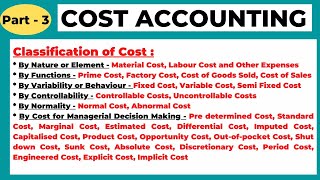

Classification of Costs

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Cost Classification Based on Nature/Elements

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will begin our discussion on cost classification by looking at the two primary types: direct and indirect costs. Can anyone tell me what direct costs are?

Direct costs are those that can be directly traced to a specific product or service.

Exactly! Examples include raw materials and direct labor. Now, can someone explain what indirect costs are?

Indirect costs cannot be traced to a single product. They're like overheads, right?

Correct! Things like office rent and utilities fall into this category. To help remember this, think of 'DR' for Direct Costs and 'IN' for Indirect Costs.

So, does that mean all project-related costs can fit into these two categories?

That's a great question! While many costs fit within these categories, we will go deeper into other classifications as well. Summary: Direct costs link to products directly, while indirect costs cover broader business expenses.

Cost Classification Based on Function

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let's look at cost classifications based on their function within an organization, particularly manufacturing, administrative, and selling costs.

What are manufacturing costs specifically?

Manufacturing costs relate directly to the production process. Can anyone give examples?

Machine maintenance and factory salaries would be considered manufacturing costs.

Great! Now, what's the difference for administrative costs?

They’re expenses related to managing the business, like office salaries and utilities.

Right! And now, can you explain selling and distribution costs?

Those are costs associated with promoting and delivering products, like advertising.

Perfect! To summarize, costs can be classified by function into manufacturing, administrative, and selling, which helps manage budgets effectively.

Cost Classification Based on Behavior

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s dive into cost classification based on behavior. We categorize costs as fixed, variable, and semi-variable. Student_3, can you define fixed costs?

Fixed costs don’t change with the level of production, like rent.

Exactly! And what about variable costs, Student_4?

They change directly with production levels, like raw materials.

Correct! Finally, for semi-variable costs, what does that mean?

Those costs have both fixed and variable components, like an electricity bill.

Excellent! Remembering FIXED for fixed and VARIABLE for variable can help; think of the word 'FVV.' In summary, costs can behave differently based on production levels, which is vital for budgeting.

Cost Classification Based on Identifiability

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's discuss cost classification based on identifiability. Can anyone explain traceable costs?

Traceable costs are related to a specific cost object, like a specific project or product.

That's right! And how about common costs?

Common costs are shared across multiple cost objects and can't be traced back to a single one.

Spot on! An example could be the overall office rent used by various departments. To help remember this, think of the phrase 'Trace to Specific, Common to All.' In summary: traceable costs link to specific objects, while common costs apply broadly.

Cost Classification Based on Relevance for Decision-Making

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Lastly, let’s talk about costs that are relevant and irrelevant to decision-making. Who wants to start?

Relevant costs are future costs that differ between alternatives.

Very true! And what about irrelevant costs?

They don’t affect decisions at all, like sunk costs.

Exactly! To help you remember, think of 'RELEVANT for choices, IRRELEVANT for forgetfulness.' In summary: understanding these costs is crucial in making effective business decisions.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Cost classification is essential in cost accounting as it helps businesses identify and analyze costs in various ways, such as direct versus indirect costs, fixed versus variable costs, and relevant versus irrelevant costs, to make informed business decisions.

Detailed

Classification of Costs

Cost classification is a systematic way of analyzing costs in order to aid in budgeting, decision-making, and control within a business. In this section, we examine the multiple ways in which costs can be categorized:

- Based on Nature/Elements: Distinguishes between

- Direct Costs: Directly attributable to a specific product (e.g., raw materials, direct labor).

- Indirect Costs (Overheads): Cannot be traced directly to a single product (e.g., office rent).

- Based on Function: Classifies costs into:

- Manufacturing Costs: Relating to production (e.g., machine maintenance).

- Administrative Costs: General management expenses.

