Role of Financial Institutions

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Financial Institutions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are discussing the role of financial institutions. Can anyone share what they believe financial institutions do for businesses?

They provide loans and help with funding.

Correct! Their main role is to support businesses financially by providing loans, among other services. We can remember this with the acronym 'BLIS' - Banks, Loans, Insurance, and Stocks. Now, what do you think is the difference between banks and NBFCs?

I think banks have more services and are regulated more strictly.

Exactly, banks are full financial institutions with more regulatory oversight, while NBFCs are less regulated but still important for providing loans. Each serves a distinct purpose in supporting businesses.

What about stock exchanges?

Good question! Stock exchanges are platforms where companies can raise funds by issuing shares, creating opportunities for investment. Let's never forget - 'Investors buy, businesses thrive.'

Can insurance companies help with finance too?

Absolutely! They manage risks and help businesses keep going despite uncertainties. Any further thoughts?

To summarize, banks, NBFCs, stock exchanges, and insurance companies each play distinct yet overlapping roles in providing financial support and risk management, contributing to business growth. Remember BLIS!

Functions of Banks

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's get more specific and think about banks again. What services do they offer to businesses?

They give out loans and help with overdrafts.

Correct! They focus on loans and overdrafts primarily. 'L' for Loans and 'O' for Overdrafts can help us remember. Why might a business need an overdraft?

To cover expenses when they run low on funds temporarily.

Exactly! It’s essential for handling day-to-day expenses. Also, banks often provide financial advice. Can anyone tell me why that is important?

They can guide businesses on budgeting and investment?

Spot on! Banks can offer insights that help businesses grow strategically. It’s almost like having a financial coach. In summary, banks provide loans, overdraft facilities, and essential financial advice, making them vital partners for businesses.

Role of Stock Exchanges

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's discuss stock exchanges. How do you think they help businesses raise funds?

By allowing companies to sell shares to the public?

Exactly! Selling shares is a primary method for companies to gather capital. Can anyone tell me the benefit of having public investors?

It increases the company's funds without debt.

Right! It helps companies grow without the burden of repayment like loans. And by participating in the stock market, investors can reap the benefits too. It's a win-win! Lastly, how do stock exchanges impact the economy?

They create liquidity and encourage investments.

Exactly! 'Liquidity' is a key term here. In summary, stock exchanges are crucial for raising capital, providing growth opportunities for businesses, and contributing to economic health.

Insurance Companies

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s consider insurance companies. What do they offer businesses?

They protect against financial losses, right?

Correct! They provide financial protection against various risks. This security allows businesses to operate more confidently. What are some risks they might protect against?

Fire, theft, and liability issues!

Exactly! And through insurance, businesses can plan their finances better. Let's incorporate the idea of risk management. Can anyone explain why that's essential?

It helps prevent huge financial losses and allows for better decision-making.

Well said! In summary, insurance companies play a crucial role in helping businesses manage risks and improve their financial planning.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Financial institutions such as banks, non-banking financial companies (NBFCs), stock exchanges, and insurance companies provide essential services including loans and financial protection, thereby facilitating business operations and growth.

Detailed

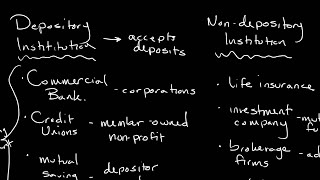

Role of Financial Institutions

Financial institutions are crucial for the successful operation of businesses. They provide financial services that enable businesses to manage their operations, raise capital, and mitigate risks. This section highlights four primary types of financial institutions:

- Banks: They offer various financial services including loans, overdraft facilities, and other support crucial for business operations.

- Non-Banking Financial Companies (NBFCs): These companies provide loans and advances but lack a full banking license, serving as important alternative sources of finance.

- Stock Exchanges: Stock exchanges serve as platforms for businesses to raise capital by issuing shares to the public, enhancing their financial resources and shareholder base.

- Insurance Companies: These organizations help businesses protect against financial risks, enabling better financial planning and stability.

In essence, financial institutions bolster business growth by providing necessary funding and risk management services.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Banks

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Banks: Provide loans, overdraft facilities, and other financial services to businesses.

