Importance of Cost Classification

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Cost Classification

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're diving into the importance of cost classification in cost accounting. Can anyone tell me why classifying costs might be important for business?

I think it helps in understanding expenses better.

Exactly! It helps in understanding which costs to account for when making financial decisions. What do you think about budgeting? How does cost classification play a role there?

Knowing which costs are fixed versus variable can definitely help when preparing a budget.

Yeah, if we underestimate costs, it could lead to financial issues later.

Great point! By classifying costs, we can create more effective budgets. Let's remember—*B.U.D.G.E.T.*: *Budgeting Utilizes Direct and General Expense Tracking*—it helps us structure our approach.

Cost Control Mechanisms

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's talk about cost control. Why might knowing the difference between controllable and uncontrollable costs be essential?

If managers know which costs they can control, they can take steps to reduce waste or unnecessary expenses.

Exactly! Understanding controllable costs allows for targeted actions for improvement. Can anyone think of an example of a controllable cost?

Salaries for a marketing team; if they aren't performing well, we can adjust or reevaluate.

Perfect! Remember, *C.O.N.T.R.O.L.*: *Costs Often Need Tracking to Optimize Resources Logically*. This can be your mnemonic for thinking about cost control.

Pricing Strategies

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let’s discuss pricing. How does understanding different types of costs impact pricing strategies?

If we know our fixed and variable costs, we can set a price that covers them and still makes a profit.

And if we want to undercut competitors, we should know our variable costs to adjust accordingly.

Exactly! This is why it's essential to recognize fixed costs, which don't change, versus variable costs that do. Think of it like this: *P.R.I.C.E.*: *Pricing Requires Insight on Cost Efficiencies*.

Profitability Analysis

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let's talk about profitability analysis. How does distinguishing between direct and indirect costs play a role?

Direct costs are easier to allocate to products, which helps in seeing how much profit each makes.

Indirect costs can complicate things, but knowing them lets us see overall business efficiency.

Exactly! Understanding costs in terms of profit margins helps drive better business decisions. Just remember *P.R.O.F.I.T.*: *Profit Reflects Overall Financial Insights Today*. This summary will guide you in future analyses!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Understanding cost classification is crucial for businesses as it aids in budgeting different costs, enables informed pricing decisions, enhances cost control management, and improves profitability analysis. This knowledge is beneficial for managerial decision-making.

Detailed

Importance of Cost Classification

Cost classification is a crucial aspect of cost accounting that enables businesses to organize and analyze costs based on various attributes. This structured approach not only assists in better budgeting and pricing decisions but also improves cost control mechanisms and enhances profitability analysis. By recognizing the different types of costs - such as fixed costs, variable costs, and direct costs - managers can make strategic decisions regarding resource allocation, pricing strategies, and operational efficiencies. The significance of this classification extends beyond mere accounting, serving as a foundational tool for effective financial management.

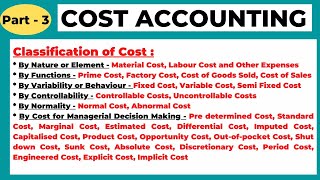

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Helps in Budgeting

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Helps in Budgeting: Different costs affect budgets differently.

Detailed Explanation

Cost classification helps in budgeting by allowing businesses to understand which types of costs will impact their budget plans. By recognizing fixed and variable costs, a company can create a more accurate and effective budget. Fixed costs are stable and predictable, while variable costs may fluctuate based on activity levels. This distinction helps managers allocate resources appropriately.

Examples & Analogies

Imagine planning a party. You have fixed costs, like the venue rental which won’t change regardless of the number of guests, and variable costs, like food and drinks that depend on how many people you invite. By classifying these costs, you can set a budget that reflects both your fixed expenses and the costs that may change.

Enables Pricing Decisions

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Enables Pricing Decisions: Understanding variable and fixed costs is essential in setting prices.

Detailed Explanation

Understanding the two main types of costs—fixed and variable—is crucial for making informed pricing decisions. Businesses need to know their cost structure so they can set prices that not only cover costs but also generate profit. If a business is heavily weighted towards fixed costs, they might need to sell a certain number of products to break even, while variable costs might allow for more flexible pricing strategies.

Examples & Analogies

Consider a bakery that knows the rent (a fixed cost) for its shop is $1,000 per month. If they sell cookies (a variable cost) for $5 each, they must sell at least 200 cookies just to cover the rent. Understanding these costs helps them better price their products to ensure profitability.

Improves Cost Control

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Improves Cost Control: Knowing which costs are controllable guides managerial action.

Detailed Explanation

By classifying costs, management can distinguish between controllable and uncontrollable costs. Controllable costs are those that managers can influence through their decisions and actions, such as labor or materials used. Knowing which costs they can control helps managers focus efforts where they can make the most impact in reducing expenses.

Examples & Analogies

Think of a restaurant manager who can decide to switch suppliers for ingredients to reduce costs. By distinguishing between controllable costs (like ingredients) and uncontrollable costs (like rent), they can make strategic decisions to enhance profitability.

Enhances Profitability Analysis

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Enhances Profitability Analysis: Distinguishing direct and indirect costs improves clarity on margins.

Detailed Explanation

Understanding the difference between direct costs (like raw materials for a product) and indirect costs (like administrative expenses) helps businesses analyze their profit margins better. By clearly categorizing these costs, companies can see where their spending goes and how it affects profitability. This analysis is critical for evaluating the success of various products or services.

Examples & Analogies

Imagine a clothing brand that uses fabric (a direct cost) and pays salaries for office staff (an indirect cost). By analyzing these costs separately, the brand can determine which clothing line generates more profit and thereby focus on promoting or improving that line.

Key Concepts

-

Cost Classification: Important for organizing costs and supporting financial decisions.

-

Cost Control: A vital aspect of financial management that focuses on managing controllable costs.

-

Pricing Strategy: Understanding different costs is crucial for setting effective pricing.

-

Profitability Analysis: Distinguishing between cost types helps in assessing the financial health of a business.

Examples & Applications

A software company identifies its developer salaries as fixed costs and cloud service fees as variable costs, helping them budget effectively for projects.

A retail company uses cost classification to evaluate the profitability of different product lines by analyzing their direct and indirect costs.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Costs are filed and categorized, to save a budget that's well-managed.

Stories

Imagine a chef preparing dishes, knowing how much each ingredient costs helps him price the menu just right!

Memory Tools

B.U.D.G.E.T.: Budgeting Utilizes Direct and General Expense Tracking.

Acronyms

P.R.I.C.E.

Pricing Requires Insight on Cost Efficiencies.

Flash Cards

Glossary

- Budgeting

The process of creating a plan to spend money, allocating resources efficiently.

- Controllable Costs

Costs that can be influenced by management actions, such as salaries.

- Uncontrollable Costs

Costs that management cannot change in the short term, like fixed contracts.

- Direct Costs

Costs that can be directly linked to a specific product or service.

- Indirect Costs

Costs that are not directly traceable to a single product and support multiple areas.

Reference links

Supplementary resources to enhance your learning experience.