Digital Payments

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding UPI

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to discuss the Unified Payments Interface, or UPI for short. UPI is a real-time payment system that allows for instant money transfer between bank accounts via mobile devices. Can anyone tell me how UPI enhances convenience for users?

UPI allows us to transfer money 24/7 instantly without needing to visit a bank.

Exactly! UPI operates on a 24/7 basis and allows for a seamless transaction experience. Remember the acronym 'UPI' as 'User-friendly Payment Interface' to help you recall its core purpose!

Is it safe to use?

Great question! UPI provides a secure way of transferring money using a personal identification number (PIN). This adds a layer of security, making it safer than carrying cash.

What are its main features?

The key features include instant payments, 24/7 availability, and the ability to use multiple bank accounts in one app. These make UPI a powerful tool.

Mobile Wallets

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let’s talk about mobile wallets, such as Paytm and PhonePe. Can someone explain how these wallets function?

They allow us to store money digitally and make payments online or in stores.

Exactly! These wallets act like a virtual bank. What do you think are the main benefits of using mobile wallets over traditional cash?

They are faster and can also integrate with loyalty programs.

Right! Speed and convenience are crucial. A mnemonic to remember is 'MPS' for 'Mobile Payment Speed'.

Are there any drawbacks?

Yes, possible drawbacks include dependency on smartphones and concerns about security, but overall, the benefits often outweigh these challenges.

POS and QR Codes

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's explore Point of Sale systems (POS) and QR codes. Can anyone describe what a POS system is?

It's a system that enables merchants to process payments through card swipes or mobile transactions.

Well done! POS systems represent a crucial part of the retail experience. What about QR codes?

QR codes allow users to scan and pay using their mobile wallets.

Exactly! They provide a contactless payment method which became increasingly popular during the pandemic. Remember 'QR' as 'Quick Response' to recall its usage!

So, the contactless payment trend is set to continue, right?

Indeed! As consumers increasingly prefer contactless options, POS and QR codes are leading the way in enhancing user experience and security.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section explores various digital payment methods such as UPI, IMPS, NEFT, and mobile wallets like Paytm and PhonePe. It emphasizes their significance in making financial transactions faster and more secure, highlighting the integration of POS and QR code systems.

Detailed

Digital Payments

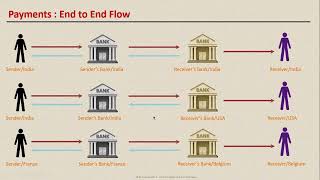

Digital payments represent a significant advancement in the financial landscape, allowing users to complete transactions through electronic means without the need for physical cash. This section discusses the various methods of digital payment available today, including:

- Unified Payments Interface (UPI) - A real-time payment system developed by the National Payments Corporation of India (NPCI) facilitating inter-bank transactions using mobile devices.

- Immediate Payment Service (IMPS) - An instant inter-bank electronic fund transfer service available on mobile and online banking platforms.

- National Electronic Funds Transfer (NEFT) - A centralized system that allows one-to-one fund transfers between banks.

In addition, the section delves into widely used mobile wallets such as Paytm and PhonePe, which enable users to store funds electronically and make transactions easily. Furthermore, the increasing prevalence of Point of Sale (POS) systems and QR code transactions is highlighted as a trend that enhances consumer payment experiences. Digital payments are not only faster but also more secure, paving the way for a cashless economy.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Unified Payments Interface (UPI)

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• UPI

Detailed Explanation

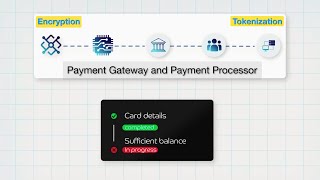

The Unified Payments Interface (UPI) is a revolutionary digital payment system that allows users to transfer money between bank accounts instantly via their smartphones. It simplifies the process for users by enabling them to make transactions using a mobile application, without needing to interact with their bank's website or physical branches. UPI operates on a real-time basis, meaning that the transfer of funds occurs almost immediately, which enhances the convenience for users.

