Importance of Understanding Accounting Systems

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Monitoring Business Performance

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's start with monitoring business performance. Understanding your accounting system allows you to gauge how well the business is doing financially. Can anyone tell me why this is important?

It's important because it helps businesses make informed decisions!

Exactly! By tracking revenue and expenses through these systems, you can identify trends and make adjustments. Remember, 'CASH' stands for 'Comprehensive Assessment of Sales and Health!'

So, monitoring really helps in spotting any financial issues before they become major problems?

Absolutely! Monitoring helps catch issues early. Let's move to the next point.

Building Financial Discipline

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Another key benefit is building financial discipline. Can anyone share how accounting systems achieve this?

By keeping track of all transactions accurately?

Exactly! This encourages businesses to be responsible with their finances. Think of the acronym 'SAVE' - 'Systematic Accounting Valuing Expenditures'!

So, it helps in budgeting too, right?

Yes, it does! Financial discipline ensures businesses maintain good cash flow and make informed spending choices.

Transparency and Audit

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s talk about transparency and audits. Why are these important in accounting?

Because they build trust among stakeholders!

Correct! Transparency in accounting systems allows for external audits, which can validate a company's financial statements. Remember the mnemonic 'TAPE' - 'Trust And Proof of Earnings!'

That makes sense! It shows that the company is honest about its financial situation.

Exactly! Transparency not only builds trust but can also attract investors.

Budgeting and Forecasting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, how do accounting systems assist in budgeting and forecasting?

They provide accurate data about past and present financial operations!

Exactly! With this data, businesses can predict future financial conditions, using 'PLAN' - 'Prepare, Look Ahead, Analyze Numbers.'

So, forecasting helps plan for expenses and revenue?

Right! It enables better decision-making regarding investments and resource allocation.

Tax Filing and Compliance

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Lastly, let’s discuss how accounting systems make tax filing easier. Why is this crucial?

Because it helps avoid legal issues!

Absolutely! An organized accounting system simplifies the filing process. Think of the acronym 'SAFE' - 'Simplified Accounting for Filing Ease!'

So if our records are clean, tax filing becomes stress-free?

Exactly! It ensures compliance and reduces the chance of errors.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Grasping the importance of accounting systems is essential for businesses, as these systems aid in tracking performance, building financial discipline, ensuring transparency for audits, and simplifying the budgeting process. They also make tax compliance more manageable.

Detailed

In today's competitive business environment, understanding accounting systems is vital for any business's survival and growth. Effective accounting systems enable monitoring of business performance, fostering financial discipline that is necessary for responsible management. They contribute to transparency and accountability, which are crucial for audits and maintaining stakeholder trust. Moreover, accounting systems aid in budgeting and forecasting, ensuring that businesses can plan effectively for the future. Lastly, they simplify tax filing and compliance, making it easier to adhere to legal requirements and avoid penalties.

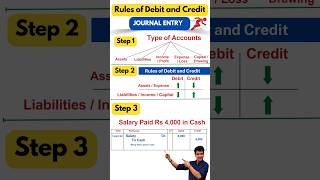

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Monitoring Business Performance

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Helps in monitoring business performance

Detailed Explanation

Understanding accounting systems allows business owners and managers to keep track of how the business is performing financially. This involves regularly reviewing financial statements, such as the profit and loss statement, to assess whether the business is making a profit or incurring losses. By monitoring performance, businesses can make informed decisions to improve operations and strategically plan for the future.

Examples & Analogies

Think of it like a fitness tracker. Just as a fitness tracker monitors your daily steps, heart rate, and calories burned to help you maintain your health, accounting systems keep track of financial data to help a business maintain its financial health.

Building Financial Discipline

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Builds financial discipline

Detailed Explanation

A solid understanding of accounting systems fosters financial discipline within an organization. When employees and managers are aware of budgeting processes and accounting systems, they become more mindful about spending and resource allocation. This discipline leads to better financial management and helps avoid unnecessary expenditures.

Examples & Analogies

Imagine creating a monthly household budget. It helps you limit your spending on non-essential items and ensures you save for important expenses. Similarly, understanding accounting systems encourages businesses to stick to budgets and maintain financial discipline.

Transparency and Audit

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Essential for transparency and audit

Detailed Explanation

Accounting systems are crucial for maintaining transparency within a business, which is vital for trust among stakeholders, including investors, employees, and customers. A well-implemented accounting system ensures that all financial transactions are accurately recorded and can be audited. This process of auditing confirms the integrity and accuracy of the financial statements, which is especially important for compliance with legal requirements.

Examples & Analogies

Consider a transparent glass jar containing cookies. It allows anyone to see how many cookies are inside and ensures there are no hidden surprises. Similarly, an effective accounting system offers transparency in financial dealings, making it easy for auditors or stakeholders to verify the business's financial condition.

Budgeting and Forecasting

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Aids in budgeting and forecasting

Detailed Explanation

Understanding accounting systems is invaluable when it comes to budgeting and forecasting future financial performance. By analyzing past financial data, businesses can project future revenues and expenses, which assist in budget creation. Accurate forecasts help in planning resource allocation for future projects or expansions.

Examples & Analogies

Think of it like weather forecasting. Meteorologists analyze past weather patterns to predict future weather events. Similarly, businesses analyze past accounting data to predict financial outcomes and prepare budgets accordingly.

Tax Filing and Compliance

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Makes tax filing and compliance easier

Detailed Explanation

A strong understanding of accounting systems simplifies the complexities of tax filing and ensures compliance with tax laws. When a business accurately maintains its financial records, it becomes easier to calculate taxable income and prepare tax returns, reducing the risk of errors and potential audits by tax authorities.

Examples & Analogies

Consider organizing your paperwork for a tax return. If everything is neatly categorized and documented, it becomes easier to file taxes accurately. In the same way, a well-maintained accounting system ensures that all financial records are organized for easy access during tax season.

Key Concepts

-

Monitoring Business Performance: The ability to track and assess financial performance over time.

-

Financial Discipline: The adherence to responsible financial practices.

-

Transparency: Providing clear visibility of financial data to stakeholders.

-

Audit: An examination of financial records to ensure compliance and accuracy.

-

Budgeting: The preparation of estimates for future financial performance.

-

Forecasting: Predicting future financial conditions based on historical data.

-

Tax Compliance: Ensuring that business tax obligations are met accurately and promptly.

Examples & Applications

A business uses accounting systems to track sales monthly, allowing it to make informed decisions about inventory management.

During the annual audit, a company is able to present clear and accurate financial statements thanks to their organized accounting system.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To keep finances on track, monitoring's the key, it helps see the trends, just watch and you'll see!

Stories

Imagine a farmer who tracks every seed they plant and every grain they harvest. By doing so, they know which crops yield the best results, mirroring how businesses monitor performance.

Memory Tools

Use 'TAPE' for Transparency And Proof of Earnings, helping you remember its importance in audits.

Acronyms

SAVE - Systematic Accounting Valuing Expenditures, reinforces the need for financial discipline.

Flash Cards

Glossary

- Monitoring

The process of observing and checking the progress or quality of something over a period.

- Financial Discipline

The ability to manage finances prudently and consistently to ensure the health of a business.

- Transparency

The extent to which stakeholders can access and comprehend relevant financial information.

- Audit

An official inspection of an organization's accounts, typically by an independent body.

- Budgeting

The process of creating a plan to spend your money.

- Forecasting

Estimating future financial trends based on historical data.

- Tax Compliance

Meeting the legal requirements to pay taxes correctly and on time.

Reference links

Supplementary resources to enhance your learning experience.