Equivalent Annual Cost Calculation

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Equivalent Annual Cost

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to learn about Equivalent Annual Cost or EAC. EAC helps us understand how much we need to allocate annually for the purchase and maintenance of equipment. Can anyone tell me why it's important to calculate this?

I think it helps in budgeting for equipment costs.

Absolutely! It gives us a clearer picture of long-term costs versus short-term expenditure. Now, remember the acronym EAC for Equivalent Annual Cost. Can anyone give an example of costs that fall under this category?

Purchase price, maintenance, and maybe salvage value?

Exactly! These are the key elements we will focus on today. Let's move into how we calculate EAC for these components.

Calculating EAC for Purchase Price

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

First, let’s tackle the purchase price. If we have a purchase price of 35,00,000 and an interest rate of 15%, what might be the first step to calculating EAC?

We need to find the USCRF?

Right! The Uniform Series Capital Recovery Factor or USCRF is key. The formula we use is: $USCRF = rac{i(1+i)^n}{(1+i)^n - 1}$. For three years, it turns out to be 0.4380. What does this USCRF do when multiplied with the purchase price?

It gives us the annualized cost?

Correct! So, $EAC = 0.4380 imes 35,00,000$ gives us 15,33,000 rupees per year. Now, why is understanding this number vital in managing equipment?

It helps to compare other options like operating costs!

Very good! Understanding these costs helps businesses make informed replacement decisions.

O&M Cost Calculation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's talk about operating and maintenance costs. If we have an O&M cost of 1,13,200 for year 1, how do we convert this to present worth?

We can use the present worth factor?

Yes! Using the present worth factor of 0.8696, how do we calculate?

It would be $P.W = 1,13,200 imes 0.8696$ which gives us 98,438.72 rupees.

Great job! This present worth is essential for determining the EAC of O&M costs. Who can describe what we do next to get the EAC?

We multiply the present value with the USCRF?

Exactly! Each year's O&M costs must be converted in a similar manner to keep track of total costs over its lifetime.

Salvage Value and Total EAC Calculation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s discuss what happens to the salvage value. Why is this important when we discuss EAC?

It’s the cash we get back when we’re done using the equipment, right?

Correct again! This cash inflow must ultimately factor into our total cost calculations. If we calculate EAC for the salvage value too, how will that impact our total EAC?

It would reduce the total EAC because it’s a positive cash flow.

Exactly! So, we add the EAC of the purchase price and the EAC of the O&M costs, then subtract the EAC of salvage value. That way we can clearly see our total costs.

So the process helps identify the optimal time for replacing equipment?

Exactly right! That’s the essence of what we’re learning here. Always remember to assess these calculations to identify the economic lifespan!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, we explore how to compute the equivalent annual cost for machinery by involving the purchase price, operating and maintenance costs, and the salvage value. We utilize formulas like the Uniform Series Capital Recovery Factor (USCRF) to calculate these costs over a period, demonstrating their significance in determining the economic life of equipment.

Detailed

Detailed Explanation of Equivalent Annual Cost Calculation

Equivalent Annual Cost (EAC) is a crucial concept in financial decision-making for equipment management. This section delves into the methodologies of calculating EAC through various costs associated with machinery, primarily focusing on:

- Purchase Price: The initial outlay required for acquiring the machine, followed by the application of the Uniform Series Capital Recovery Factor (USCRF) to determine the annualized cost for a specific lifespan. For instance, with a purchase price of 35,00,000 rupees and a 15% interest rate, the EAC is calculated using:

- $EAC = USCRF imes Purchase ext{ }Price$, where $USCRF = 0.4380$

- Therefore, $EAC = 0.4380 imes 35,00,000 = 15,33,000$ rupees annually.

- Operating & Maintenance (O&M) Costs: The annual O&M costs must also be converted into a present worth before determining their EAC. This involves:

- Calculating the present worth factor corresponding to the O&M cost (e.g., 1,13,200 rupees for year one) using:

- $P.W = O&M imes Present Worth Factor$

- For example, $P.W = 1,13,200 imes 0.8696 = 98,438.72$ rupees.

