Profitability Index (PI)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Profitability Index

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we'll explore the Profitability Index, or PI. The PI is a key financial metric that helps us determine the value of an investment relative to its cost. Can anyone tell me why this might be important in capital budgeting?

It's important because it helps businesses decide if the investment will be worth it.

Yeah, if we invest money, we want to know if we will make more in return, right?

Exactly! The PI tells us whether the present value of future cash inflows exceeds the initial investment. If PI is greater than one, it indicates a potentially profitable investment. Remember the mnemonic 'PI is Profit, Increment!' to help recall what PI stands for.

Calculating the Profitability Index

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s look at how we actually calculate the Profitability Index. We use the formula: $$ PI = \frac{PV \ of \ Cash \ Inflows}{Initial \ Investment} $$. Can someone try to explain what goes into this formula?

So, we need the present value of future cash inflows and the amount we initially invest, right?

Is the present value important because it tells us what future cash flows are worth today?

Exactly right! The present value accounts for the time value of money, emphasizing that money now is worth more than the same amount in the future due to its potential earning capacity. Great job!

Decision Rules and Advantages

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

So, what happens once we compute the PI? What are the decision rules involved?

If the PI is greater than one, we should accept the project.

And if it’s less than one, we reject it, right?

Correct! The PI specifically helps highlight which projects provide the best returns for limited funding, making it invaluable for prioritizing investments. What's an advantage of using PI over other methods?

It's based on DCF principles, right? So it factors in the time value of money.

Exactly! You've grasped the concept well. Just remember, while calculating PI, it does require accurate discount rate estimation, which can sometimes be tricky.

Disadvantages and Challenges

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's discuss some limitations of using the PI. What do you think is challenging about estimates involved in the PI?

I think it's tough because the discount rate can vary widely, affecting our calculations.

What if there's a change in expected cash flows? That might make our PI inaccurate too.

Absolutely! Those factors highlight the complexity and need for precision when estimating cash flows and the discount rate. Always keep these challenges in mind when using the PI.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Profitability Index (PI) helps investors assess the relative profitability of investment projects. A PI greater than 1 indicates a potentially worthwhile project, while a value less than 1 suggests rejection. The PI incorporates the time value of money, making it a vital tool for informed decision-making in capital budgeting.

Detailed

Profitability Index (PI)

The Profitability Index (PI) is a crucial financial metric used in capital budgeting to analyze the attractiveness of an investment. It is calculated as the ratio of the present value (PV) of future cash inflows to the initial investment. The formula can be represented as:

$$ PI = \frac{PV \ of \ Cash \ Inflows}{Initial \ Investment} $$

Decision Rule

- A PI greater than 1 (PI > 1) suggests that the investment is expected to generate more value than its cost, indicating it might be an attractive project to accept.

- Conversely, a PI less than 1 (PI < 1) indicates that the investment is not expected to cover its cost and should be rejected.

Advantages

- Helpful for Limited Funds: The PI is particularly beneficial when available funds are constrained as it helps prioritize projects that offer the highest return per unit of investment.

- DCF Principles: It aligns with the principles of Discounted Cash Flow (DCF), incorporating the time value of money, thus giving a more accurate picture of a project's profitability.

Disadvantages

- Requires Discount Rate Estimation: The calculation of PI necessitates an accurate estimation of the discount rate, which can be challenging.

- Complexity: Compared to simpler metrics like the Payback Period, the PI can be more difficult to compute due to its reliance on various cash flow estimates.

Understanding the PI is fundamental for effective capital budgeting as it aids managers in making informed investment decisions that align with the organization’s financial strategy.

Youtube Videos

![[#8] Capital Budgeting technique | Profitability Index Method in Financial Management | kauserwise®](https://img.youtube.com/vi/wC2x9QAw4D0/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of Profitability Index (PI)

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Profitability Index (PI)

- Definition: Ratio of present value of future cash inflows to the initial investment.

Detailed Explanation

The Profitability Index (PI) is a financial metric used to assess the attractiveness of an investment. It is calculated by taking the present value of all future cash inflows generated by an investment and dividing it by the initial investment amount. This formula gives a ratio that helps indicate how much value is expected for each dollar invested. A PI greater than 1 suggests that the investment is likely to generate more cash inflows than its cost, making it a desirable choice.

Examples & Analogies

Imagine you are considering buying a piece of equipment for your business that costs $10,000. If you believe this equipment will generate $15,000 in future cash inflows, the PI would be calculated as follows: 15,000 (future cash inflows) / 10,000 (initial investment) = 1.5. This means for every dollar spent, you expect to get $1.50 back. A PI greater than 1 shows you are making a profitable investment.

