Financing Entrepreneurial Ventures

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Bootstrapping

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's start with bootstrapping. Bootstrapping means you fund your startup using your own savings or revenue generated from initial sales. Can anyone tell me why someone might choose to bootstrap?

So they can keep full control of their business without outside influence?

Exactly! Bootstrapping allows full control but can limit how quickly you can grow due to finite resources. Remember the acronym 'C.R.E.A.M' - Cash Rules Everything Around Me, emphasizing the need for cash flow in startups.

What if someone runs out of money while bootstrapping?

That's a great concern! Entrepreneurs must meticulously manage their finances and plan for contingencies. Any thoughts on how one might extend their resources?

Angel Investors

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's look at angel investors. These are individuals who provide capital to startups in exchange for equity. Why do you think an angel investor would be interested in a startup?

They want to make money when the startup grows and becomes successful?

Correct! They aim for a return on their investment. Also, they might offer valuable mentorship. Who can tell me the risks for a startup when relying on angel investors?

They could lose a part of their business control if they give away too much equity?

Precisely! Balancing control while seeking investment is critical. Remember, 'Equity comes at a price.'

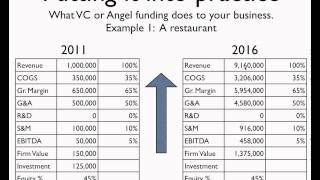

Venture Capital

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Venture capital (VC) is generally a larger, more structured form of funding compared to angel investments. Can anyone explain what type of businesses usually attract venture capital?

Typically newer companies with high growth potential, often in tech sectors, right?

Exactly! VCs look for companies that can scale quickly. Remember the saying 'High risk, high reward.' Can anyone identify a downside of seeking venture capital?

They often want a say in how the business operates?

Spot on! They usually require a board seat or involvement in strategic decisions. So, plan accordingly!

Crowdfunding

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Crowdfunding has gained popularity recently. It allows entrepreneurs to present their product ideas to the public. What are the benefits of using crowdfunding?

It can help generate interest and provide funds at the same time?

Exactly! It also functions as a validation tool for ideas. However, it requires significant marketing efforts. What are some challenges you think come with crowdfunding?

What if you don’t meet the funding goal?

That's a valid concern. Failing to reach your goal means not receiving any funds raised. Always have a plan!

Government Schemes

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let's discuss government schemes that help entrepreneurs. In India, initiatives like Startup India and MUDRA loans aim to provide financial backing for startups. Can anyone name a benefit of these programs?

They often provide funding without requiring equity?

That's right! They support innovation and reduce the financial burden on new businesses. Can anyone think of how to apply for these schemes?

I think there are specific eligibility criteria and documentation needed, right?

Exactly! Research and prepare well to ensure your application is strong. Always keep up with changing regulations!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, we explore different ways entrepreneurs can finance their ventures. It highlights self-funding methods, various types of investors, crowdfunding platforms, and specific government schemes available in India that support startups. Each financing method plays a critical role in helping nascent businesses grow and succeed.

Detailed

Financing Entrepreneurial Ventures

This section focuses on the different sources of financing available to entrepreneurs. Financing is a crucial aspect of launching and growing a business, especially in a competitive market. Here are the primary methods discussed:

- Bootstrapping - This involves self-funding a venture using personal savings. Entrepreneurs who bootstrap retain complete control over their business but may face limitations in growth due to resource constraints.

- Angel Investors - Wealthy individuals who provide capital to startups in exchange for equity. This can be invaluable for new ventures needing seed money without taking on significant debt.

- Venture Capital - This is a form of funding provided by investment firms to startups and emerging businesses that are deemed to have long-term growth potential. They typically require equity and often want a say in business decisions.

- Crowdfunding - A modern funding method that allows individuals to gather small amounts of money from a large number of people, usually through platforms like Kickstarter. This method also serves as a marketing tool, generating interest in the product before its launch.

- Government Schemes (India) - Specific initiatives such as Startup India, Stand-Up India, and MUDRA loans offer financial support to entrepreneurs, helping them to navigate the initial phases of their business journey.

Understanding these financing options is vital for entrepreneurs to make informed decisions, align their funding strategies with business goals, and successfully navigate the complex landscape of startup financing.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Bootstrapping

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Bootstrapping: Self-funding from personal savings

Detailed Explanation

Bootstrapping is a method of financing a business where the entrepreneur uses their own personal savings to fund the startup. This means not relying on external investors or loans initially. Entrepreneurs may cover costs from savings, income from their current job, or using the profits made from early sales.

