Objectives of Budgeting

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Planning in Budgeting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we'll start by discussing one of the key objectives of budgeting: planning. Why do you think planning is essential in budgeting?

I think it's important because it helps organizations prepare for future challenges.

Exactly! Planning ensures that an organization can anticipate challenges ahead. Now, can anyone think of how planning impacts a tech startup’s capability to thrive?

If they plan well, they can allocate funds for necessary tools and resources to support their development.

Right! This smooth allocation prevents resource shortages. Remember, effective planning can be succinctly summed up with the acronym 'P-A-C-E': Prepare, Allocate, Coordinate, and Execute. Let's move on to how budgeting aids coordination.

Coordination through Budgeting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Coordination is vital in ensuring all departments work towards common goals. Can anyone provide an example of how budgeting facilitates coordination?

Like when the marketing and development teams collaborate on a project budget to ensure the product meets customer needs?

Perfect example! By budgeting collaboratively, departments can align their activities effectively. Remember the 'C' in P-A-C-E stands for the crucial role of Coordination. Now, let’s discuss how we allocate resources effectively.

Resource Allocation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Resource allocation is another major objective. How do you think organizations decide which areas get more funding?

They probably prioritize departments that drive revenue or support critical operations.

Absolutely! Prioritization is key in resource allocation. It's all about aligning financial resources with strategic goals. If we think of 'resources' in the budgeting context, we can use the example of a startup deciding between investing in marketing or product development. Can someone summarize the effects of poor resource allocation?

It could lead to missed opportunities or hinder a team’s capacity to function effectively.

Exactly! Misallocation results in operational inefficiencies and lost competitive edges. Let's explore how budgeting assists in performance evaluation now.

Performance Evaluation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Performance evaluation is crucial in identifying whether organizations meet their planned objectives. Why do you think it’s essential to compare actual performance against the budget?

It helps in measuring effectiveness and efficiency in operations.

Correct! By comparing budgeted figures with actual results, organizations can identify variances and gauge success. How would variance analysis help companies?

It highlights areas that may need adjustments or improvements.

Exactly! Variance analysis acts as a guiding tool, directing improvements where necessary. Summarizing, keep in mind that budgeting provides not only a financial plan but also a tracking mechanism for ongoing performance.

Cost Control and Forecasting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Cost control is essential for preventing overspending. Can anyone share how budgeting helps in identifying unnecessary expenses?

Budgeting tracks expenditures against the budget, right? So if something exceeds the budgeted amount, it flags a problem.

Exactly! By highlighting overspending, organizations can quickly act to correct their paths. Now, how does budgeting assist in forecasting?

It uses historical data to predict future revenue and expenses, helping businesses prepare.

Correct! It enables proactive decisions rather than just reactive ones. In conclusion, remember the six objectives: Planning, Coordination, Resource Allocation, Performance Evaluation, Cost Control, and Forecasting.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The objectives of budgeting encompass planning for future operations, coordinating departmental efforts towards common goals, allocating resources, evaluating performance, controlling costs, and forecasting trends. These objectives ensure that organizations can operate efficiently and effectively while aligning financial strategies with operational goals.

Detailed

Objectives of Budgeting

Budgeting plays a pivotal role in the financial management of organizations, especially in technology-driven environments like STEM fields. The primary objectives of budgeting can be outlined as follows:

- Planning: Budgeting allows for careful preparation for future operations, ensuring that the organization is equipped to meet coming challenges and opportunities. Through effective planning, organizations can anticipate their resource needs and economic conditions.

- Coordination: A well-formulated budget fosters alignment among different departments, encouraging collaboration towards shared organizational goals. Coordination ensures that all teams are on the same page and working synergistically rather than in isolation.

- Resource Allocation: Budgeting helps organizations efficiently allocate resources based on priority needs, thereby enhancing their effectiveness in achieving their objectives. This ensures that the most critical areas are adequately funded and supported.

- Performance Evaluation: Budgets enable organizations to assess actual performance against planned benchmarks. This evaluation facilitates feedback loops, allowing for adjustments and improvements in organizational strategies.

- Cost Control: By identifying unnecessary expenditures, budgeting aids in maintaining fiscal discipline. This objective is vital for organizations to remain cost-effective and profitable.

- Forecasting: Budgets assist in predicting trends in sales, expenses, and resource requirements, thereby empowering organizations to make informed strategic decisions based on expected future conditions.

In summary, the objectives of budgeting are intertwined with the fundamentals of financial planning and management, providing a structured approach to achieving both operational and financial success.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Planning

Chapter 1 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Planning: Ensures the organization is prepared for future operations.

Detailed Explanation

Planning in budgeting is the process of setting goals for what the organization wants to achieve in the future. By creating a budget, an organization can anticipate needs for resources and prepare accordingly. This means that they can ensure they have enough funds allocated to complete projects or provide services effectively.

Examples & Analogies

Consider a student planning a trip. They need to budget for transportation, accommodation, and activities. By planning these expenses in advance, the student can ensure they save enough money and make the trip enjoyable without overspending.