- Selling and Distribution Costs: Costs for product delivery and promotion.

- Based on Behavior: Helps understand cost behavior with output:

- Fixed Costs: Remain constant regardless of output (e.g., rent).

- Variable Costs: Change directly with production (e.g., raw materials).

- Semi-variable Costs: Contain both fixed and variable elements (e.g., electricity bills).

- Based on Identifiability:

- Traceable Costs: Associated with a specific cost object.

- Common Costs: Shared among different cost objects.

- Based on Relevance for Decision-Making:

- Relevant Costs: Future costs differing across alternatives.

- Irrelevant Costs: Costs that do not impact the decision outcome (e.g., sunk costs).

Classifying costs allows businesses to plan, control, and make strategic decisions effectively.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Classification Based on Nature/Elements

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Costs can be classified based on different attributes depending on the purpose.

20.2.1 Based on Nature/Elements

- Direct Costs: Costs that can be directly attributed to a specific product, service, or project.

- Examples: Raw materials, direct labor, specific software licenses.

- Indirect Costs (Overheads): Costs that cannot be directly traced to a single product or service.

- Examples: Office rent, general administration expenses, electricity for the whole office.

Detailed Explanation

This chunk discusses how costs are classified based on their nature or elements, dividing them into direct and indirect costs.

- Direct Costs are expenses that can be traced to a specific item, such as raw materials used in manufacturing or wages paid directly to workers involved in a particular project. This makes it easy to assess how much each item contributes to overall costs.

- Indirect Costs, on the other hand, are those that cannot be linked to a single product or service but are necessary for the overall functioning of the business, like rent for the office space where multiple products are designed and developed. Recognizing the difference between these costs helps in better financial and operational decisions.

Examples & Analogies

Consider a bakery. The cost of flour and sugar (direct costs) can be directly traced to the cake you're making. However, the rent for the bakery (indirect cost) supports all the various cakes and pastries made but isn't directly attributable to any single product.

Classification Based on Function

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

20.2.2 Based on Function

- Manufacturing/Production Costs: Related to production (e.g., machine maintenance, factory salaries).

- Administrative Costs: Costs related to the general management of the business.

- Selling and Distribution Costs: Costs for promoting and delivering the product.

Detailed Explanation

This chunk classifies costs based on their functions within a business.

- Manufacturing/Production Costs relate to expenses directly involved in creating a product. This includes costs for tools, equipment, and salaries paid to factory workers.

- Administrative Costs cover expenses related to the management and support functions of the business, such as office supplies and salaries of the management team.

- Selling and Distribution Costs are linked to efforts that promote and deliver the products, including advertising and transportation expenses. This classification helps businesses decide where to allocate resources based on their strategic needs.

Examples & Analogies

Imagine a company that manufactures bicycles. The costs associated with the machinery used to build the bikes and the wages for the assembly line workers fall under manufacturing costs. Meanwhile, salaries for the marketing team working on promotional campaigns would be categorized as selling costs.

Classification Based on Behavior

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

20.2.3 Based on Behavior

These help in understanding how costs change with output:

- Fixed Costs:

- Do not change with output in the short term.

- Examples: Rent, salaries of permanent staff, depreciation.

- Variable Costs:

- Vary directly with the level of production.

- Examples: Raw materials, packaging.

- Semi-variable (Mixed) Costs:

- Contain both fixed and variable components.

- Example: Electricity bill (basic charge + usage-based cost).

Detailed Explanation

This chunk discusses how costs behave under different production conditions.

- Fixed Costs remain constant regardless of production levels, meaning they don't fluctuate with the output in the short term, such as rent for facilities.

- Variable Costs change directly with output; the more products produced, the higher these costs, like purchasing more packaging materials when making more bicycles.

- Semi-variable Costs have a mixture of both fixed and variable characteristics, such as an electricity bill, which has a fixed monthly charge plus costs that vary based on usage. Understanding these behaviors aids in budgeting and financial planning.