Examples & Analogies

Imagine a budding chef who wants to start her own restaurant. Instead of taking loans or seeking investors, she uses her savings from years of working in a café. This way, she retains all the control and profits from her restaurant, but she also bears all the risks if it doesn't succeed.

Angel Investors

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Angel Investors: Wealthy individuals funding early-stage ideas

Detailed Explanation

Angel investors are affluent individuals who provide capital for startups, usually in exchange for convertible debt or ownership equity. They often invest in the early stages of a business when there is a higher risk, and their investment can help businesses reach significant milestones before they seek larger funding.

Examples & Analogies

Think of an angel investor as a lifeguard at a beach. If a swimmer (the startup) is struggling, the lifeguard (angel investor) comes in to help, providing support to keep the swimmer safe until they can swim on their own. The lifeguard invests their time and resources with the hope that the swimmer will succeed and thrive.

Venture Capital

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Venture Capital: Equity-based funding from investment firms

Detailed Explanation

Venture capital (VC) involves funding provided by investment firms to startups that show high growth potential. In exchange for their investment, VCs usually take an equity stake in the company. This type of financing typically comes after a startup has proven its business model and has some traction in the market.

Examples & Analogies

Consider a tech company that has developed a promising new app. After establishing an initial user base, the founders approach a venture capital firm for funding. The VC invests money into the company, becoming a partner, which helps the company scale quickly while also sharing in the profits once it succeeds.

Crowdfunding

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Crowdfunding: Collective investment via platforms (e.g., Kickstarter)

Detailed Explanation

Crowdfunding is a method where entrepreneurs raise small amounts of money from a large number of people, typically via the Internet. Platforms such as Kickstarter or Indiegogo allow startups to present their ideas to the public, who can then contribute money to help the project come to life. This approach helps entrepreneurs validate their ideas by gauging public interest.

Examples & Analogies

Think of crowdfunding like a community potluck, where everyone brings a dish to share. In this scenario, instead of bringing food, people contribute money to help bring a creative project to life. If the gathering gets enough dishes from various contributors, it becomes a successful feast (the startup gets funded and able to start operating).

Government Schemes in India

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Government Schemes (India):

– Startup India

– Stand-Up India

– MUDRA loans

Detailed Explanation

The Indian government offers several schemes to promote entrepreneurship and help startups secure funding. 'Startup India' aims to foster innovation and ease of doing business. 'Stand-Up India' focuses on providing loans to start-ups led by Scheduled Castes and Scheduled Tribes entrepreneurs. 'MUDRA loans' provide financial support for small enterprises, encouraging entrepreneurship among various demographics.

Examples & Analogies

Imagine a garden with different types of plants. Each scheme from the government acts like a gardener that provides water, nutrients, and support to different types of plants in the garden. Just like some plants require special care to grow, entrepreneurs from various backgrounds can access these schemes to flourish and succeed in their ventures.

Key Concepts

-

Bootstrapping: Self-funding a venture using personal resources.

-

Angel Investors: Individuals who invest their personal funds in startups in exchange for shares.

-

Venture Capital: Funding from investment firms in exchange for equity.

-

Crowdfunding: Raising small amounts of money from a large group of people.

-

Government Schemes: Initiatives by the government to provide financial backing for startups.

Examples & Applications

An entrepreneur using savings to launch a web application is an example of bootstrapping.

A tech startup receiving initial funding from a wealthy individual with business experience illustrates angel investing.

A mobile app developer leveraging Kickstarter to fund their application shows how crowdfunding works.

A startup in India obtaining MUDRA loans to facilitate its operations represents government support.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Bootstrapping can be quite nice, you fund your dream without a price!

Stories

Imagine an inventor who uses her savings to make a gadget. She controls everything, but she wonders if she will have enough to make it big. This is bootstrapping!

Memory Tools

A to remember: B - Bootstrapping, A - Angel Investors, V - Venture Capital, C - Crowdfunding, G - Government schemes.

Acronyms

F.I.N.A.N.C.E

Funds

Investors

New ventures

Angel investors

Network

Crowdfunding

Enterprise.

Flash Cards

Glossary

- Bootstrapping

Self-funding a venture using personal savings or revenue generated.

- Angel Investors

Wealthy individuals who provide capital to startups in exchange for equity.

- Venture Capital

Equity-based funding provided by investment firms to high-potential startups.

- Crowdfunding

Collective funding through small contributions from a large number of people via platforms.

- Government Schemes

Tailored financial support programs provided by the government to aid startups.

Reference links

Supplementary resources to enhance your learning experience.