ICSE Class 12 Accounts – Chapter 5: Ratio Analysis

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Ratios

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome, class! Today we will explore Ratio Analysis. To start, can anyone tell me what a ratio is?

Isn't a ratio a relationship between two figures?

Exactly right! A ratio is a quantitative relationship between two numbers. In accounting, we use it to help simplify and analyze financial statements.

Can you give us an example of a ratio?

Sure! For instance, the Current Ratio, which is calculated by dividing Current Assets by Current Liabilities. This helps determine the company's short-term financial strength.

What's an ideal current ratio?

The ideal Current Ratio is typically 2:1, meaning a company should have twice as many current assets as current liabilities!

That's helpful to remember! Thanks!

Great! So, to summarize, ratios like the Current Ratio help us assess short-term financial health, allowing for better-informed decisions.

Objectives of Ratio Analysis

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now moving on, can anyone state the objectives of Ratio Analysis?

One of the objectives is to simplify complex accounting data.

Correct! Simplification is key. It also helps in analyzing the financial performance of a firm.

What about decision-making? How does it help?

Excellent question! By providing insights into financial health, Ratio Analysis enables stakeholders—like investors—to make informed decisions regarding investments.

And assessing strengths and weaknesses, right?

Yes! That's vital. It helps identify the areas where the business excels and where improvements are needed.

This really emphasizes the importance of analysis!

Absolutely! To summarize, Ratio Analysis simplifies data, helps in performance evaluation, supports decision-making, and assesses a firm's strengths and weaknesses.

Types of Ratios

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's dive into the types of ratios we have in accounting. Who can list some categories?

I remember Liquidity Ratios!

Great! Liquidity Ratios measure a firm's ability to meet short-term obligations. What's an example?

The Quick Ratio!

Right! Now, what about Solvency Ratios?

They evaluate long-term obligations, like the Debt-Equity Ratio.

Exactly! The Debt-Equity Ratio indicates how much debt a company is using to finance its assets relative to equity.

What about Profitability Ratios? How do they fit in?

Profitability Ratios measure the income a firm generates relative to its sales or investments. A key example is the Net Profit Ratio.

To summarize, we have Liquidity Ratios, Solvency Ratios, Activity Ratios, and Profitability Ratios, each serving a specific purpose in financial analysis.

Uses and Limitations of Ratio Analysis

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

So, what are the uses of Ratio Analysis that we should remember?

It aids in assessing financial soundness!

That's right! It also assists in trend analysis over multiple periods.

What about comparisons with other firms?

Correct! It facilitates inter-firm comparisons. Now, how about some limitations? What can go wrong?

It doesn't consider qualitative factors!

Absolutely! Care must be taken since qualitative factors can significantly affect financial analysis.

Historical data is another issue, right?

Yes, relying on historical data can mislead if the business environment changes significantly. Overall, while Ratio Analysis is invaluable, one must be cautious of these limitations.

To summarize, Ratio Analysis is extremely useful for assessing a company's health but remember to consider its limitations like qualitative factors and historical dependence.

Key Takeaways

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

As we conclude, let's summarize the key points covered in Ratio Analysis.

We learned that ratios simplify complex data and assist in analyzing financial health.

Correct! And they fall into different categories like liquidity and profitability.

We also discussed the important role stakeholders play when using this analyses.

Exactly! Finally, let's not forget the limitations which remind us to use these tools wisely.

I feel more prepared to analyze financial statements now!

That's wonderful to hear! Remember, a strong grasp of Ratio Analysis will serve you well in your future business endeavors!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Introduction to Ratio Analysis

Chapter 1 of 1

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Ratio Analysis is a powerful financial tool used to interpret and analyze the financial statements of a business. It simplifies complex accounting figures and helps stakeholders—like investors, creditors, and management—understand the financial health and performance of an enterprise. This chapter explains various types of accounting ratios and how they assist in making informed business decisions.

Detailed Explanation

Ratio Analysis serves as a crucial method for understanding financial statements. By converting raw data into understandable relationships, it provides insights into a company's financial performance. Stakeholders like investors, creditors, and management can gauge how well the company is performing and whether it's a good investment. Various accounting ratios provide different insights, aiding in decision-making processes.

Examples & Analogies

Think of Ratio Analysis like a fitness report. Just as a health report helps you understand your physical condition—like body mass index, cholesterol, and blood pressure—financial ratios help stakeholders assess the financial health of a business, indicating strengths or areas that need improvement.

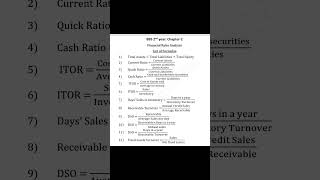

Key Concepts

-

Ratio Analysis: A tool used to analyze and interpret financial statements.

-

Liquidity Ratios: Measure ability to meet short-term obligations.

-

Debt-Equity Ratio: A solvency measure comparing total debt to equity.

-

Profitability Ratios: Indicator of financial performance relative to sales and equity.

Examples & Applications

Current Ratio Calculation: If Current Assets are ₹1,00,000 and Current Liabilities are ₹50,000, the Current Ratio is ₹1,00,000/₹50,000 = 2:1.

Net Profit Ratio: If Net Profit is ₹20,000 and Net Sales are ₹1,00,000, then Net Profit Ratio is (₹20,000/₹1,00,000) * 100 = 20%.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Liquidity ratio, two to one, helps show, short-term funds on the run.

Stories

Imagine a firm with 10 apples but owed 5 oranges; the apples represent current assets, ensuring all can be paid when due! This shows liquidity.

Memory Tools

L-SAP for remembering Ratio types: Liquidity, Solvency, Activity, Profitability.

Acronyms

R-A-P-S for remembering Ratio Analysis parts

Ratios

Analysis

Performance

Stakeholders.

Flash Cards

Glossary

- Ratio

A quantitative relationship between two amounts expressed as a fraction.

- Liquidity Ratio

Ratios that measure a firm's ability to meet its short-term obligations.

- DebtEquity Ratio

A solvency ratio that indicates the proportion of debt to equity in a company's capital structure.

- Profitability Ratio

Ratios that assess a business's ability to generate profit in relation to its revenue, assets, or equity.

- Operating Ratio

Calculates the percentage of revenue that constitutes operating expenses.

- Current Ratio

Measures a company's ability to pay short-term obligations with current assets.

- Quick Ratio

Also known as the Acid-Test Ratio, evaluates liquidity without considering inventory.

- Earnings per Share

The portion of a company's profit allocated to each outstanding share of common stock.

Reference links

Supplementary resources to enhance your learning experience.