RegTech (Regulatory Technology)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

What is RegTech?

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are going to discuss RegTech, also known as Regulatory Technology. Can anyone tell me what they think RegTech involves?

Is it about using technology to help financial institutions comply with regulations?

Exactly! RegTech focuses on automating compliance processes to meet regulatory requirements effectively. One of the ways it helps is by reducing human errors, which can lead to significant penalties.

How does it actually automate these processes?

Good question! RegTech uses advanced technologies like machine learning and data analytics to monitor financial transactions and ensure compliance with regulations. Memory Aid: Think of it as a 'Regulatory Robot' working tirelessly to keep everything in check.

So, it can help organizations be proactive with their compliance?

Absolutely, by providing real-time insights and alerts about potential compliance risks. Let's summarize: RegTech automates compliance, reduces human errors, and helps organizations stay proactive. Any questions?

Importance of RegTech in Finance

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s talk about the importance of RegTech in finance. Why do you think it is vital for financial institutions?

I guess it's important because the financial sector faces constant regulatory changes?

That's right! Financial regulations are ever-evolving. RegTech allows companies to keep up without extensive manual effort. Think of it as a 'Compliance Companion' that evolves with the rules.

What could happen if a financial institution doesn't keep up with regulations?

Great question! Non-compliance can result in hefty fines, reputational damage, and even legal trouble. It's critical for sustaining trust in the financial system.

Are there any examples of RegTech tools?

Yes! Tools such as compliance management software or AI-driven risk assessment tools are great examples. To recap: RegTech helps organizations keep pace with regulatory changes, preventing penalties and maintaining trust.

Future Trends in RegTech

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let's explore the future trends of RegTech. What advancements do you think lie ahead for this field?

I think AI and machine learning will continue to play a significant role.

Yes! AI will enhance the efficiency of RegTech solutions even more. Furthermore, as regulations become complex, RegTech will need to incorporate more sophisticated analytical tools. Remember: 'RegTech = Ready for Growing'!

Will RegTech also address data privacy issues?

Absolutely! RegTech is essential in maintaining data privacy compliance, especially with laws like GDPR. Before we finish, let's summarize: RegTech's future is tied to AI advancements and robust data privacy protection.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

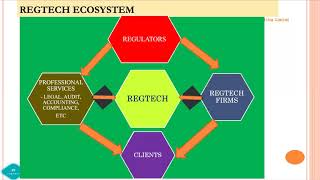

RegTech, or Regulatory Technology, automates compliance processes and enables the monitoring of financial regulations, helping organizations to meet regulatory standards in a more efficient and effective manner. It plays a critical role in enhancing transparency and reducing the burden of compliance on financial organizations.

Detailed

Detailed Summary

RegTech, short for Regulatory Technology, refers to the application of technology to facilitate compliance with regulatory requirements in the financial sector. This includes automating compliance processes such as data collection, reporting, monitoring regulations, and risk management. The primary objective of RegTech is to streamline the compliance process, making it more efficient and reducing the potential for human error, which could lead to regulatory fines or breaches. Additionally, RegTech solutions often include advanced technologies like artificial intelligence and machine learning to analyze vast amounts of data to ensure compliance standards are continually met. The significance of RegTech lies in its ability to adapt to the rapidly evolving regulatory landscape, thus providing organizations with tools to support a proactive rather than reactive approach to compliance.

Youtube Videos

![What is REGTECH | Regulatory Technology | RegTech in Fintech | Future Tech! [UPDATED 2022]](https://img.youtube.com/vi/B1TWqSeYcTc/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Automated Compliance

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Automated compliance

Detailed Explanation

Automated compliance refers to the use of technology to ensure that organizations are adhering to financial regulations and standards automatically, without the need for extensive manual oversight. This helps to reduce the risk of human error and ensures that compliance is maintained consistently.

Examples & Analogies

Imagine a robot that checks and maintains your home’s security system. Instead of relying on you to manually lock the doors and check the cameras every day, this robot automatically does it for you, ensuring everything is secure without needing constant human intervention. Similarly, automated compliance systems monitor financial regulations constantly, ensuring organizations are always compliant.

Monitoring of Financial Regulations

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Monitoring of financial regulations

Detailed Explanation

Monitoring financial regulations involves continuously observing and analyzing regulatory changes and requirements in the financial industry. RegTech solutions can provide real-time updates and alerts to companies about new laws or amendments, helping them stay informed and compliant with the latest rules.

Examples & Analogies

Consider a weather app that sends you alerts about rain or severe weather changes. Just as this app helps you prepare for changing conditions outside, RegTech monitoring systems alert financial institutions to changing regulatory landscapes, allowing them to adapt quickly and make necessary changes to their operations.

Key Concepts

-

Automation of Compliance: RegTech automates the compliance processes to ensure better adherence to regulations.

-

Real-time Monitoring: RegTech solutions allow for immediate tracking of regulatory changes and compliance needs.

-

Data Privacy: Ensures the protection of personal information and compliance with data protection laws.

Examples & Applications

Compliance management software that automates data reporting and submission to regulators.

AI tools used to identify potential fraud or risks in financial transactions.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In finance, when rules change, RegTech is there, to help us comply with speed and care.

Stories

Imagine a bank where a robot named Reggie keeps track of all the financial rules, reminding people to follow them without fail.

Memory Tools

Remember 'A.I. for RegTech': Automation, Innovation, and Intelligence for better compliance!

Acronyms

RegTech = Reliable & Efficient Government Technology.

Flash Cards

Glossary

- RegTech

A field that employs technology to facilitate compliance with regulatory requirements in financial services.

- Compliance

The act of conforming to established guidelines or regulations set by governing bodies.

- Machine Learning

A subset of AI focused on the development of algorithms that allow computers to learn and make decisions from data.

- Data Analytics

The process of examining datasets to draw conclusions and support decision-making.

Reference links

Supplementary resources to enhance your learning experience.