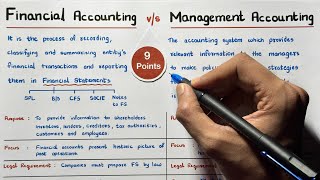

Differences Between Financial and Management Accounting

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Objective of Financial vs Management Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we’re going to explore the objectives of financial and management accounting. Can anyone tell me what the main goal of financial accounting is?

Isn't it to report the financial position of the organization?

Exactly, Student_1! Financial accounting aims to provide a clear picture of a company's financial health to external stakeholders. Now, what about management accounting? What does it aim to achieve?

I think it assists internal management in making decisions.

Spot on, Student_2! Management accounting focuses on aiding internal management with planning and decision-making. Therefore, while financial accounting looks backward at historical data, management accounting is more forward-thinking.

So, financial accounting is for external use and management accounting is for internal use?

Yes, that’s correct! Financial accounting serves external audiences like investors, while management accounting assists internal users. Great job, everyone!

Audience of Financial vs Management Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s delve deeper into the audiences for financial and management accounting. Why do we think different audiences have different needs?

Because external stakeholders need assurance about the company’s finances, while management needs information for operational success.

Exactly, Student_4! The distinct needs shape the different approaches taken in reporting. Can anyone name examples of external stakeholders?

Shareholders and banks, right?

Correct! Now, who would the internal stakeholders be in the realm of management accounting?

The managers and executives.

Certainly! And they need detailed, relevant information about the company’s operations, future forecasts, and performance metrics to guide decisions effectively.

Time Frame in Financial vs Management Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let’s address the time frame differences. Can someone explain whether financial accounting is more historical or forward-looking?

It’s definitely historical. It looks at past performance.

Great! Financial accounting does report historical data. On the other hand, what can we say about management accounting's time frame?

It’s more about future plans and forecasts, right?

Exactly! Management accounting focuses on future-oriented information to assist in planning and strategy. Would anyone like to discuss why understanding these time frames is essential?

It helps in making better decisions based on how the company performed before and the projections for the future.

Well said! Understanding both perspectives equips individuals to make informed strategic decisions.

Legal Requirements of Financial vs Management Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let’s tackle the legal requirements. Which type of accounting—financial or management—has stricter legal obligations?

Financial accounting, because it’s mandatory for companies.

Correct! Companies must adhere to standards like GAAP or IFRS in financial accounting. What about management accounting? Is it under any legal requirement?

No, it’s not mandated by law, so companies can create their own systems.

Exactly! Management accounting has the freedom to adapt its data collection and reporting methods. How does that flexibility benefit companies?

It can tailor reports to align with specific strategic goals.

Absolutely! This adaptability is crucial for organizations wanting to stay competitive.

Format and Standardization in Financial vs Management Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s review the differences in format and standardization. What characterizes financial accounting?

It follows standardized formats and principles.

Correct, Student_1! This ensures credibility in financial statements. What about management accounting—how does it differ?

It’s more flexible and can be designed as needed.

Exactly! This flexibility allows companies to present information in ways that best suit internal decision-making. Why do we think this flexibility is important?

Because different organizations have different needs, and one-size-fits-all would be limiting.

Well put! Understanding these format differences ensures accounting information is utilized effectively.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The section delineates the distinct goals and target audiences of financial versus management accounting. Financial accounting primarily targets external stakeholders and is geared toward compliance with legal standards, whereas management accounting is aimed at internal management for decision-making purposes. The time frame, legal requirements, and format also differ significantly, emphasizing how each type of accounting serves its unique role within an organization.

Detailed

Differences Between Financial and Management Accounting

This section provides a comprehensive comparison between financial accounting and management accounting, emphasizing their unique roles within an organization.

Basis of Comparison

- Objective:

- Financial Accounting aims at reporting the financial position of the organization, focusing on historical data to provide insights for external stakeholders.

- Management Accounting assists internal management in decision-making and planning through more flexible, forward-looking analyses.

- Audience:

- Financial accounting primarily serves external stakeholders, such as shareholders, creditors, and regulatory bodies, by ensuring transparency and accountability in financial reporting.

- In contrast, management accounting focuses on internal management, providing relevant information tailored to support strategies and operational efficiency.

- Time Frame:

- Financial accounting is historical, reporting past performance over defined periods, which is essential for compliance and external reporting.

- Management accounting is future-oriented, helping organizations plan and strategize by analyzing projected trends and data.

- Legal Requirement:

- Financial accounting practices are generally mandatory for companies, governed by standardized frameworks like GAAP or IFRS.

- Conversely, management accounting practices are not legally mandated, granting organizations the flexibility to adopt various methods that best fit their internal needs.

- Format/Standardization:

- Financial accounting must follow standardized formats and principles to ensure credibility and comparability across organizations.

- Management accounting employs a more flexible format, allowing companies to tailor their information formats according to their unique management needs.