Examples & Analogies

In a pizza restaurant, the rent (fixed) stays the same regardless of how many pizzas are sold, while the cost of ingredients (variable) increases with every additional pizza made. The electricity bill could be viewed as semi-variable – there’s a base charge (fixed) plus additional costs if many ovens are used.

Classification Based on Identifiability

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

20.2.4 Based on Identifiability

- Traceable Costs: Specifically related to a particular cost object.

- Common Costs: Costs incurred for multiple cost objects and not traceable to a single one.

Detailed Explanation

This chunk explains how costs can be classified based on how easily they can be traced to specific items or projects.

- Traceable Costs are expenses that can be directly linked to a specific item or project, allowing for clear assignment.

- Common Costs are shared expenses that cannot be allocated to just one item; for example, general costs of running a department that serve multiple projects. Distinguishing between these costs is crucial for accurate cost allocation and financial reporting.

Examples & Analogies

Think of a construction project where the salary of the architect (traceable cost) can be directly allocated to a single building. In contrast, the cost of utilities for the whole office where various projects are managed is a common cost, as it supports multiple builds, but isn’t tied to any one specifically.

Classification Based on Relevance for Decision-Making

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

20.2.5 Based on Relevance for Decision-Making

- Relevant Costs: Future costs that will differ between alternatives.

- Used in decision-making.

- Irrelevant Costs: Do not affect the decision outcome.

- Examples: Sunk costs.

Detailed Explanation

This chunk focuses on how costs are classified based on their relevance in decision-making.

- Relevant Costs are those that will have an impact on future business decisions; they will change based on the course of action selected.

- Irrelevant Costs, in contrast, do not influence any future decisions, such as sunk costs which are costs that have already been incurred and cannot be recovered. Understanding which costs are relevant helps businesses make more informed choices.

Examples & Analogies

Imagine you are deciding whether to invest in a new software tool for your business. The costs associated with that software (relevant costs) help you make your decision. However, if you previously spent money on a tool that did not work out (sunk cost), that amount should not influence your current decision on the new software.

Key Concepts

-

Direct Costs: Directly attributable costs to specific products.

-

Indirect Costs: Overheads that are not directly traceable.

-

Fixed Costs: Costs that do not vary with output.

-

Variable Costs: Costs that change with production levels.

-

Relevant Costs: Future costs impacting decision-making.

-

Irrelevant Costs: Past or future costs that do not affect decisions.

Examples & Applications

Raw materials used in production are considered direct costs.

Office rent, which supports overall operations, is an indirect cost.

Salaries of permanent staff are fixed costs, remaining constant over time.

Costs for raw materials increase as production levels rise, illustrating variable costs.

A sunk cost, such as previous investment in marketing, does not impact future decision-making.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Direct costs are the ones you'd know, traceable and visible, they clearly show.

Stories

Imagine a baker who buys flour—it's a direct cost. But when he pays for the shop rent, that's an indirect cost shared by all his baked goods!

Memory Tools

Use the acronym 'DFIRE' - Direct, Fixed, Indirect, Relevant, and Expense - to remember different cost types.

Acronyms

'CVS' to remember

- Cost by Behavior

- Variable

- Semi-variable.

Flash Cards

Glossary

- Direct Costs

Costs that can be directly attributed to a specific product, service, or project.

- Indirect Costs

Costs that cannot be directly traced to a single product or service and are also known as overheads.

- Fixed Costs

Costs that do not change with output in the short term, such as rent or salaries.

- Variable Costs

Costs that vary directly with the level of production, such as raw materials.

- Traceable Costs

Costs that can be specifically related to a particular cost object.

- Relevant Costs

Future costs that will differ between alternatives, critical in decision-making.

- Irrelevant Costs

Costs that do not affect the decision outcome, such as sunk costs.

Reference links

Supplementary resources to enhance your learning experience.