Types of Budgets

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Short-term vs. Long-term Budgets

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we’re going to explore the differences between short-term and long-term budgets. Can anyone tell me what a short-term budget is?

It's a budget that covers a year or less, right?

Exactly! Short-term budgets help organizations manage operational control. And what about long-term budgets?

They cover periods longer than a year and are used for strategic planning.

Well done! Can anyone give an example of where we might use a long-term budget?

Maybe when planning a new product launch that requires more time and investment?

Correct! It’s all about aligning with strategic goals. Remember, short-term is for operations, while long-term focuses on strategy. Let’s summarize: Short-term for daily operations, long-term for big picture planning.

Function-based Budgets

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s explore the function-based types of budgets. Who can list some types?

I remember sales, production, and cash budgets!

Great start! The sales budget projects our future sales volume. Student_1, can you explain what a production budget does?

It plans for how much we need to produce to meet sales estimates.

Exactly! And what about the cash budget?

It predicts cash inflows and outflows to ensure we manage liquidity.

Spot on! By using these budgets, we can effectively keep different functions aligned with our financial goals. Let's remember this phrase: sales for revenue, production for output, and cash for liquidity!

Flexible vs. Fixed Budgets

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today's focus is on flexible and fixed budgets. What is a fixed budget?

A budget that doesn’t change regardless of activity levels.

Yes! And what’s the downside of fixed budgets?

They can be rigid and don’t adapt to changes in operations.

Exactly! Now, what about flexible budgets?

They adjust based on actual activity levels to reflect true performance!

You’re all doing wonderful! Flexible budgets provide a more realistic view of performance. Remember: Fixed doesn’t change; Flexible adapts to reality.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

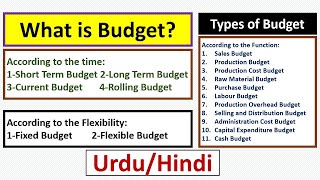

The section elaborates on three major categorizations of budgets: based on time (short-term and long-term), based on function (including sales, production, purchase, cash, capital expenditure, and personnel budgets), and based on flexibility (fixed and flexible budgets), underscoring their importance in financial planning and control.

Detailed

Types of Budgets

This section outlines the different types of budgets that organizations utilize to manage their financial resources effectively. Budgets can be categorized in the following ways:

1. Based on Time

- Short-term Budget: Typically covers a year or less and is primarily focused on operational management. It helps organizations maintain day-to-day activities efficiently.

- Long-term Budget: This budget stretches beyond one year and is aligned with the organization’s strategic objectives, aiding in long-term planning and investment analysis.

2. Based on Function

- Sales Budget: Predicts expected sales in terms of volume and revenue.

- Production Budget: Outlines the planned levels of manufacturing outputs to meet sales forecasts.

- Purchase Budget: Estimates the required materials for production.

- Cash Budget: Monitors expected cash inflows and outflows to manage liquidity.

- Capital Expenditure Budget: Details planned spending on significant long-term assets.

- Personnel Budget: Forecasts employee-related expenses, ensuring adequate allocation for salaries and wages.

3. Based on Flexibility

- Fixed Budget: Stays constant regardless of actual activity levels, making it easy to manage but less adaptable to changes in circumstances.

- Flexible Budget: Adjusts based on actual activity levels, providing a more realistic view of performance by accommodating variances in operational activity.

Understanding these types of budgets is critical for engineers and managers as they help align financial planning with operational needs, ensuring that resources are allocated efficiently and effectively.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Types of Budgets Based on Time

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Based on Time:

- Short-term Budget: Typically for one year or less; used for operational control.

- Long-term Budget: Covers periods beyond one year; used for strategic planning.

Detailed Explanation

Budgets can be classified based on the time frame they cover. A short-term budget is designed for less than a year, focusing on operational needs. It helps manage daily operations effectively, ensuring that resources are allocated efficiently within a short time frame. In contrast, a long-term budget spans beyond a year and is used for strategic planning. This type involves predicting future trends and goals, allowing organizations to make informed decisions regarding expansion and investments.

