Financing Decisions

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Financing Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are going to explore financing decisions. These are crucial choices about how a business raises funds. Can anyone tell me why financing decisions are important?

I think it’s important because it can affect how much profit the company makes, right?

Exactly! The right financing can maximize profit and minimizes risk. Let’s dive deeper. What are the two main types of financing sources?

Are they equity and debt financing?

Correct! Equity financing involves raising capital by selling shares, while debt financing involves borrowing money. Now, if a company relies heavily on debt, what do we call this effect when profits are amplified but so are potential losses?

That would be financial leverage.

Great job! Remember, while leverage can boost returns, it can also escalate risks. Let’s summarize: financing decisions are essential for maximizing profitability while managing risk.

Cost of Capital and Financial Leverage

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's discuss costs. Why do we need to evaluate the cost of capital when making financing decisions?

To ensure that the returns exceed the cost, otherwise, we lose money.

Exactly! The cost of capital is crucial in evaluating different financing sources. Additionally, how can high levels of debt affect a company's risk?

It raises the risk of bankruptcy because there are more obligations to pay off.

Precisely, and understanding this balance is key for sustainable business growth. Who can summarize the connection between financing decisions and risk?

Financing decisions affect how much debt a company carries, which impacts both its risk level and cost of capital.

Excellent summary! Financing decisions play a pivotal role in an organization’s financial strategy.

Real-Life Implications of Financing Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s apply what we’ve learned. Imagine you are starting a tech startup with limited funds. What financing options would you consider?

I would think about getting venture capital since they might be interested in innovative tech ideas.

But I also worry about giving away too much equity.

Excellent point! Balancing equity and potential profit is vital. Now, if you opted for a bank loan, what risks would you need to consider?

There’s the risk of not being able to repay the loan, leading to bankruptcy.

Exactly! Every decision has its trade-offs. Let’s close with the reminder that diverse financing strategies can mitigate risk while supporting growth.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section delves into financing decisions, which focus on how firms procure and manage funds through equity or debt. Key considerations include the cost of capital, financial leverage, and the risk of bankruptcy associated with different financing sources.

Detailed

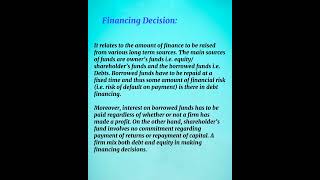

Financing Decisions

Financing decisions are critical as they encompass how a firm raises capital through various sources like equity and debt. These choices have substantial implications for an organization's capital structure and overall risk profile. This section particularly emphasizes key considerations:

- Equity Financing: Involves raising capital by issuing shares. This may also include venture capital, where investors provide funds in exchange for equity stake.

- Debt Financing: Involves borrowing funds through loans or bonds, requiring repayment with interest. It's crucial to balance debt levels to avoid excessive financial risk.

- Cost of Capital: Organizations assess the cost associated with different financing sources to ensure profitability and sustainability.

- Financial Leverage: This refers to the use of debt to fund assets, which can amplify profits but also increases the potential for loss.

- Risk of Bankruptcy: High levels of debt raise the risk of default, making prudent financing decisions essential to maintain liquidity and trustworthiness with investors.

The significance of financing decisions cannot be overstated; they directly affect a firm's financial health and capacity for future investments and growth. Understanding these decisions is essential for students pursuing careers in engineering and IT, as they often engage in start-up scenarios requiring sound financial judgment.

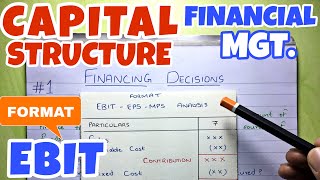

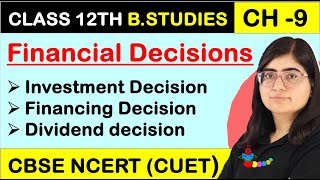

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Understanding Financing Decisions

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

These relate to raising funds through various sources:

Detailed Explanation

Financing decisions are crucial for a company as they determine how a business will acquire the funds needed to start or expand its operations. This involves evaluating different sources of finance that can be used to fund business activities. It is important for businesses to carefully consider these decisions, as they can significantly impact financial stability and operational success.