Detailed Explanation

Banks are key players in the financial system that offer various services to businesses. They provide loans, which are funds borrowed with the obligation to repay over time, usually with interest. Additionally, banks offer overdraft facilities, allowing businesses to withdraw more money than they have in their accounts, up to a certain limit. This flexibility can help businesses manage their cash flow effectively.

Examples & Analogies

Imagine a small bakery that anticipates a busy holiday season. It approaches a bank to secure a loan to purchase additional baking equipment. The bank agrees, allowing the bakery to expand production. This scenario illustrates how banks support businesses by providing necessary funds to seize opportunities and meet demands.

Non-Banking Financial Companies (NBFCs)

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Non-Banking Financial Companies (NBFCs): Offer loans and advances but do not have a full banking license.

Detailed Explanation

NBFCs are financial institutions that provide similar services to banks but operate under a different set of regulations. They offer loans and advances, often targeting underserved segments that may not qualify for traditional bank loans. While they don’t have the same comprehensive banking license, they play a vital role in the finance sector by filling gaps, especially for smaller businesses or individuals needing quick access to credit.

Examples & Analogies

Consider a tech startup that needs quick financing to develop a new app but struggles to meet a bank's loan application requirements. An NBFC might step in, allowing the startup to secure the necessary funds without the stringent requirements of a traditional bank, showcasing the NBFC's role in assisting growing businesses.

Stock Exchanges

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Stock Exchanges: Help companies raise funds by issuing shares to the public.

Detailed Explanation

Stock exchanges are platforms where shares of publicly traded companies are bought and sold. When a company decides to raise funds, it can issue shares that investors can purchase. This not only provides the company with the necessary capital for expansion or operations but also allows investors to participate in the company's growth. The stock exchange thus acts as a crucial intermediary in facilitating these transactions.

Examples & Analogies

Think of a local tech company planning to grow and needing substantial funds to develop new products. By registering on a stock exchange and issuing shares, it allows individual and institutional investors to buy ownership stakes in the company. As the company succeeds, its stock price may rise, benefiting investors and providing the company with the capital needed for innovation.

Insurance Companies

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Insurance Companies: Provide financial protection against risks, enabling better financial planning.

Detailed Explanation

Insurance companies play an essential role by offering financial protection to businesses against various risks such as property damage, liability claims, and employee-related issues. By paying a regular premium, businesses can secure themselves against unforeseen events that could have detrimental financial effects. This risk management aspect enables companies to plan their finances more effectively and invest in growth without the fear of potential losses.

Examples & Analogies

Imagine a construction firm that takes out an insurance policy to protect against accidents on the job site. In the unfortunate event of an accident, the insurance company covers the costs, allowing the firm to continue operations without severe financial disruption. This scenario highlights how insurance can help businesses mitigate risks and maintain stability while planning for future growth.

Key Concepts

-

Banks: Institutions providing loans and financial services.

-

Non-Banking Financial Companies (NBFCs): Lenders without full banking capabilities.

-

Stock Exchanges: Platforms for companies to raise capital via shares.

-

Insurance Companies: Providers of risk management and protection against financial losses.

Examples & Applications

A business obtains a loan from a bank to purchase a new delivery vehicle.

A startup raises capital by issuing shares on a stock exchange.

An entrepreneur secures an insurance policy to protect against theft of inventory.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Banks lend cash, NBFCs do the same, / Stock exchanges help you play the investing game, / Insurance keeps you safe in the financial fight, / Together they ensure businesses take flight.

Stories

Once upon a time, in the Kingdom of Finance, banks were knights offering loans to help businesses build their castles. NBFCs were the clever merchants providing alternative funds. The stock exchange was the marketplace where treasures were raised by selling shares, and insurance acted like a protective shield against dragons of risk.

Memory Tools

Remember 'B.L.I.S' for Banks, Loans, Insurance, Stock Exchange - they all play crucial roles in business finance.

Acronyms

BLIS

Banks

Loans

Insurance

Stock Exchanges – remember these for their roles in supporting business operations.

Flash Cards

Glossary

- Banks

Financial institutions that offer loans, overdraft facilities, and various banking services.

- NonBanking Financial Companies (NBFCs)

Financial institutions that provide loans and financial services but do not have full banking licenses.

- Stock Exchanges

Platforms for businesses to raise capital by issuing shares to the public.

- Insurance Companies

Organizations that provide financial protection against various risks.

Reference links

Supplementary resources to enhance your learning experience.