Introduction to Financial and Management Accounting

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Meaning of Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's begin by understanding the fundamental meaning of accounting. It is defined as a systematic process involving the recording, classifying, summarizing, analyzing, and interpreting financial transactions. Its primary goal is to provide accurate financial information for stakeholders' decision-making. Does everyone understand what that entails?

So, accounting is all about keeping track of money?

That's correct! It's about tracking financial information systematically to help in making informed decisions.

Can you give an example of what kind of transactions would be recorded?

Sure! Transactions like sales, purchases, loans, and payments all get recorded. Think of it as maintaining a financial diary of the business.

What are the stakeholders you mentioned?

Stakeholders include anyone with an interest in the business, such as owners, investors, creditors, and employees. Each of them uses accounting information to make decisions.

How can we remember these concepts?

A good memory aid is the acronym 'RCA' - Record, Classify, Analyze. This reminds us of the systematic processes central to accounting.

To summarize, accounting systematically tracks financial transactions to provide clarity and aid decision-making for various stakeholders.

Objectives of Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we know what accounting is, let’s discuss its objectives. The main goal is to systematically record transactions and ascertain the profitability of a business. Can anyone tell me why that might be important?

Knowing if the business is making money or losing money helps management make better choices.

Absolutely correct! Accurate records help in identifying trends and financial stability. What other objectives do you think are relevant?

To provide information to stakeholders?

Yes! Informing stakeholders like management and investors ensures transparent decision-making based on financial health.

What about estimating future needs?

That's a great observation! Accounting supports future economic decision-making by presenting reliable and comparable financial data. This dual focus on the past and future enriches strategic planning.

To summarize, the main objectives of accounting are maintaining records, calculating profit or loss, assessing the financial position, and aiding stakeholders in effective decision-making.

Branches of Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Moving on, let’s explore the different branches of accounting. Which branches are the most critical for this course?

I think Financial Accounting and Management Accounting are the key ones.

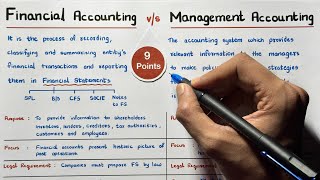

Precisely! Financial Accounting focuses on recording and reporting financial transactions to external stakeholders, while Management Accounting aids internal decision-making. Can anyone share why this distinction is important?

Isn’t financial accounting about compliance, while management accounting helps with planning and control?

Exactly! Compliance is essential for financial accounting, while management accounting helps businesses plan for the future. What other branches exist?

There’s also Cost Accounting and Tax Accounting, right?

Great! Other branches like Forensic Accounting and Auditing also play significant roles in specialized scenarios. Remember, each branch serves specific purposes in understanding financial data.

To sum up, there are multiple branches of accounting, each serving unique functions, with Financial and Management Accounting being the most crucial ones for our discussions.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, we explore the principles of financial and management accounting, including their meanings, objectives, branches, and the impact of technology. We also highlight the differences between financial and management accounting and their practical applications in decision-making processes within organizations.

Detailed

Introduction to Financial and Management Accounting

In today’s data-driven business environment, understanding accounting principles is essential for professionals across various fields, including engineering and technology. This chapter delves into Financial Accounting and Management Accounting, providing a comprehensive introduction to their definitions, objectives, branches, and significance in organizational decision-making.

Accounting Definition

Accounting is the systematic process of recording, classifying, summarizing, analyzing, and interpreting financial transactions aimed at providing stakeholders with accurate financial information.

Definition (AICPA)

"Accounting is the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions, and events which are, in part at least, of a financial character, and interpreting the results thereof."

Objectives of Accounting

- Maintain systematic records of financial transactions.

- Ascertain profit or loss for a given period.

- Determine the financial position of a business.

- Provide information to stakeholders (management, investors, government, etc.).

- Facilitate decision-making with reliable and comparable financial data.

Branches of Accounting

1. Financial Accounting

Deals with recording and reporting financial transactions for external users like shareholders and regulators.

2. Management Accounting

Focuses on internal analysis to aid management in planning and decision-making.

Financial Accounting: Concepts and Components

Key Characteristics

- Historical in nature

- Primarily for external stakeholders

- Based on standardized rules (GAAP, IFRS)

Key Concepts

- Going Concern

- Accrual Concept

- Matching Principle

- Consistency

- Prudence/Conservatism

Financial Statements

- Income Statement: Profit or loss overview.

- Balance Sheet: Presentation of assets, liabilities, and equity.