Examples & Analogies

Imagine sending a quick message to your friend via WhatsApp. Just like how you hit 'send' and it arrives instantly, UPI allows you to send money to anyone with just a few taps on your phone, making it as easy as sending a text message.

Immediate Payment Service (IMPS)

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• IMPS

Detailed Explanation

The Immediate Payment Service (IMPS) is another digital payment system designed to facilitate real-time inter-bank transfers instantaneously, 24/7. This service provides users with the ability to send and receive money from one bank account to another at any time of the day or night. It is especially valued for its speed and convenience, making it ideal for urgent transactions.

Examples & Analogies

Think of IMPS as a fast-track lane at an amusement park. Just like how that lane allows you to get on rides quicker, IMPS makes sure your money reaches the destination faster, even when banks are closed.

National Electronic Funds Transfer (NEFT)

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• NEFT

Detailed Explanation

National Electronic Funds Transfer (NEFT) is a payment system that enables one-to-one funds transfer between banks. While NEFT transactions may not be instant, they are processed in batches, making it secure and reliable for transferring larger sums of money at lower fees. NEFT operates on a more traditional schedule, often facilitating transfers in a systematic way during specified hours, unlike UPI and IMPS.

Examples & Analogies

Imagine sending a letter through traditional postal services. Unlike email, which is immediate, the letter takes time to reach the recipient, but it is reliable for important documents. NEFT is similar, as it gives you a reliable way to transfer larger amounts when urgency isn't a major factor.

Digital Wallets

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Wallets: Paytm, PhonePe

Detailed Explanation

Digital wallets, such as Paytm and PhonePe, are applications that store users' payment information and securely manage transactions for online purchases or in-store payments. These wallets allow users to preload money, making transactions faster and easier by eliminating the need to enter card details for every purchase. They can also support a variety of services, including bill payments and peer-to-peer transfers.

Examples & Analogies

Think of a digital wallet as a cashless purse or wallet. In real life, you might carry cash to pay for things conveniently, but with a digital wallet, all your money is stored safely on your phone, allowing for quick and easy payments wherever you go.

Point of Sale (POS) and QR Code Systems

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• POS and QR code systems

Detailed Explanation

Point of Sale (POS) systems refer to the hardware and software that merchants use to process sales transactions. Coupled with QR code systems, POS allows customers to make payments conveniently using mobile apps by scanning a code at checkout. This approach streamlines the payment process and enhances the shopping experience for both merchants and customers.

Examples & Analogies

Picture going to a cafe where you simply scan a QR code on your table with your phone to pay your bill instead of waiting for a card reader; that's how POS and QR code systems work together to make transactions smoother and faster.

Key Concepts

-

Digital Payments: Transactions processed electronically rather than through cash.

-

UPI: A real-time payment system allowing instant transfers.

-

Mobile Wallets: Applications that store money digitally for payments.

-

POS Systems: Technologies that facilitate transaction processing for merchants.

-

QR Codes: Codes scanned for instant payments or information retrieval.

Examples & Applications

Using UPI to send money instantly to a friend through a mobile app.

Paying for groceries with a QR code at the checkout counter.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

With UPI, you can pay, anytime, any day, no need for cash, transactions are a flash.

Stories

Imagine being a merchant in a modern village where everyone uses digital wallets, simplifying trade and enhancing customer engagement with just a tap of their phones.

Memory Tools

Use 'QR' for 'Quick Response' to remember how fast you can pay using QR codes.

Acronyms

Remember 'MPS' - 'Mobile Payment Speed' to understand the efficiency of mobile wallets.

Flash Cards

Glossary

- UPI

Unified Payments Interface; a real-time payment system for inter-bank transactions.

- IMPS

Immediate Payment Service; a service enabling instant money transfers between banks.

- NEFT

National Electronic Funds Transfer; a payment system allowing one-to-one transactions through banks.

- POS System

Point of Sale system; technology used by merchants to facilitate payment processing.

- QR Code

Quick Response Code; a type of matrix barcode that can be scanned for payments or information retrieval.

- Mobile Wallet

A digital wallet that stores payment information to complete transactions online or in-person.

Reference links

Supplementary resources to enhance your learning experience.