Limits to Credit Creation and Money Multiplier

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Credit Creation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to learn about how banks can create credit. When a bank receives a deposit, they don't just keep all of it. Instead, they can lend a portion of it out. Does anyone know why they can't lend all of it?

I think it's because they need to have some money available for customers who want to withdraw their deposits.

Exactly! This is called keeping reserves. There are specific regulations, like the Cash Reserve Ratio, which mandate how much of a deposit a bank must keep. Can anyone explain what happens if a bank operates outside these regulations?

They might end up with not enough cash to give back to their depositors, right?

So true! It could lead to a bank run. Now, let's remember CRR as 'Cash Reserve Ratio.' Each bank’s lending capabilities fundamentally start with how much they keep in reserve.

Understanding the Money Multiplier

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Building on what we discussed, when banks lend out money, new deposits are created, which is where the money multiplier comes into play. Can someone tell me what they think the money multiplier signifies?

Is it how much the money supply increases based on the initial reserves?

Yes, precisely! So if a bank starts with Rs 100 in reserves and the money multiplier is, say, 5, how much total money can potentially exist in the system?

It would be Rs 500! That’s a big multiplication of money.

Great job! Remember, this multiplier effect shows how effective and expansive lending can be when there are proper regulations in place.

Limitations Imposed by Central Bank

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's talk about the role of the central bank. The Reserve Bank of India, for instance, sets the reserve requirements. What is the consequence of increasing the Cash Reserve Ratio?

It would mean banks have to keep more money in reserve and can lend less.

Correct! This is one tool to control money supply. If they want to reduce lending in the economy, they could raise the CRR. What might happen to consumers if credit becomes less available?

People might struggle to get loans, which could slow down spending.

Exactly! That interplay of regulation and lending highlights the central bank's vital role in shaping economic conditions.

Real World Application of Money Multiplier

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's think of a real-world example where the money multiplier impacts our daily lives. Can anyone think of how this process affects local businesses?

If banks lend more money to people, they can spend more at local shops.

Exactly! So, the money circulating can influence job creation and business growth. The healthier the lending environment, the more local economies thrive.

So, if there’s less lending due to higher reserve requirements, it can actually hurt job growth.

Spot on. It’s crucial for aspiring economists to grasp this interconnectedness!

Conclusion of Credit Creation Concepts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

To wrap up, we discussed how banks create credit and the important limits placed by central banks through required reserves. How does the concept of the money multiplier further expand our understanding?

It shows how small reserves can lead to a lot of money being created through loans!

Great summary! Always remember that while banks have the capacity to create money, it is the regulations that ensure stability and prevent chaos in the financial system.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The section details the mechanics of credit creation by banks, introduces the concept of the money multiplier, and explains the role of the central bank in regulating money supply through reserve requirements like the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

Detailed

Limits to Credit Creation and Money Multiplier

In modern banking, financial institutions like banks are capable of creating money through lending processes, but such activities are governed by certain limitations. The primary limitation to credit creation stems from regulations set by the central bank, specifically through a framework known as the required reserve ratio (RRR). This ratio determines the percentage of deposits that banks must retain as reserves, discouraging over-lending.

For example, if a bank possesses deposits of Rs 100 and a required reserve ratio of 20%, it must maintain Rs 20 in reserves, allowing it to lend the remaining Rs 80. Each time a loan is issued, new deposits are created, causing the money supply to expand, a phenomenon explained through the money multiplier concept. The money multiplier is effectively the ratio of total money supply to the reserve level and showcases how initial reserves can lead to a significant increase in overall money within the economy.

By systematically understanding the cycle of deposits, reserve requirements, and resultant credit issuance, one can appreciate how monetary policy can control money supply and its broader economic impacts.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Introduction to Credit Creation Limits

Chapter 1 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Suppose Mr. Mathew comes to this bank for a loan of Rs 500. Can our bank give this loan? If it gives the loan and Mr Mathew deposits the loan amount in the bank itself, the total bank deposits and therefore, the total money supply will rise. It seems as though the banks can go on creating as much money as they want.

Detailed Explanation

This chunk introduces the idea that while banks can create credit (loans), there is a question about whether there is a limit to this creation. If Mr. Mathew takes a loan and then deposits it back into the same bank, it would increase the bank's total deposits. This might suggest that banks can endlessly generate money, which is not the case.

Examples & Analogies

Imagine a student borrowing money to buy books. If they take a loan but put that money back into their bank account, it appears as if the bank now has extra money to lend again. However, just like a student can't borrow an infinite amount, banks also have restrictions.

Role of the Central Bank in Limiting Credit

Chapter 2 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

But is there a limit to money or credit creation by banks? Yes, and this is determined by the Central bank (RBI). The RBI decides a certain percentage of deposits which every bank must keep as reserves. This is done to ensure that no bank is ‘over lending’. This is a legal requirement and is binding on the banks. This is called the ‘Required Reserve Ratio’ or the ‘Reserve Ratio’ or ‘Cash Reserve Ratio’ (CRR).

Detailed Explanation

This chunk explains that the Central Bank, specifically the Reserve Bank of India (RBI), imposes limits on how much credit banks can create through a regulation called the Required Reserve Ratio (CRR). The CRR mandates that banks must keep a specific percentage of their deposits in reserve and not lend them out, preventing excessive lending.