- Cash Flow Statement: Inflows and outflows.

- Statement of Changes in Equity.

Management Accounting: Tools and Techniques

Key Characteristics

- Future-oriented

- Supports strategic decisions

- No legal compulsion

Major Tools

- Budgeting

- Variance Analysis

- Cost-Volume-Profit (CVP) Analysis

- Break-even Analysis

- Standard Costing

- Key Performance Indicators (KPIs)

Differences Between Financial and Management Accounting

| Basis | Financial Accounting | Management Accounting |

|---|---|---|

| Objective | Reporting financial position | Assisting internal decision-making |

| Audience | External stakeholders | Internal management |

| Time Frame | Historical | Future-oriented/planning |

| Legal Requirement | Mandatory (for companies) | Not mandatory |

| Format/Standardization | Standardized (GAAP/IFRS) | Flexible |

Importance in Engineering and IT Sector

- Integration of financial modules in ERP Systems

- Necessity of accounting logic in FinTech and Data Analytics

- Budgeting knowledge for startup founders/engineers

- Decision automation involving financial datasets

Role of Technology in Accounting

- Cloud Accounting tools (e.g., Zoho Books)

- Blockchain for secure ledgers

- AI & RPA for automating processes

- Data Analytics for real-time dashboards

Common Terms and Their Meanings

- Asset: Resources owned

- Liability: Obligations owed

- Equity: Owner’s interest

- Revenue: Income earned

- Expense: Costs incurred

- Depreciation: Decrease in asset value

- Capital Expenditure: Money for acquiring assets

- Operating Expenditure: Day-to-day costs

Real-world Applications

- Startup Budgeting: Estimating needs and costs.

- Performance Dashboards: Utilize KPIs for management.

- Tax Filing: Financial records essential for taxes.

- Loan Approval: Banks review balance sheets before lending.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Importance of Accounting in Business

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

In today’s data-driven and fast-paced business environment, the ability to understand and apply accounting principles is essential—not just for commerce professionals but also for engineers and technologists. As Computer Science and IT professionals work increasingly with enterprise systems, automation of financial operations, ERP tools, and business intelligence, a fundamental understanding of Financial and Management Accounting becomes a vital skill.

Detailed Explanation

This chunk emphasizes the growing importance of accounting knowledge in various professional fields. In modern business, understanding accounting principles is crucial, not only for finance-specific roles but also for sectors like engineering and IT. Many professionals are now required to interact with enterprise software that manages financial operations, making accounting skills essential for effective collaboration and decision-making.

Examples & Analogies

Consider a software engineer who develops a budgeting app. Without a basic understanding of financial concepts, they may struggle to implement features that truly meet users' needs. By understanding how people track expenses and revenues, the engineer can create a more effective tool that helps users manage their finances better.

Core Objectives of Accounting

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

This chapter provides an in-depth introduction to Financial Accounting and Management Accounting, their core principles, differences, applications in the real-world, and their relevance to decision-making in organizations.

Detailed Explanation

This chunk outlines the objectives of accounting which include maintaining systematic records, determining profit or loss, assessing the financial position of a business, and providing stakeholders with information for decision-making. These objectives serve to help individuals and organizations make informed financial decisions and plans.

Examples & Analogies

Imagine a small business owner who regularly tracks their sales and expenses using accounting principles. By maintaining thorough records and calculating profits, they can make crucial business decisions like whether to expand their product line, hire more staff, or invest in marketing.

Branches of Accounting

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

There are several branches of accounting, but two core types are essential for this course: Financial Accounting and Management Accounting. Other branches include: Cost Accounting, Tax Accounting, Forensic Accounting, and Auditing.

Detailed Explanation

This chunk introduces the main branches of accounting. Financial accounting focuses on reporting financial data to external parties, while management accounting aids internal management in decision-making processes. Other branches serve specialized roles, such as cost accounting which deals with costs of production, and forensic accounting which investigates financial discrepancies.

Examples & Analogies

Think of these branches as different departments within a hospital. Financial accounting is like the billing department that tracks payments and financial records, while management accounting is akin to the hospital's administration that uses data to make decisions about staffing and services.

Key Characteristics of Financial Accounting

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Financial Accounting: It deals with the recording and reporting of financial transactions to external users like shareholders, creditors, and regulators.

Detailed Explanation

This section describes the main focus of financial accounting, which includes documenting financial transactions and producing reports that adhere to standardized regulations. The target audience for these reports typically includes external stakeholders who require information to assess the company's financial health.

