Dividend Decisions

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Dividend Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will explore dividend decisions. This refers to the percentage of a company's profit that gets distributed as dividends versus what is retained for future investments. Why do you think this balance is essential for a company?

I guess it helps the company grow while also rewarding investors?

Exactly, Student_1! Companies need to ensure they have enough money to invest in opportunities while also keeping shareholders happy. Let's discuss the main factors that influence these decisions.

What are those factors?

Good question! The factors include growth opportunities, earnings stability, and shareholder expectations. Can anyone provide an example of how these factors might play out?

Influencing Factors of Dividend Policy

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s dive deeper into these influencing factors. First, how do growth opportunities influence a company's dividend decision?

If a company has many growth opportunities, it might keep more profit to invest rather than paying it out?

Correct! Retaining profits for growth can be more beneficial in the long run. But what about earnings stability?

If earnings are stable, the company might feel more secure about paying out dividends?

Absolutely! A stable earning stream often leads to higher dividends since the company is confident in its profit levels. Let's also briefly discuss shareholder expectations.

Shareholders might expect regular dividends for their investment.

Exactly! Balancing these factors is crucial for effective dividend policy. To summarize, dividend decisions shape a company's financial stability and investor satisfaction.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Dividend decisions are essential for ensuring that firms balance the need to reinvest earnings for growth with rewarding shareholders. This section discusses the factors influencing dividend policy, including business growth opportunities, earnings stability, and shareholder expectations.

Detailed

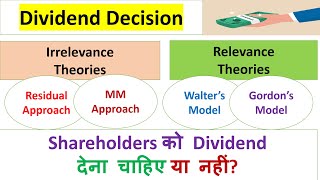

Dividend Decisions

Dividend decisions are a fundamental aspect of financial management concerned with determining how much profit should be distributed to shareholders versus retained for reinvestment in the company. This balance is crucial as it influences both the firm’s capital availability for growth as well as shareholder satisfaction.

Key Points:

- Retention vs Distribution: Companies must decide the percentage of profits that will be retained for expansion versus what will be paid out to shareholders in the form of dividends.

- Influencing Factors: Key considerations include growth opportunities available to the business, the stability and predictability of earnings, and the expectations of shareholders regarding returns.

- Long-Term Strategy: Dividend policy should align with the company’s long-term goals, balancing immediate shareholder satisfaction with the need for funds to fuel growth and development.

In summary, dividend decisions are critical for sustaining growth while meeting investor expectations and play an essential role in a company’s overall financial strategy.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Understanding Dividend Decisions

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• How much of the earnings to retain and how much to distribute.

Detailed Explanation

Dividend decisions are crucial financial choices made by companies regarding how to allocate their profits. This involves determining what portion of the earnings will be paid out to shareholders as dividends and what portion will be retained within the company for reinvestment. This decision impacts both the company's growth potential and the satisfaction of the shareholders. It reflects the strategies the company intends to use to foster growth while also providing returns to investors.

Examples & Analogies

Imagine a small bakery that makes $100 in profit in a month. The owner can choose to either give each investor back $50 as dividends or retain it to invest in better equipment, explore new recipes, or increase marketing. Choosing to retain some earnings might mean future growth that can lead to higher profits and dividends later on!

Factors Influencing Dividend Decisions

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Influenced by growth opportunities, earnings stability, shareholder expectations.

Detailed Explanation

Several factors can influence a company's dividend decisions. First, the availability of growth opportunities plays a key role. If a company has projects that require significant funding, it might choose to retain more earnings to support those initiatives rather than distribute them as dividends. Furthermore, the stability of earnings is critical. Companies with consistent profits can afford to pay dividends regularly, reassuring shareholders. Lastly, shareholder expectations matter; if investors expect dividends regularly, a company may feel pressured to maintain or increase dividend payouts even in the face of growth opportunities.

Examples & Analogies

Think of a tech startup that has innovative ideas but needs to fund its development. If investors are demanding quick returns through dividends, the startup might risk stagnation by not investing sufficiently in growth. This highlights the balancing act companies perform between satisfying immediate shareholder desires and ensuring long-term success through reinvestment.

Key Concepts

-

Dividend Decisions: The process of determining how much of earnings to distribute versus retain.

-

Retention Ratio: Represents the percentage of earnings a company keeps for growth.

-

Earnings Stability: The consistency of a company's profits, influencing its dividend decisions.

Examples & Applications

Example 1: A company with numerous growth opportunities might choose to reinvest 80% of its profits to fund new projects, paying out only 20% as dividends.

Example 2: A mature company with stable earnings might opt for a 50% payout ratio, distributing half of its profits while retaining the other half for operational needs.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When profits rise and numbers shine, dividends flow, and growth is fine.

Stories

Imagine a farmer who has a bountiful harvest. He must decide how to use his crops - sell some to make profit today, or keep more for future seeds. Just like that, companies must balance dividends and reinvestments.

Memory Tools

Remember the acronym 'GREW' for factors influencing dividends: Growth opportunities, Retention ratio, Earnings stability, Shareholder expectations.

Acronyms

DPR

Dividend

Profit Retention - key in understanding dividend decisions.

Flash Cards

Glossary

- Dividend

A portion of a company's earnings distributed to shareholders.

- Retention Ratio

The percentage of earnings retained in the company after dividends are paid.

- Earnings Stability

A measure of how consistently a company generates profit over time.

Reference links

Supplementary resources to enhance your learning experience.