InsurTech

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to InsurTech

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're diving into InsurTech, which refers to the use of technology to improve the insurance sector. Can anyone tell me why this might be important?

Maybe it makes it easier for people to find insurance?

Absolutely! InsurTech helps streamline the insurance buying process. Think of how you choose products online; now imagine doing that with insurance. What's one method they might use?

Online comparison sites?

Exactly! Online insurance comparison sites allow users to compare various policies easily. This enhances transparency and helps consumers make informed decisions.

Claims Processing in InsurTech

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s talk about another critical aspect: how InsurTech uses AI for claims verification. Why do you think that would be beneficial?

It could make processing faster?

Exactly! AI can analyze claims and verify information much quicker than a human can. This leads to faster claim settlements. What might that mean for customer satisfaction?

It would probably make customers happier because they get paid faster!

Correct! Faster settlements improve customer experiences significantly, a win-win for both consumers and insurance companies.

Future Implications of InsurTech

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Looking ahead, how do you think InsurTech might change the landscape of the insurance industry even more?

Maybe there will be more personalized insurance products?

Yes! With more data available, companies can tailor policies to individual needs. Are there any concerns that might arise with this level of personalization?

What about privacy? People might worry about how their data is being used.

Great point! Balancing personalization with data privacy will be crucial moving forward.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

InsurTech involves the use of technology to improve various aspects of the insurance industry such as online comparison and purchasing of insurance, as well as utilizing AI for claims verification, leading to enhanced efficiency and customer experience in insurance services.

Detailed

InsurTech

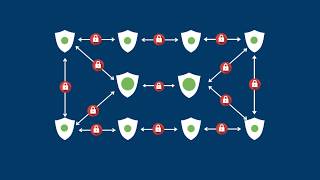

InsurTech encompasses the innovative use of technology to enhance insurance processes and services, effectively transforming how insurance products are offered and managed. A critical aspect of InsurTech includes online insurance comparison platforms, enabling customers to efficiently evaluate options and make informed decisions. Furthermore, artificial intelligence (AI) applications streamline claims verification processes, reducing the time taken for claim settlements and improving overall customer experience. The rise of InsurTech signals a significant shift towards a more tech-driven insurance industry where customer needs are prioritized through personalized, efficient services.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Online Insurance Comparison and Purchase

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Online insurance comparison and purchase

Detailed Explanation

InsurTech, or insurance technology, allows consumers to compare and purchase insurance policies online. This process involves using digital platforms where users can view various insurance options side by side, checking prices, coverage details, and terms without needing to speak to an insurance agent. The convenience of online comparison means consumers can make informed decisions quickly and tailor their insurance selections to fit their specific needs.

Examples & Analogies

Imagine you are shopping for a new phone. Instead of going to multiple stores and speaking to various salespeople, you can use a website to compare prices, features, and reviews of different phones in one place. Similarly, with InsurTech, instead of meeting insurance agents, you can explore multiple insurance policies online and choose the best one that fits your requirements.

AI for Claim Verification

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• AI for claim verification

Detailed Explanation

AI technology is now being used in the insurance industry to streamline the claims verification process. When a claim is submitted, AI algorithms can quickly assess the claim's validity by analyzing data from various sources, including historical claims, policy details, and even social media. This helps insurers make faster decisions on claims, reducing the time it takes for customers to receive payouts and enhancing the overall efficiency of the claims process.

Examples & Analogies

Think of AI in claim verification as a smart assistant who can process documents and information at lightning speed. If you're trying to get a refund for a product you returned, it can take time to sort through receipts and tracking numbers. But with AI, similar to having a super-efficient assistant, all the necessary details are analyzed quickly, making the refund process faster and more accessible.

Key Concepts

-

InsurTech: Technology use in the insurance sector.

-

AI: Critical for processing claims efficiently.

-

Online Comparison: Key feature enabling informed decisions.

Examples & Applications

An example of InsurTech is using an app to compare health insurance options that allows users to filter by price and coverage.

AI-based platforms can analyze claim data and automate the verification process, drastically reducing fraud.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In InsurTech's way, insurance is bright, claims verified right, with data in sight.

Stories

Imagine a customer who found the perfect insurance policy online, feeling both relieved and satisfied as claims are processed quickly by an AI helper.

Memory Tools

IAO: InsurTech = Insurance Automation Online.

Acronyms

INSUR

Insurance Networks Simplifying Underwriting & Risk.

Flash Cards

Glossary

- InsurTech

The use of technology to streamline and improve the insurance industry.

- AI (Artificial Intelligence)

The simulation of human intelligence in machines, used in InsurTech for tasks like claims processing.

- Claims Verification

The process of checking the validity of claims made by policyholders, often enhanced by technology.

Reference links

Supplementary resources to enhance your learning experience.