Coordination

Chapter 2 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Coordination: Aligns the activities of different departments toward common goals.

Detailed Explanation

Coordination in budgeting involves making sure all departments within an organization are working towards the same objectives. This can be achieved by sharing the budget across departments, allowing them to understand how various functions contribute to overall goals. By aligning budgets, organizations ensure that resources are allocated efficiently across departments.

Examples & Analogies

Imagine a sports team where each player has a specific role, but all work together towards winning a championship. Budget coordination ensures that the resources allocated for training, travel, and player development all contribute to the main goal of winning.

Resource Allocation

Chapter 3 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Resource Allocation: Helps distribute resources based on priorities.

Detailed Explanation

Resource allocation refers to the method by which an organization distributes its resources—such as money, time, and manpower—based on what is most important for achieving its goals. A well-prepared budget allows managers to direct funds towards the most critical areas first, ensuring that essential projects and needs are met.

Examples & Analogies

Think of a chef preparing a meal. They need to decide how much of each ingredient is necessary based on the dish’s importance and complexity. If the main course requires more expensive ingredients, the chef might allocate less attention to simpler sides, reflecting a priority-based resource distribution.

Performance Evaluation

Chapter 4 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Performance Evaluation: Enables the measurement of actual performance against planned performance.

Detailed Explanation

Performance evaluation involves monitoring and comparing an organization's actual performance to the goals set in the budget. This assessment helps identify areas where the organization is doing well and where there is a need for improvement. By regularly reviewing these evaluations, an organization can adjust strategies and improve future performance.

Examples & Analogies

Consider a student taking a class where they have set goals for grades. At the midpoint, they compare their current grades to their goals; if they are falling short, they can change their study habits to improve by the end of the semester.

Cost Control

Chapter 5 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Cost Control: Identifies and reduces unnecessary expenditures.

Detailed Explanation

Cost control is about keeping expenses within the planned budget. By tracking spending against the budget, organizations can identify unnecessary costs and address them quickly. Effective cost control helps prevent overspending and improves overall financial health, ensuring funds are used efficiently.

Examples & Analogies

Imagine a person on a diet who tracks their calorie intake against a daily limit. Recognizing that they are consuming too many calories on snacks, they can adjust their eating habits to meet their health goals without overspending their calorie budget.

Forecasting

Chapter 6 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Forecasting: Predicts trends in sales, expenses, and resource requirements.

Detailed Explanation

Forecasting is the process of predicting future trends based on historical data. In budgeting, this means estimating how much revenue an organization expects to generate and how much it will spend. Accurate forecasting helps organizations prepare for changes in demand and appropriately allocate their budget.

Examples & Analogies

Think of a farmer determining how much seed to plant. By analyzing past harvests, they can predict how much they can expect to grow this season, allowing them to allocate resources efficiently for planting, watering, and harvesting.

Key Concepts

-

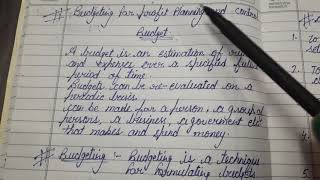

Budgeting: A systematic approach to preparing estimates of income and expenditure.

-

Cost Control: Monitoring expenditures to ensure they are within budget limits.

-

Performance Evaluation: Comparing actual performance to planned targets.

-

Resource Allocation: Distributing resources based on priorities.

-

Forecasting: Predicting future financial needs and trends.

-

Planning: The preparatory phase for a successful budgeting process.

-

Coordination: Aligning different departments to work towards shared objectives.

Examples & Applications

A tech startup preparing a budget to ensure adequate funding for both product development and marketing efforts.

A large corporation revising its budget quarterly to monitor spending against projected revenues.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Plan, Coordinate, Allocate with care; Evaluate performance, Costs beware.

Stories

Imagine a captain sailing a ship, budgeting his supplies carefully to navigate to a distant land. He plans his route, coordinates the crew's tasks, allocates resources for each journey phase, checks their performance against the map, controls the supplies on board, and forecasts weather changes ahead.

Memory Tools

Remember the acronym 'P-C-R-P-C-F': Planning, Coordination, Resource Allocation, Performance evaluation, Cost control, Forecasting.

Acronyms

Use 'BUDGET' to remember

Budgeting

Understanding

Distribution

Goals

Evaluation

Trends.

Flash Cards

Glossary

- Budgeting

The process of preparing budgets to estimate an organization's revenues and expenditures.

- Cost Control

The efforts made to monitor and reduce unnecessary expenditures.

- Performance Evaluation

The process of measuring actual performance against budgeted performance.

- Resource Allocation

The distribution of resources based on the priority needs of the organization.

- Forecasting

The prediction of future trends in sales, expenses, and resource requirements.

- Planning

The process of preparing an organization for future operations.

- Coordination

The alignment of activities among different departments towards common goals.

Reference links

Supplementary resources to enhance your learning experience.