the 110 dollars, not just the original 100 dollars.

So in the second year, we earn more than 10 dollars?

Correct! That's the beauty of compounding. Let's break down how we can derive a formula for calculating it.

To summarize, compound interest differs from simple interest as it accumulates on both the principal and accrued interest.

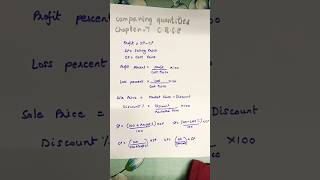

Deriving the Formula

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's derive the formula for compound interest. Suppose we have a principal amount P and a rate R% for n years. What should be our first step?

We calculate the interest for the first year, right?

Exactly! The interest earned in the first year is simply P × R/100. The total amount at the end of the first year is then A1 = P + (P × R/100). Let's write that down.

How do we continue for the second year?

Great question! The principal amount for the second year is now A1, which leads us to A2 = A1 + (A1 × R/100). Substituting A1 gives us the formula.

So the formula for the amount A can be written as A = P(1 + R/100)^n?

Right! This formula will help us calculate the total amount after n years.

To recap, the total amount after n years is derived from the expression A = P (1 + R/100)^n.

Applying the Formula to Find Compound Interest

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let's apply the formula to calculate compound interest. Suppose P = 10000, R = 5%, and n = 2. Can anyone calculate the amount?

So A = 10000 × (1 + 5/100)^2. That means A = 10000 × (1.05)^2. I'll work it out.

That equals 10000 × 1.1025, which is about 11025.

Correct! And what is the compound interest then?

The compound interest is the total amount minus the principal, so 11025 - 10000 equals 1025.

Excellent! This method can be applied to any amount, rate, and time. Always remember to subtract the principal to find the compound interest.

To summarize, we apply the formula A = P(1 + R/100)^n to find the total amount, and CI = A - P gives us the compound interest.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The section explains how to derive a formula for compound interest using specific examples and mathematical deductions. It emphasizes understanding the principles behind the calculation of compound interest compared to simple interest.

Detailed

Deducing a Formula for Compound Interest

In this section, we delve into the process of deriving a formula for compound interest, highlighting the differences with simple interest. The discussion begins with Zubeda inquiring about an easier way to determine compound interest. The teacher introduces the concept of calculating compound interest on a sum compounded annually at a certain rate.

If we consider a principal sum (P) subjected to a rate of interest (R%), the derivation involves calculating the interest accrued each year. By observing that the amount to be paid at the end of the first year (A1) includes the principal and the interest from that year, we can express this as:

A1 = P + (P × R/100)

Following this, the amount at the end of the second year builds on the first year's amount:

A2 = A1 + (A1 × R/100)

This leads to the formulation which effectively compounds the interest based on the previous year's total (P)

:

A = P (1 + R/100)^n

The section presents practical examples showing how to compute the compound interest using this newly derived formula, reinforcing the relationship between the principal, rate, and the duration in years. Notably, it concludes by demonstrating how to calculate both the total amount to be paid and the compound interest after a specified duration.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Introduction to Compound Interest Formula

Chapter 1 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Zubeda asked her teacher, ‘Is there an easier way to find compound interest?’ The teacher said ‘There is a shorter way of finding compound interest. Let us try to find it.’

Detailed Explanation

In this chunk, we learn that Zubeda is curious about finding an easier method to calculate compound interest (CI). Her teacher responds positively, indicating that there is indeed a more straightforward formula that can be used.

Examples & Analogies

Think about how sometimes you may struggle to bake a cake without a recipe. However, once you find a simpler recipe, it becomes easier for you. In the same way, Zubeda is seeking a simpler approach to calculate compound interest.

Setting up the Example

Chapter 2 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Suppose P is the sum on which interest is compounded annually at a rate of R% per annum. Let P = ₹5000 and R = 5.

Detailed Explanation

Here, we define 'P' as the principal amount, which is the initial sum of money that is the basis for interest calculations. In this case, P is specified as ₹5000 with an annual interest rate of 5% defined by 'R'. This sets the foundation for calculating the compound interest.

Examples & Analogies

Imagine you are saving money for a new bicycle. If you start with ₹5000 in a savings account that earns 5% interest, you're establishing a baseline amount from which your savings will grow.

Calculating Simple Interest for One Year

Chapter 3 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

SI = ₹5000 × 5 × 1 / 100 = ₹250.