Examples & Analogies

Think of the CRR as a rule that says if you have a box of cookies, you must save some for later rather than giving them all away. This ensures that you always have some cookies (money) available, preventing you from running out.

Understanding Cash Reserve Ratio (CRR)

Chapter 3 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Cash Reserve Ratio (CRR) = Percentage of deposits which a bank must keep as cash reserves with the bank. Apart from the CRR, banks are also required to keep some reserves in liquid form in the short term. This ratio is called Statutory Liquidity Ratio or SLR.

Detailed Explanation

The CRR is defined as the percentage of a bank's deposits that must be held as reserves in cash. This ensures banks have enough liquidity to meet withdrawal demands. Additionally, banks must also maintain a Statutory Liquidity Ratio (SLR), which requires them to hold liquid assets in cash or cash-equivalents.

Examples & Analogies

Consider a restaurant that must keep a certain amount of food ingredients in stock at all times to ensure they can serve customers. The CRR is similar – it's a way for banks to ensure they can always provide money to depositors.

Illustrating the Money Multiplier

Chapter 4 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

In our fictional example, suppose CRR = 20 per cent, then with deposits of Rs 100, our bank will need to keep Rs 20 (20 per cent of 100) as cash reserves. Only the remaining amount of deposits, i.e., Rs 80 (100 – 20 = 80) can be used to give loans.

Detailed Explanation

This chunk illustrates how the money multiplier works by using the example of a bank starting with Rs 100 in deposits and a CRR of 20%. The bank is required to keep Rs 20 in reserves and can lend out Rs 80. This shows how a portion of deposits can create more loans while maintaining the necessary reserves.

Examples & Analogies

Imagine a bank that's like a library with 100 books (deposits). If the library has a rule (CRR) that says it must keep 20 books in a special room, it can lend out the remaining 80 books. This lending helps spread the resources while preserving safety.

The Money Multiplier Effect

Chapter 5 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

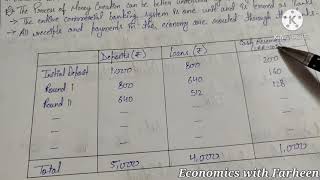

Let us assume that our bank starts with a deposit of Rs 100 made by Leela. The reserve ratio is 20 per cent. Thus our bank has Rs 80 (100 – 20) to lend and the bank lends out Rs 80 to Jaspal Kaur, which shows up in the bank’s deposits in the next round as liabilities, making a total of Rs 180 as deposits.

Detailed Explanation

Here, the chunk highlights how money creation works through multiple lending rounds. Starting with Rs 100, the bank lends out Rs 80 after reserving Rs 20. When this Rs 80 is subsequently deposited back, it increases the total deposits further, thus propelling the cycle of lending and deposit growth, illustrating the money multiplier concept.

Examples & Analogies

Think of this as a chain reaction: when you donate Rs 80 to a cause, it’s used to help others who in turn add to that fund. Each person’s contribution enhances the original amount, increased by those contributions over time.

Final Outcome of the Money Multiplier

Chapter 6 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The required reserves will be Rs 100 only when the total deposits become Rs 500. This is because for deposits of Rs 500, cash reserves would have to be Rs 100 (20 per cent of 500 = 100). The process is illustrated in Table 3.2.

Detailed Explanation

The process concludes by stating that after several rounds of lending and depositing, the total deposits can increase significantly up to Rs 500, while maintaining the required reserves of Rs 100. This illustrates how the money multiplier effect works in the banking system.

Examples & Analogies

This is akin to seeds planted in a garden: each seed grows and produces more. Initially, you plant a few seeds (deposits), but with nurturing (lending), the garden expands, resulting in much larger growth (total deposits).

Key Concepts

-

Credit Creation: The process by which banks create money through loans.

-

Money Multiplier: It indicates how much money supply can expand based on initial reserves.

-

Cash Reserve Ratio (CRR): A requirement for banks to hold a percentage of deposits in reserve.

-

Statutory Liquidity Ratio (SLR): A regulatory requirement for liquidity maintained by banks.

Examples & Applications

If a bank receives Rs 100 in deposits and the CRR is 20%, it can lend out Rs 80.

With a money multiplier of 5, an initial reserve of Rs 100 can potentially lead to a total money supply of Rs 500 in the system.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Money grows like a seed when banks lend every need, but reserve it must, or into trouble it will thrust.

Stories

Imagine a bakery that bakes 10 loaves of bread. If it sells to customers, and they return with fresh orders, the bakery's dough grows just as a bank’s lending grows money supply from deposits.

Memory Tools

Remember 'CRR' - Cash Reserves Require keeping some dough, so more bread can flow!

Acronyms

CRR

Cash Reserve Requirement sets the limit for the bank's lending spree.

Flash Cards

Glossary

- Credit Creation

The process by which banks create new money through lending activities.

- Money Multiplier

The factor by which an initial deposit can be multiplied to determine the total amount of money created in the banking system.

- Cash Reserve Ratio (CRR)

The percentage of a bank's total deposits that must be kept in reserve and not lent out.

- Statutory Liquidity Ratio (SLR)

The minimum percentage of a bank's net demand and time liabilities that must be maintained in the form of liquid cash, gold, or other securities.

Reference links

Supplementary resources to enhance your learning experience.