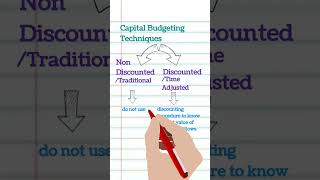

Traditional Techniques (Non-discounted Methods)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Payback Period

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to discuss the Payback Period. Can anyone tell me what the Payback Period measures?

Isn't it the time it takes to recover the initial investment?

Exactly! The formula is: Payback Period = Initial Investment divided by Annual Cash Inflow. Can someone explain why this is important for a business?

It helps companies understand how quickly they can get their money back.

Right! But doesn’t it ignore cash flows after the payback period?

That's correct! It's a limitation we need to consider. Remember, the Payback Period is simple but doesn’t account for the time value of money. Let's take another student, Student_4. Can you summarize the advantages of this method?

Sure! It's easy to understand and good for evaluating liquidity.

Perfect! Always remember: simple methods are useful but be aware of their limitations.

Exploring Accounting Rate of Return

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s move on to the Accounting Rate of Return or ARR. Who can tell me what ARR is?

It measures return based on accounting profits!

Correct! And the formula is ARR equals Average Annual Profit divided by Initial Investment times 100. Student_1, could you explain the significance of ARR?

I think it's important because it gives a quick assessment of returns based on familiar accounting data.

Exactly! However, remember that it also has limitations, like ignoring cash flows and time value of money. What about the disadvantages, Student_2?

Yes, it can be misleading since it relies on accounting profits that may not accurately reflect cash flow.

Great! In summary, while both methods can provide quick insights, they should not be the only tools used in capital budgeting decisions.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The section explores two traditional capital budgeting techniques: the Payback Period (PBP), which measures the time required to recover an investment, and the Accounting Rate of Return (ARR), which assesses return based on accounting profits. Each method's advantages and limitations are discussed, providing insights into their applications in capital investment decisions.

Detailed

Traditional Techniques (Non-discounted Methods)

In capital budgeting, traditional techniques play a significant role in evaluating investments without accounting for the time value of money. This section focuses on two prominent methods: Payback Period (PBP) and Accounting Rate of Return (ARR).

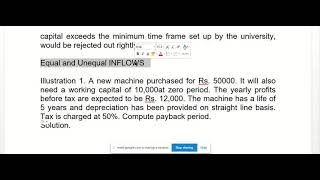

Payback Period (PBP)

The Payback Period is defined as the duration required to recover the initial investment. It is calculated using the formula:

$$Payback \, Period = \frac{Initial \, Investment}{Annual \, Cash \, Inflow}$$

Advantages:

- Simple and easy to understand, making it accessible for quick assessments.

- Useful for gauging a project’s liquidity, providing a quick snapshot of when the investment will be recovered.

Disadvantages:

- Ignores the time value of money, which can lead to miscalculations regarding the value of future cash flows.

- Fails to account for cash inflows that occur after the payback period, potentially overlooking valuable long-term returns.

Accounting Rate of Return (ARR)

The Accounting Rate of Return measures the return on an investment based on accounting profits rather than cash flows. It is calculated using the following formula:

$$ARR = \left( \frac{Average \, Annual \, Profit}{Initial \, Investment} \right) \times 100$$

Advantages:

- Straightforward as it relies on accounting data familiar to most business professionals.

Disadvantages:

- Like the PBP, the ARR also disregards the time value of money, potentially leading to misleading conclusions.

- Utilizes accounting profit instead of cash flow, which can be distorted by non-cash items and accounting practices.

Overall, while traditional techniques such as PBP and ARR offer quick evaluations, they lack the robustness necessary for comprehensive capital budgeting decisions, especially in complex business environments.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Payback Period (PBP)

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Payback Period (PBP)

- Definition: Time it takes to recover the initial investment.

- Formula:

\[ \text{Payback Period} = \frac{\text{Initial Investment}}{\text{Annual Cash Inflow}} \]

- Advantages:

- Simple and easy to understand.

- Good for assessing liquidity.

- Disadvantages:

- Ignores time value of money.

- Does not consider cash flows after payback period.

Detailed Explanation

The Payback Period (PBP) measures how quickly an investment can be recovered. The formula divides the initial investment by the amount of cash inflows generated annually. For example, if a company invests $10,000 and receives $2,000 every year, it will take 5 years (10,000 ÷ 2,000) to recover that investment.

This technique is advantageous because it is straightforward and helps companies assess how quickly they recoup their investments, which can be essential for short-term financial planning. However, it has limitations, such as the fact that it does not take into consideration the time value of money—meaning money today is worth more than the same amount in the future—and it disregards any cash inflows that occur after the payback period.

Examples & Analogies

Think of it like a friend who lends you money to start a small lemonade stand. If you agree to pay them $1,000, and your stand earns $100 every day, it will take you 10 days to repay your friend. While you can easily see when you'll pay them back, you don't consider how the $1,000 could grow if invested elsewhere or what happens after those 10 days.

Accounting Rate of Return (ARR)

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Accounting Rate of Return (ARR)

- Definition: Measures return based on accounting profits.

- Formula:

\[ \text{ARR} = \frac{\text{Average Annual Profit}}{\text{Initial Investment}} \times 100 \]

- Advantages:

- Simple and based on accounting data.

- Disadvantages:

- Ignores time value of money.

- Uses accounting profit, not cash flow.

Detailed Explanation

The Accounting Rate of Return (ARR) is a method used to evaluate an investment by comparing the average annual profit it generates to the initial investment cost. The formula involves dividing the average annual profit by the initial investment and multiplying by 100 to express it as a percentage.

For example, if your total profit over 5 years from an investment of $10,000 is $5,000, your ARR would be calculated as (5,000 ÷ 10,000) × 100 = 50%. While this method is straightforward and relies on easily accessible accounting data, it does not consider how the timing of profits may affect their value. Investments could yield different profits at different times, impacting overall profitability.

Examples & Analogies

Imagine you open a small bakery and invest $10,000. If, at the end of five years, you averaged an annual profit of $2,000, your ARR would be 20%. This gives you a basic idea of your returns, but it doesn't show you the ups and downs in profits or take into account that an investment now might yield more in a few years due to inflation.

Key Concepts

-

Payback Period: A method that calculates the time needed to recover an investment.

-

Accounting Rate of Return: A technique that assesses the return based on accounting profits.

Examples & Applications

If a company invests $50,000 and generates $10,000 annually, the Payback Period would be 5 years.

If an investment yields an average annual profit of $15,000 on an initial investment of $100,000, the ARR would be 15%.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Payback quick, ARR makes you pick, cash or profit, make your fiscal stick.

Stories

Imagine a farmer who plants seeds worth $100. Each year, he harvests plants worth $25. He wonders how long before he sees his $100 back— this is his Payback Period!

Memory Tools

Use 'P-A-R' to remember: Payback for cash recovery, ARR for accounting savings.

Acronyms

ARR = Average Returns Recorded (ARR)

Flash Cards

Glossary

- Payback Period (PBP)

The time it takes for an investment to generate an amount of income equal to the cost of the investment.

- Accounting Rate of Return (ARR)

A ratio that measures the return of an investment based on its accounting profits rather than cash flows.

Reference links

Supplementary resources to enhance your learning experience.