Detailed Explanation

This chunk focuses on calculating simple interest (SI) for one year using the formula SI = P × R × T/100, where T is time in years. For the first year with a principal of ₹5000 at 5%, the calculation shows that the interest earned is ₹250.

Examples & Analogies

Consider your savings from a part-time job. If you earn ₹250 for a month as interest, each month you level up your savings by this amount. Over time, these simple interests accumulate.

Finding Total Amount after One Year

Chapter 4 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Amount at the end of 1st year = P + SI = ₹5000 + ₹250 = ₹5250.

Detailed Explanation

After calculating the simple interest for the first year, we add that interest back to the principal to find the total amount (A) at the end of one year. Here, ₹250 is added to the original ₹5000 to give a total of ₹5250.

Examples & Analogies

If you’re saving for a holiday and each month you add your $250 earnings from your part-time job, you can visually see your total savings increase. This total is like your compounded amount growing for every successful month.

Calculating Interest for the Second Year

Chapter 5 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

SI for 2nd year: SI = ₹5250 × 5 / 100 = ₹262.50.

Detailed Explanation

Now, for the second year, we use this new total amount (₹5250) to calculate the interest again. The interest increases because now it is calculated on the total amount including the previously earned interest, leading to ₹262.50 for that second year.

Examples & Analogies

Think of it like watering a plant. The more you water it (or invest), the more it grows. In this case, as your principal amount grows, so does the interest you earn.

Final Amount after Two Years

Chapter 6 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Amount at the end of 2nd year = ₹5250 + ₹262.50 = ₹6512.50.

Detailed Explanation

Finally, we add the second year's interest to the amount from the first year. This shows that the total amount at the end of two years accumulates to a larger sum due to the compound nature of the interest being calculated on an increasing principal.

Examples & Analogies

Just like a snowball gets larger as it rolls down a hill, compound interest means your savings can grow more significantly with each passing year. Every bit of interest from previous years becomes part of the new base that earns more interest.

Establishing the General Formula for Compound Interest

Chapter 7 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Proceeding in this way the amount at the end of n years will be A = P(1 + R/100)ⁿ.

Detailed Explanation

This chunk summarizes the key formula derived from the outlined steps: A = P(1 + R/100)ⁿ. It indicates that the total amount after n years is calculated by multiplying the principal amount by one plus the rate divided by 100, raised to the power of the number of years.

Examples & Analogies

Creating a recipe from your grandmother's book: each generation adds their own touch but the fundamentals remain the same. The compound interest formula is the fundamental core of managing your savings and investments.

Calculating Compound Interest

Chapter 8 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

CI = A - P = ₹15246 - ₹12600 = ₹2646.

Detailed Explanation

Finally, this chunk illustrates how to find the compound interest (CI) using the derived formula by simply considering the total amount after n years and deducting the principal. This calculation shows how much the interest has truly contributed to the total growth of the investment.

Examples & Analogies

Consider it like checking the profit from your lemonade stand after a season—by determining how much you’ve earned over your initial investment, you can gauge the success of your efforts.

Key Concepts

-

Compound interest builds on itself, unlike simple interest.

-

The formula for calculating compound interest is A = P(1 + R/100)^n.

-

CI is calculated by subtracting the principal from the total amount.

Examples & Applications

Example: If the principal is 10000 with a rate of 5% for 2 years, the formula gives A = 10000 × (1 + 0.05)^2 = 11025; thus, CI = 11025 - 10000 = 1025.

Example: A principal of 5000 at a rate of 8% for 3 years results in A = 5000 × (1.08)^3 ≈ 6300, leading to CI = 6300 - 5000 = 1300.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

For interest that compounds over time, remember the formula, it's not a crime!

Stories

Imagine investing $100 at 5%. After year one, you earn $5. In year two, you earn more than a dollar, as it's on the total including your prior dollar!

Memory Tools

P-A-R: Principal Amount, Rate, Amount.

Acronyms

C.I. = Compound Interest

Calculate Including previous interest.

Flash Cards

Glossary

- Principal (P)

The initial sum of money on which interest is calculated.

- Compound Interest (CI)

Interest calculated on the accumulated amount, including both the principal and previously earned interest.

- Rate (R)

The percentage at which interest is calculated, typically expressed annually.

- Amount (A)

The total amount of money accumulated after n years, including interest.

- n years

The number of years for which interest is compounded.

Reference links

Supplementary resources to enhance your learning experience.