Control Mechanism

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Weekly Review of Costs

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to discuss the importance of conducting a weekly review of costs. This process helps startups like our AI health app stay on track with their budgets. Why do you think regular reviews are crucial?

I think it helps to catch problems early before they get worse.

Exactly! Early detection of overspending can lead to swift corrective measures. Can anyone think of a potential risk if these reviews are skipped?

If we don't review costs, we might end up spending too much and run out of money.

That’s right! You can remember this process using the acronym *CARE*: Check, Analyze, React, Evaluate. Let's repeat that together: Check, Analyze, React, Evaluate – CARE!

That’s a good mnemonic!

Great! In summary, regular cost reviews ensure financial stability by catching issues early and allowing for effective resource management.

Adjustments in Marketing Spend

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s talk about adjusting marketing spend based on conversion rates. Why is it important to adapt our marketing budget?

If certain ads are performing better, it makes sense to put more money there!

Exactly! Allocating resources to the best-performing campaigns can maximize impact. What could happen if we allocate too much to a campaign that isn't performing well?

We could waste money and miss our budget targets.

Well said! A good practice here is the *5P Model*: Plan, Perform, Analyze, Adjust, Repeat. Who can share the steps of the *5P Model*?

Plan, Perform, Analyze, Adjust, and Repeat!

Excellent! Remember this model when discussing marketing strategies. To sum it up, it's crucial to adapt to performance insights for successful budget management.

Contingency Buffer

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s discuss the importance of having a contingency buffer in our budget. What do you think this buffer helps us manage?

It’s for unexpected costs, right? Like if we have bugs in the software or something?

Absolutely! It allows flexibility to accommodate unforeseen expenses. What could be a consequence of not having this buffer?

We might need to cut back on important features if costs increase.

Correct! To remember the importance of the contingency buffer, think of the phrase *‘Plan for the Unexpected.’* Repeat with me: Plan for the Unexpected!

Plan for the Unexpected!

Well done! In conclusion, a contingency buffer provides a safety net in budgeting, promoting resource stability and project resilience.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section details the control mechanisms used in budgeting, emphasizing the importance of weekly cost reviews for startups, dynamic adjustments to marketing strategies based on real-time data, and the necessity of a contingency buffer for unforeseen expenses. These practices collectively improve budget adherence and ensure that financial goals are met.

Detailed

Control Mechanism

The control mechanism within budgeting is essential for ensuring that an organization adheres to its financial forecasts and effectively manages its resources. This section outlines the specific strategies employed by a software startup to maintain control over its budget.

Key Points:

- Weekly Review of Costs: Conducting regular assessments each week allows the startup to monitor spending closely, identify any deviations from the budget, and take corrective action promptly.

- Adjustments in Marketing Spend: Based on conversion rates and performance metrics, marketing expenditures can be dynamically adjusted. This flexibility ensures that funds are allocated efficiently, maximizing returns on investment.

- Contingency Buffer: By reserving a portion of the budget for unexpected expenses, such as software bugs or unforeseen operational challenges, the startup can manage risk more effectively. This buffer provides financial resilience, critical in the fast-moving tech environment.

Overall, employing a robust control mechanism enables organizations to remain aligned with their financial objectives, ensuring stability and fostering growth even in uncertain conditions.

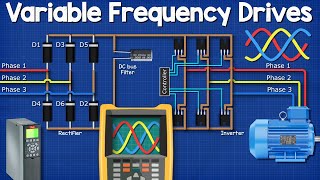

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Weekly Review of Costs

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Weekly review of costs

Detailed Explanation

The primary step in the control mechanism is to examine costs on a weekly basis. This involves looking at all expenses incurred over the week and comparing them against what was planned in the budget. Regular reviews help to identify any discrepancies early.

Examples & Analogies

Consider a personal budget for your monthly groceries. If you check your spending every week, you can quickly see if you're overspending or if you have room to buy something extra before the month ends. Similarly, the startup keeps a close eye on costs weekly to adjust if needed.

Adjustments in Marketing Spend

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Adjustments in marketing spend based on conversion rates

Detailed Explanation

Another important aspect of the control mechanism is adjusting marketing expenses in response to conversion rates. If the current marketing efforts result in a high number of conversions, the startup might decide to invest more in that area. Conversely, if a campaign is underperforming, they can allocate fewer resources there to avoid wasting funds.

Examples & Analogies

Think of a lemonade stand that spends more on advertising in a neighborhood where lots of people stop by. If they see fewer customers after a certain type of ad, they might decide to change their approach or scale back on that advertisement to save money and focus on what works best.

Contingency Buffer for Unexpected Bugs

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Contingency buffer for unexpected bugs

Detailed Explanation

The startup also sets aside a contingency buffer to address unexpected expenses, such as bugs that require urgent fixes. This means that they have a reserve of funds specifically allocated to handle surprise issues that might arise during development, ensuring that these can be managed without derailing the overall budget.

Examples & Analogies

Imagine you're planning a road trip, and while you budget for fuel and snacks, you also keep some extra cash for any unexpected car repairs. This is similar to how the startup retains a fund for unforeseen bugs, ensuring they can deal with problems right away without financial strain.

Outcome of Budgetary Control Implementation

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Result: After budgetary control implementation, the startup maintained 92% adherence to its budget and met its quarterly goals.

Detailed Explanation

The overall outcome of these mechanisms is significant. After implementing the budgetary control procedures, the startup achieved a 92% adherence rate to its budget. This means they were able to stay very close to their planned spending and, as a result, meet their financial goals for the quarter effectively.

Examples & Analogies

It's like a student who follows their study schedule closely. If they stick to it, they likely score well in their exams. Similarly, the startup’s strict adherence to its budget allowed it to hit its targets and operate smoothly.

Key Concepts

-

Weekly Review of Costs: A regular assessment to monitor spending against the budget.

-

Dynamic Marketing Adjustments: Adapting marketing budgets based on performance metrics like conversion rates.

-

Contingency Buffer: A reserve fund set aside for unplanned expenses, ensuring project flexibility.

Examples & Applications

An AI startup maintains a 92% budget adherence rate by implementing regular cost reviews and adjusting their marketing strategy based on user engagement metrics.

By setting aside 10% of their budget as a contingency, a software startup can handle unexpected costs like software bugs or changing requirements without compromising project delivery.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Review each week, keep budgets neat, find the leaks, and avoid defeat.

Stories

Imagine a startup that discovers unexpected costs. By reviewing spending weekly, they prevent overspending and make adjustments, thus saving their project from failure.

Memory Tools

Remember the 3 A's of budget control: Assess, Adjust, Act. Always apply this to stay on track.

Acronyms

Use *BUDGET*

Balance Unforeseen Developments

Guard Expenditures Tightly.

Flash Cards

Glossary

- Control Mechanism

Strategies and processes used to monitor and manage an organization's budget and resources effectively.

- Contingency Buffer

An allocated amount of funds set aside to cover unexpected expenses or losses.

- Conversion Rates

The percentage of users who take a desired action compared to the total users who visit a website or application.

Reference links

Supplementary resources to enhance your learning experience.