Significance

Understanding these differences is crucial for professionals, particularly in areas such as finance and technology, where integration of accounting knowledge leads to better decision-making processes and strategic management within organizations.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Objective of Each Accounting Type

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Basis

Financial Accounting

Management Accounting

Objective

Reporting financial position

Assisting internal decision-making

Detailed Explanation

The primary objective of financial accounting is to provide a clear picture of the financial position of a business. It focuses on what has already happened in terms of the company’s finances—like how much profit they made last quarter. In contrast, management accounting aims to assist internal management in making informed decisions about the company's future direction. This can include budgeting for upcoming projects or strategizing new business initiatives.

Examples & Analogies

Think of financial accounting like a police report: it records events that have already occurred (like crimes in the past). Management accounting, however, is like a game plan for a sports team, helping coaches decide strategies for winning future games.

Audience for Each Accounting Type

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Basis

Financial Accounting

Management Accounting

Audience

External stakeholders

Internal management

Detailed Explanation

Financial accounting is intended for external stakeholders, such as investors, creditors, and regulators, who need to understand the company's financial health to make informed decisions. In contrast, management accounting is specifically designed for internal management. This means the reports and analyses generated are tailored to meet the needs of those who run the company.

Examples & Analogies

Consider financial accounting as a public movie review that informs viewers about a film and helps them decide if they want to watch it. Management accounting, however, is like discussions among the directors and writers—focused on improving future projects and catering to audience preferences.

Time Frame Difference

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Basis

Financial Accounting

Management Accounting

Time Frame

Historical

Future-oriented/planning

Detailed Explanation

The time frame for financial accounting is historical, meaning it records transactions that have already occurred. It's backward-looking, focusing on past performance and the company's financial statements. In contrast, management accounting is future-oriented; it involves planning and forecasting for future business operations. This may include developing budgets or projections that guide decision-making.

Examples & Analogies

Think of financial accounting as looking through a rearview mirror while driving; you can see where you've been. Management accounting is like looking through the windshield, guiding your path forward and helping you plan your route.

Legal Requirements

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Basis

Financial Accounting

Management Accounting

Legal Requirement

Mandatory (for companies)

Not mandatory

Detailed Explanation

Financial accounting practices are often mandatory for companies. This means businesses must prepare their financial statements according to specific legal standards (like GAAP or IFRS) to ensure compliance and transparency. Management accounting, on the other hand, is not legally required. Companies have the flexibility to choose how they use this type of accounting, as it is primarily for internal purposes.

Examples & Analogies

Imagine financial accounting as being like a set of traffic laws that all drivers must follow; they ensure everyone is safe and knows what's expected. Management accounting is more like personal driving preferences, like how fast you want to go on an empty road without rules; it’s all about what works best for you.

Format and Standardization

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Basis

Financial Accounting

Management Accounting

Format/Standardization

Standardized

Flexible

Detailed Explanation

Financial accounting must adhere to standardized formats and conventions, such as GAAP or IFRS, which help ensure consistency and comparability for external users. Management accounting is much more flexible; businesses can choose how they format their reports and which metrics are most relevant for their decision-making needs.

Examples & Analogies

Financial accounting is like following a strict recipe when baking a cake—you must include specific ingredients and steps to achieve the desired result. Management accounting is akin to cooking without a recipe, allowing chefs to experiment and adjust based on personal taste or specific occasions.

Key Concepts

-

Financial Accounting: Focuses on historical financial data for external reporting.

-

Management Accounting: Aims to provide information for internal decision-making and strategy.

-

External Stakeholders: Users of financial information outside the organization.

-

Internal Stakeholders: Users of management accounting within the organization.

-

Legal Requirements: Financial accounting must adhere to standards and regulations; management accounting does not.

Examples & Applications

A company must prepare financial statements such as income statements, balance sheets, and cash flow statements for its shareholders, which serves as financial accounting.

A manager uses cost analysis and budgeting techniques from management accounting to plan the next quarter’s operational strategies.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Financial facts for the ones outside; Management makes plans with internal pride.

Stories

Imagine a company where the accountants on the outside create a report for investors, while the management team on the inside uses numbers to guide their strategy for the future.

Memory Tools

FAME: Financial Accounting - Managed Externally; Management Accounting - Managed Internally.

Acronyms

FAM and MAS

Financial Accounting for Reporting

Management Accounting for Strategic decisions.

Flash Cards

Glossary

- Financial Accounting

A branch of accounting focused on recording, analyzing, and reporting financial transactions for external users.

- Management Accounting

A type of accounting that helps internal management make informed business decisions using financial and operational information.

- External Stakeholders

Individuals or entities outside the organization, like investors and regulators, who rely on financial statements.

- Internal Stakeholders

Individuals within the organization, such as management and employees, who use management accounting for decision-making.

- GAAP

Generally Accepted Accounting Principles, a set of accounting standards for financial reporting in the U.S.

- IFRS

International Financial Reporting Standards, a set of global accounting standards for financial reporting.

Reference links

Supplementary resources to enhance your learning experience.