- Subsequently, this present worth is converted to EAC using the USCRF. The process is repeated for subsequent years.

- Salvage Value: The final calculation involves determining the equivalent annual cost associated with the resale or salvage value of equipment. This requires calculating its present worth and then using the USCRF to derive the EAC. The nature of the cash flows (inflows vs. outflows) will ultimately depend on whether you add or subtract these values in the total cost estimation.

This comprehensive analysis culminates in recognizing the economic life of the machine, guiding firms in effective replacement strategies to minimize costs over time.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Calculating Equivalent Annual Cost for Purchase Price

Chapter 1 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

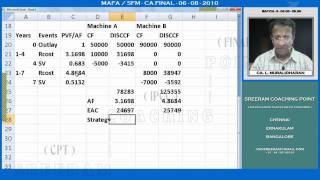

So, now we have to find the equivalent annual cost for the third year of the purchase price 3500000

for year 3,

𝑨 𝒊(𝟏+𝒊)𝒏 𝟎.𝟏𝟓(𝟏+𝟎.𝟏𝟓)𝟑

USCRF = = = = 0.4380

(𝟑𝟓𝟎𝟎𝟕𝟎𝟎,𝟎.𝟏𝟓,𝟑) (𝟏+𝒊)𝒏−𝟏 (𝟏+𝟎.𝟏𝟓)𝟑−𝟏

EAC = 0.4380 × 35,00,000 = 15,33,000 rupees.

Detailed Explanation

To calculate the Equivalent Annual Cost (EAC) for a purchase price, we apply the formula involving the Uniform Series Capital Recovery Factor (USCRF). In this case, for year 3, the USCRF is calculated based on the interest rate (15%) and the number of years (3). The EAC is obtained by multiplying the USCRF by the purchase price (3,500,000 rupees), yielding an EAC of 1,533,000 rupees for the third year. This process is essential for businesses to evaluate the annual cost of an investment over its lifespan.

Examples & Analogies

Imagine you buy a new car for 35,00,000 rupees. If you want to figure out how much that car costs you every year over a period of three years, you'd divide the total cost by how many years you will use it and account for interest on that cost. This is similar to how you figure out what the EAC is - it's like breaking down the total cost into manageable yearly expenses.

Calculating Present Worth of Operating and Maintenance Costs

Chapter 2 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Now let us find the equivalent annual cost of the operating and the maintenance cost. So, how to find the equivalent annual cost let us go back to the cash flow diagram. So, this 1,13,200 is operating and maintenance cost at the end of year 1. Now you convert it into t = 0, how to convert it into t = 0, find the present worth? So, find the present worth of 1,13,200.

Detailed Explanation

To find the equivalent annual cost of operating and maintenance costs, we first determine the present worth of these costs. For instance, if the operating and maintenance cost is 113,200 rupees at the end of year 1, we need to convert it to the present value (t=0) using the present worth factor for the specified interest rate and time. This entails multiplying the future cost by the present worth factor, yielding a present worth value that serves as the basis for further calculations.

Examples & Analogies

Think of it like saving money for a future trip. If you plan to spend 1,13,200 rupees next year, to understand how much that would be worth today, you'd apply a present value concept. It's like how much you need to save today, given that money can earn interest over time, to have the same amount next year.

Cumulative Operating and Maintenance Costs

Chapter 3 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Now you add the cumulative, so find the cumulative operating and maintenance cost. So, now, next thing is we are going to find the equivalent annual cost of the present worth of the operating and maintenance cost.

Detailed Explanation

Once the present worth of operating and maintenance costs is established, we proceed to combine these values to derive a cumulative total. This total is then essential for calculating the equivalent annual cost over the lifespan of the equipment. The equivalent annual cost allows us to understand what portion of our annual budget should be allocated toward these operating costs in the future.

Examples & Analogies

If you've had several expenses for your car maintenance over several years - like oil changes, new tires, etc. - you would total them together to understand how much that car costs you to maintain annually. This totals into a cumulative cost that can be used for future budgeting.