Formula for Profitability Index (PI)

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

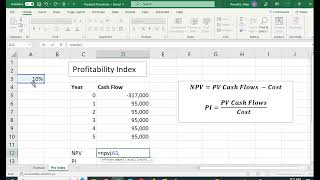

PI = PV of Cash Inflows / Initial Investment

Detailed Explanation

The PI formula is concise and focuses on two components: the present value (PV) of cash inflows and the initial investment. By dividing the present value of expected cash inflows by the initial amount spent, the profitability index shows how effectively resources are utilized. If the present value of cash inflows is high compared to the initial investment, it indicates that the project is expected to yield good returns.

Examples & Analogies

Continuing with the previous example, if your equipment costs $10,000 and you conservatively estimate that it will generate $18,000 in cash inflows, your calculation would be PI = 18,000 (PV of cash inflows) / 10,000 (initial investment) = 1.8. This indicates a strong return, exceeding your investment.

Decision Rule for PI

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Decision Rule:

- If PI > 1: Accept.

- If PI < 1: Reject.

Detailed Explanation

The decision rule of the Profitability Index is straightforward. If the PI is greater than one, it indicates that the investment's expected returns surpass its costs, making it a viable option. On the other hand, if the PI is less than one, the future cash inflows won't cover the initial investment, suggesting the project should be rejected. This binary decision-making process simplifies the evaluation of potential investments.

Examples & Analogies

Think of it this way: if you found a deal for a phone that costs $300 and you anticipate selling it for $350, you calculate the PI. If the cash inflow exceeds the cost (PI = 1.17), you would 'accept' the deal. If the phone costs $300 but you only expect to sell it for $250 (PI = 0.83), you would 'reject' the deal because it would not cover your expenses.

Advantages of Profitability Index (PI)

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Helpful when funds are limited.

- Based on DCF principles.

Detailed Explanation

One of the main advantages of using the Profitability Index is that it provides a useful metric when a business is constrained by limited capital. The PI can help prioritize projects by showing the relative profitability of multiple options. Additionally, the Profitability Index is grounded in discounted cash flow (DCF) principles—this means it takes into account the time value of money, allowing for a more accurate assessment of an investment's future cash inflows.

Examples & Analogies

Imagine a community that has limited funds for several potential projects, like building a park, setting up a library, or enhancing local roads. By applying the PI to each project, the community can prioritize funding towards the projects that offer the most significant returns (like increased usage and satisfaction), ensuring that even with limited funds, their investments create the highest possible benefit.

Disadvantages of Profitability Index (PI)

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Like NPV, requires discount rate estimation.

Detailed Explanation

While the Profitability Index is beneficial, it also has limitations. A significant disadvantage is that calculating the PI requires an estimation of the discount rate, which can be subjective. Choosing the wrong discount rate can distort the results, leading to potentially poor investment decisions. This reliance on accurate estimates can be a drawback, particularly if future cash flow predictions are uncertain.

Examples & Analogies

Consider planning a family vacation where you estimate costs for accommodation, travel, food, and entertainment. If you guess incorrectly about food costs, say you expect $50 per day but spend $100, that increased cost affects your total budget. Similarly, estimating the discount rate inaccurately can misrepresent your investment's PI, possibly leading to overspending on projects that aren't truly beneficial.

Key Concepts

-

Profitability Index: A measure of investment efficiency that compares the PV of future cash inflows to the initial investment.

-

Decision Rule: A PI > 1 suggests project acceptance while a PI < 1 suggests rejection.

-

Limitations of PI: Dependence on accurate cash flow estimates and discount rates.

Examples & Applications

Example 1: If an investment has an initial cost of $100,000 and is expected to bring in cash inflows of $120,000 after discounting, the PI would be $120,000 / $100,000 = 1.2, indicating it is a good investment.

Example 2: An initial investment of $150,000 that yields PV cash inflows of $100,000 results in a PI of $100,000 / $150,000 = 0.67, suggesting rejection.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

PI shows where profits lie, above one succeeds, below must say goodbye.

Stories

Imagine a farmer who plants seeds. If the harvest returns more than he invested in seeds, he knows he made the right choice. The PI is like that - measuring returns!

Memory Tools

Remember P.I. for 'Present Income' - it reflects the cash flow we expect today.

Acronyms

PI

Profit over Investment - it tells you how much profit you get for every dollar you invest.

Flash Cards

Glossary

- Profitability Index (PI)

A ratio that reflects the present value of future cash inflows relative to the initial investment.

- Present Value (PV)

The current worth of a future sum of money or cash flows given a specified rate of return.

- Discount Rate

The interest rate used to discount future cash flows to their present value.

Reference links

Supplementary resources to enhance your learning experience.