Examples & Analogies

Imagine a student managing their finances for the upcoming semester. They create a short-term budget focusing on monthly expenditures like rent and groceries. Meanwhile, they also plan a long-term budget for their entire college experience, considering tuition fees, future book purchases, and even an internship that could shape their career.

Types of Budgets Based on Function

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Based on Function:

- Sales Budget: Projects future sales volume and revenue.

- Production Budget: Plans for manufacturing output.

- Purchase Budget: Estimates the raw materials to be bought.

- Cash Budget: Predicts cash inflows and outflows.

- Capital Expenditure Budget: Details spending on long-term assets.

- Personnel Budget: Forecasts employee costs (wages, salaries, etc.).

Detailed Explanation

Budgets can also be categorized based on their function within the organization. Each budget serves a specific purpose: the sales budget forecasts sales and revenue, essential for planning and growth. The production budget focuses on the quantity of goods to be produced, ensuring resources align with production goals. The purchase budget estimates the necessary raw materials, while the cash budget is crucial for predicting liquid assets, preventing cash shortages. Additionally, the capital expenditure budget outlines investments in long-term assets, and the personnel budget projects costs associated with employees, allowing for effective workforce planning.

Examples & Analogies

Consider a bakery. The sales budget estimates the sales from cakes and pastries over the next month. The production budget will plan how many cakes should be made according to that sales forecast. To ensure they have enough supplies, the purchase budget will determine how much flour and sugar to buy, while the cash budget will monitor how money flows in and out to keep the bakery running smoothly.

Types of Budgets Based on Flexibility

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Based on Flexibility:

- Fixed Budget: Prepared for a single level of activity; doesn't change with volume.

- Flexible Budget: Adjusts with changes in activity levels.

Detailed Explanation

Budgets can also be differentiated based on flexibility. A fixed budget is stagnant; it does not adapt regardless of changes in activity levels. This can be useful when a stable environment is expected. However, it may not reflect reality if the actual activities vary significantly. On the other hand, a flexible budget adjusts based on the volume of activity. This adaptability makes it a valuable tool for organizations facing fluctuating environments, allowing them to reevaluate their resource allocations as circumstances change.

Examples & Analogies

Think about a gym membership. A fixed budget for gym expenses might set a specific fee regardless of how often you go, while a flexible budget might allow you to pay based on the number of classes you attend each month. If you go more often, you would pay more, aligning costs with your actual usage.

Key Concepts

-

Short-term Budget: A quick, operational budget covering a year or less.

-

Long-term Budget: A budget designed for strategic planning beyond one year.

-

Sales Budget: Projection of future sales and revenues.

-

Fixed Budget: Unchanging budget regardless of activity levels.

-

Flexible Budget: Budget that adjusts according to activity.

Examples & Applications

A tech company prepares a short-term budget for software development expenses that includes salaries, tools, and marketing costs anticipated for the upcoming year.

A manufacturing firm engages in long-term budgeting to allocate resources for a new production facility projected to be built in three years.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

For every plan, have a budget in your hand; short-term for quick spins, long-term for wins.

Acronyms

FLEX - Flexible is for changes, while FIXED stays unexplained.

Memory Tools

Sales Forecasts, Production Plans, Cash Flow – Remember them in your strategy to grow!

Stories

Imagine a startup where the team has a short-term party budget but needs a long-term vision for scaling—a happy combination leads to success!

Flash Cards

Glossary

- Budget

A detailed, quantitative plan estimating an organization's revenues and expenditures over a specific future period.

- Shortterm Budget

A budget covering a period of one year or less, used for operational control.

- Longterm Budget

A budget that extends beyond one year, aimed at strategic planning.

- Sales Budget

A budget estimating future sales volume and revenues.

- Production Budget

A budget that outlines the planned levels of manufacturing output.

- Cash Budget

A budget predicting cash inflows and outflows.

- Fixed Budget

A budget prepared for a single level of activity, remaining unchanged with fluctuations in activity levels.

- Flexible Budget

A budget that adjusts in response to changes in activity levels.

Reference links

Supplementary resources to enhance your learning experience.