Examples & Analogies

Consider a published annual report of a public company. This report is designed to inform shareholders and potential investors about the company's financial performance. It acts like a report card, summarizing how well the company does financially.

Key Characteristics of Management Accounting

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Management Accounting: It focuses on internal analysis, helping management in planning, decision-making, and control.

Detailed Explanation

Management accounting is geared towards providing internal management with the information needed for strategic planning and operational control. Unlike financial accounting, it does not have standardized requirements and is more flexible, allowing companies to choose the formats and metrics that best serve their internal goals.

Examples & Analogies

Think of a coach analyzing the performance of their sports team. They look at statistics, player performance metrics, and training results to make decisions about strategies and game plans. Similarly, management accounting provides the insights needed for business leaders to optimize operations.

Key Concepts

-

Going Concern

-

Accrual Concept

-

Matching Principle

-

Consistency

-

Prudence/Conservatism

-

Financial Statements

-

Income Statement: Profit or loss overview.

-

Balance Sheet: Presentation of assets, liabilities, and equity.

-

Cash Flow Statement: Inflows and outflows.

-

Statement of Changes in Equity.

-

Management Accounting: Tools and Techniques

-

Key Characteristics

-

Future-oriented

-

Supports strategic decisions

-

No legal compulsion

-

Major Tools

-

Budgeting

-

Variance Analysis

-

Cost-Volume-Profit (CVP) Analysis

-

Break-even Analysis

-

Standard Costing

-

Key Performance Indicators (KPIs)

-

Differences Between Financial and Management Accounting

-

| Basis | Financial Accounting | Management Accounting |

-

|---------------------|---------------------------|-------------------------------|

-

| Objective | Reporting financial position| Assisting internal decision-making |

-

| Audience | External stakeholders | Internal management |

-

| Time Frame | Historical | Future-oriented/planning |

-

| Legal Requirement | Mandatory (for companies) | Not mandatory |

-

| Format/Standardization| Standardized (GAAP/IFRS) | Flexible |

-

Importance in Engineering and IT Sector

-

Integration of financial modules in ERP Systems

-

Necessity of accounting logic in FinTech and Data Analytics

-

Budgeting knowledge for startup founders/engineers

-

Decision automation involving financial datasets

-

Role of Technology in Accounting

-

Cloud Accounting tools (e.g., Zoho Books)

-

Blockchain for secure ledgers

-

AI & RPA for automating processes

-

Data Analytics for real-time dashboards

-

Common Terms and Their Meanings

-

Asset: Resources owned

-

Liability: Obligations owed

-

Equity: Owner’s interest

-

Revenue: Income earned

-

Expense: Costs incurred

-

Depreciation: Decrease in asset value

-

Capital Expenditure: Money for acquiring assets

-

Operating Expenditure: Day-to-day costs

-

Real-world Applications

-

Startup Budgeting: Estimating needs and costs.

-

Performance Dashboards: Utilize KPIs for management.

-

Tax Filing: Financial records essential for taxes.

-

Loan Approval: Banks review balance sheets before lending.

Examples & Applications

A company records its annual revenue and expenses to generate an income statement, which shows whether the company made a profit or a loss over that year.

An organization conducts variance analysis during budgeting to see if it met its financial objectives compared to its actual spending.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Accounting's a game, with records you claim; profits or losses, you bring to the frame.

Stories

Imagine a baker who keeps track of every cupcake sold. This method helps him know when to bake more or when he needs to lower prices based on demand—just like efficient businesses do with accounting.

Memory Tools

Remember the acronym 'ARROW': Assets, Revenue, Recording, Operations, and Wealth to focus on the key areas of accounting.

Acronyms

Use 'FAME' for Financial Accounting

Financial position

Accuracy

Mandatory reporting

External users.

Flash Cards

Glossary

- Accounting

The systematic process of recording, classifying, summarizing, analyzing, and interpreting financial transactions.

- Financial Accounting

Deals with the recording and reporting of financial transactions for external users.

- Management Accounting

Focuses on internal analysis to assist management in decision-making and planning.

- GAAP

Generally Accepted Accounting Principles, the framework of accounting standards.

- IFRS

International Financial Reporting Standards, a set of accounting standards for financial reporting internationally.

- Assets

Resources owned by a business.

- Liabilities

Obligations or debts owed by a business.

- Equity

The owner's interest in the company.

- Revenue

Income earned by a business from its operations.

- Expenses

Costs incurred by a business in generating revenue.

Reference links

Supplementary resources to enhance your learning experience.