Marginal Cost

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Marginal Cost

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to explore marginal cost. Can anyone tell me what they think marginal cost refers to?

Is it the cost of making one more item?

Exactly! Marginal cost is the additional expense incurred to produce one more unit of a good or service. Why do you think this is important for businesses?

It might help them decide whether to make more products or not.

Right! If the marginal cost is less than the selling price of that item, businesses can increase their profits.

What if the marginal cost is higher than the selling price?

Good question! In that case, it may not be sensible for the business to produce more of those items. They might lose money. So, understanding marginal cost helps in making strategic decisions.

To remember this, think of the acronym 'MC'. MC stands for 'Money Added' when producing more.

Calculating Marginal Cost

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand what marginal cost is, how do we calculate it? Can someone think of how we can determine this cost?

Is it just the change in total costs when one more unit is produced divided by the change in the quantity?

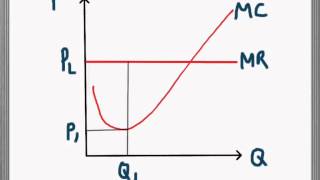

"Correct! It’s expressed as:

Applications of Marginal Cost

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s discuss real-world applications of marginal cost. Can anyone provide examples of where businesses might use this concept?

In product pricing strategies to maximize profit!

Great example! Businesses often set prices based on the relationship between marginal cost and market price. How else might they use it?

They might also consider it when deciding on whether to expand production.

Exactly right! If the marginal cost to produce more is lower than expected profits, it's often a good idea to scale up production.

To retain this idea, think about marginal cost as the 'Go/No-Go' indicator for production!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section details the concept of marginal cost, emphasizing its importance in production and pricing decisions. Understanding marginal cost aids businesses in making strategic financial choices.

Detailed

Marginal Cost

Marginal cost represents the increase in total cost when one additional unit of output is produced. It is a crucial concept in cost accounting and decision-making, particularly in the realms of production and pricing. By analyzing marginal cost, businesses can assess whether to increase production or adjust pricing strategies. For instance, if the marginal cost of producing another unit is lower than the selling price, the company stands to gain profit. Furthermore, it aids in optimizing resource allocation, helping managers make informed choices about scaling operations or entering new markets. Understanding marginal cost is not only relevant for manufacturing but also applies to service-oriented industries, especially in tech sectors where incremental changes can lead to significant financial implications.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of Marginal Cost

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The additional cost incurred in producing one more unit of output.

Detailed Explanation

Marginal cost refers to the increase in total cost that arises from producing one additional unit of output. To calculate marginal cost, you look at how total costs change as the volume of production increases by one unit. It helps businesses understand how much more they need to spend to increase their production by a single unit.

Examples & Analogies

Imagine a bakery that produces loaves of bread. If the cost of ingredients, electricity, and labor to produce 10 loaves is ₹500, but to produce 11 loaves it rises to ₹515, then the marginal cost of the 11th loaf is ₹15. This small addition helps the bakery decide whether it is worth increasing production.

Role of Marginal Cost in Decision Making

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Helps in pricing and production decisions.

Detailed Explanation

Understanding marginal cost is crucial for businesses when setting prices for their products. If the marginal cost of producing one more unit is lower than the price they plan to sell it for, producing more units can increase profitability. Conversely, if the marginal cost exceeds the selling price, it’s a signal to reduce production or find ways to cut costs.

Examples & Analogies

Think of a soft drink company that determines it costs ₹10 to produce one additional can of soda. If they plan to sell that can for ₹15, it's profitable to make more. However, if the market is saturated and the price drops to ₹8, producing any additional cans would lead to losses.

Key Concepts

-

Marginal Cost: The additional cost incurred by producing one more unit.

-

Production Decisions: Using marginal cost to influence whether to increase output.

-

Total Cost and Marginal Cost Relationship: Understanding how changes in production affect total costs.

Examples & Applications

If a company produces 100 smartphones at ₹20,000 and decides to make an additional unit that costs ₹24,000, the marginal cost for that additional smartphone is ₹4,000.

A factory finds that increasing its production from 200 to 201 units increases costs from ₹1,500 to ₹1,580. The marginal cost is ₹80.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Marginal cost is what we pay, for one more unit every day.

Stories

Imagine a baker who bakes 10 loaves. If baking one more loaf costs him ₹50, that’s his marginal cost – helping him decide if he should bake more or stick to his batch!

Memory Tools

M-A-R-G-I-N-A-L: Make Additional Revenue, Gain Incremental Net Advantage in Labor.

Acronyms

MC

'Money for Change' to remember that marginal cost indicates how much the budget shifts with each unit produced.

Flash Cards

Glossary

- Marginal Cost

The additional cost associated with producing one more unit of a product.

- Total Cost

The overall expense of production, including fixed and variable costs.

- Fixed Costs

Costs that do not change with the level of production.

- Variable Costs

Costs that vary directly with production levels.

Reference links

Supplementary resources to enhance your learning experience.