Examples & Analogies

Think of financing decisions like choosing how to pay for a car. You have the option to pay cash, take out a loan, or lease the car. Each option has different implications for your finances, just as each financing source has different costs and risks associated with it.

Equity Financing Options

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Equity Financing – Shares, Venture Capital

Detailed Explanation

Equity financing involves raising money for a business by selling shares or obtaining venture capital. When a company issues shares, it allows investors to buy ownership stakes. This type of financing does not require repayment like a loan, but it does dilute the ownership and control of the original owners. Venture capital, on the other hand, involves investment from firms or individuals willing to invest in startups or early-stage companies in exchange for equity, especially if the company has high growth potential.

Examples & Analogies

Imagine you start a bakery and need funds to expand. You offer shares of your bakery to friends and family, letting them become co-owners. In return, they invest their money, helping you grow your business without needing to repay a loan.

Debt Financing Options

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Debt Financing – Loans, Bonds

Detailed Explanation

Debt financing involves borrowing funds that must be paid back with interest. This can come in the form of loans from banks or issuing bonds. Loans can provide quick access to capital for immediate needs, while bonds allow businesses to raise larger sums of money over a longer term but require regular interest payments. It is important for businesses to consider their ability to repay this debt, as excessive borrowing can lead to financial strain and risk of bankruptcy.

Examples & Analogies

Consider a small business that needs to purchase a delivery truck. They take out a bank loan. Just like you might borrow money to pay for a car, the business will need to repay this loan monthly while also keeping up with their operations.

Key Considerations in Financing Decisions

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Considerations include cost of capital, financial leverage, risk of bankruptcy

Detailed Explanation

When making financing decisions, businesses must carefully consider several factors. The cost of capital refers to the cost of obtaining funds, whether through equity or debt, and affects profitability. Financial leverage indicates how much debt is used in relation to equity; too much leverage can increase risk, especially during downturns. Finally, the risk of bankruptcy is a critical consideration. A company must ensure its financing strategy is sustainable to avoid falling into financial difficulties.

Examples & Analogies

Imagine if your cupcake shop took out a large loan to open a second location during an economic downturn. If the sales needed to pay off that loan aren't there, you risk going out of business. Balancing how much debt to take on is crucial for ensuring the longevity of the business.

Key Concepts

-

Equity Financing: Raising funds by selling shares.

-

Debt Financing: Borrowing capital to finance operations.

-

Cost of Capital: The expense of utilizing funds for business purposes.

-

Financial Leverage: Use of debt to increase potential investment returns.

-

Bankruptcy Risk: The threat of not being able to meet debt obligations.

Examples & Applications

A tech startup raises $1 million in exchange for 20% of its equity from venture capitalists.

A company takes a bank loan of $500,000, requiring a fixed interest payment over five years.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Debt can help you chase the gold, but too much debt can leave you cold.

Stories

Imagine a tech start-up, eager and bold; they borrowed some cash and bought a new fold. The profits grew fast, their dreams unrolled; but too much leverage could leave them sold.

Memory Tools

Every Debt Raises A Risk: EDRAR - Equity, Debt, Returns, Assets, Risk.

Acronyms

B.E.D. - Balance Equity and Debt in decisions.

Flash Cards

Glossary

- Equity Financing

Raising capital by selling shares to investors.

- Debt Financing

Borrowing funds to be repaid with interest.

- Cost of Capital

The cost of funds used for financing a business.

- Financial Leverage

Using borrowed funds to increase the potential return on investment.

- Bankruptcy Risk

The risk of being unable to pay debts, leading to legal insolvency.

Reference links

Supplementary resources to enhance your learning experience.