Finding Equivalent Annual Cost Using USCRF

Chapter 4 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Now we are going to find the A, equivalent A for this P, so how to do that? A = P × USCRF. So, this factor you multiply it by the operating and the maintenance cost present value that is 98,438.72.

Detailed Explanation

After determining the present worth of operating and maintenance costs, the next step is to convert that total into an equivalent annual cost using the USCRF. This involves multiplying the present worth value (98,438.72 rupees) by the USCRF corresponding to the interest rate and the period under consideration. This effectively spreads the total present worth cost over the desired timeframe, giving a clearer picture of annual financial expectations.

Examples & Analogies

Consider your favorite subscription service that charges a one-time fee for a year but provides monthly benefits. To understand how much you effectively pay each month, you take the total fee and divide it by the number of months, thus giving you a clear monthly cost reflecting the annual total.

Calculating Equivalent Annual Cost for Resale Value

Chapter 5 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Now let us find the equivalent annual cost of the resale value, that is your salvage value. So, now we are going to calculate the present value of the resale value.

Detailed Explanation

To compute the equivalent annual cost of the resale (or salvage) value, we first need to determine its present value. This involves applying the present worth factor similarly as before to the expected resale value at the end of its useful life. Once we have the present worth, we can then convert that value to an equivalent annual cost using the same approach we previously applied.

Examples & Analogies

If you decide to sell an old phone, the money you receive is your resale value. But depending on when you sell it, its value may differ. Understanding its current worth helps you assess how to factor that into your overall budget when planning to buy a new phone.

Summarizing Total Equivalent Annual Costs

Chapter 6 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Now you can find the total cost. So, how to find the total cost? You are supposed to add the purchase price and the operating and maintenance cost, your salvage value is in flow cash inflow, so you subtract it.

Detailed Explanation

The final step involves summing the equivalent costs calculated throughout the previous sections to derive the total equivalent annual cost. This total aligns the investment and expected operational expenses while factoring in the resale value as a cash inflow, giving a holistic view of the economic implications of the investment.

Examples & Analogies

It's like preparing a yearly budget where you account for all your spending and income. You list your fixed costs (like rent or car payments), add additional costs (like groceries), and subtract any expected income (like bonuses from work) to ensure you understand your financial situation over the year.

Key Concepts

-

EAC: Represents the annualized cost structure of a machine, crucial for budgeting and financial planning.

-

USCRF: A critical tool to annualize lump sum costs over time considering interest rates.

-

Present Worth: Provides insights into future costs and cash flows in today's money, enhancing accuracy in financial forecasting.

-

Salvage Value: A necessary component that can significantly reduce the overall financial burden if accounted for correctly.

-

O&M Costs: Essential for understanding the complete financial implications of equipment over its lifespan.

Examples & Applications

If an asset has a purchase price of 1,000,000 rupees and an expected life of 5 years with an interest rate of 10%, the EAC can be calculated as EAC = USCRF × Purchase Price, leading to annual allocations for financial planning.

A machine with an annual O&M cost of 50,000 rupees that lasts for 3 years would have its present worth calculated to establish a foundation for further EAC calculations.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To find the EAC with ease, remember USCRF’s keys, add costs with a smile, save cash for a while.

Stories

Imagine a company named Cost Co., analyzing their machines. They learned EAC helped them choose wisely when to swap their equipment for better savings.

Memory Tools

M.O.S. (Maintenance, Operating, Salvage) helps remember what to include in EAC calculations!

Acronyms

EAC = Every Annual Cost! This means keeping all costs in mind!

Flash Cards

Glossary

- Equivalent Annual Cost (EAC)

The annual cost of owning and operating an asset over its useful life, including purchase, operating, maintenance, and salvage costs.

- Uniform Series Capital Recovery Factor (USCRF)

A factor used to convert total costs into an equivalent annual amount over a specified time period at a certain interest rate.

- Present Worth

The current value of a cash flow received in the future, discounted to the present based on an interest rate.

- Salvage Value

The estimated resale value of an asset at the end of its useful life.

- Operating and Maintenance (O&M) Costs

The ongoing costs for operating and maintaining an asset throughout its lifespan.

Reference links

Supplementary resources to enhance your learning experience.