Controllable and Uncontrollable Costs

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Controllable Costs

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's start with controllable costs. These are costs that managers can influence or control through their decisions. Can someone provide an example?

Maybe salaries of temporary staff? Managers can hire or fire them.

Exactly! Salaries for temporary staff can be adjusted based on project needs. This flexibility is the essence of controllable costs. What about other examples?

How about utility expenses if the office can switch providers?

Great point! Utility expenses can indeed be managed. Remember, controllable costs are any costs direct management can affect.

Exploring Uncontrollable Costs

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's shift our focus to uncontrollable costs. What does this term mean for us?

These are costs that managers cannot change or influence, like taxes.

Exactly! Taxes are a prime example. Once a tax is imposed, managers must account for them without any control over the amounts. Can anyone think of another example?

Long-term contracts? Once signed, we are obligated to pay those costs.

Correct! Long-term contracts, once established, become fixed costs that cannot be altered by the managers. Remember, while managers cannot change uncontrollable costs, understanding them is still vital for budgeting.

Importance of Cost Control

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Why do you think it's critical to differentiate between controllable and uncontrollable costs in budgeting?

It helps in targeting areas to cut costs effectively.

Yeah, if we know what we can control, we can manage our budget better.

Spot on! Managers can focus their efforts on areas where they can make a difference, ultimately maximizing effectiveness. Remember the acronym 'CAME' to keep controllable costs in mind: Change, Adjust, Manage, and Evaluate.

That’s a helpful mnemonic!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

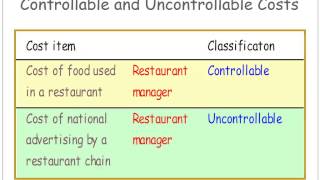

The focus of this section is on the differences between controllable and uncontrollable costs in cost accounting. Controllable costs can be managed and changed by managers, while uncontrollable costs are fixed due to external factors and cannot be influenced by managerial decisions.

Detailed

In this section, we delve into the concepts of controllable and uncontrollable costs, which are crucial for effective cost management in any organization. Controllable costs are those expenses that a manager can directly influence through decisions and actions, such as wages for hourly workers or operational expenses. In contrast, uncontrollable costs arise from factors outside managerial control, including statutory taxes and long-term contracts. Understanding these distinctions is essential for efficient budgeting and resource management, as it allows managers to focus their efforts on areas where they can have the most impact, ultimately improving strategic decision-making.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Controllable Costs

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Controllable: Can be influenced by a manager.

Detailed Explanation

Controllable costs are expenses that managers have the power to influence or change through their decisions and actions. For instance, if a manager decides to cut back on office supplies or negotiate better rates with suppliers, those costs are considered controllable. This means that the management can directly impact the financial outcome by managing these costs judiciously.

Examples & Analogies

Imagine you are managing a party budget. You can control how much you spend on decorations, catering, or entertainment. If you choose to buy less expensive decorations or fewer snacks, you are controlling those costs. This is similar in a business where managers control costs through spending decisions.

Uncontrollable Costs

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Uncontrollable: Cannot be influenced (e.g., statutory taxes).

Detailed Explanation

Uncontrollable costs are expenses that cannot be changed or influenced by managers, regardless of their initiatives. These can include fixed costs such as tax obligations, lease agreements, or regulatory fees that a company must pay regardless of its business activities. Managers must account for these costs while planning, but they cannot alter them through management decisions.

Examples & Analogies

Think of uncontrollable costs like your phone bill if you have a fixed plan. No matter how much you use your phone, the monthly fee remains the same unless you change your plan or provider. Similarly, businesses must pay certain costs, like taxes, regardless of how much they sell or produce.

Key Concepts

-

Controllable Costs: Costs that management can influence or control.

-

Uncontrollable Costs: Costs that are fixed and cannot be influenced by management.

Examples & Applications

Salaries for part-time employees: Management can adjust hours or positions based on project needs.

Statutory taxes: Once imposed, they remain constant despite management preferences.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Controllable means you can control, while uncontrollable stays on patrol.

Stories

Imagine a manager at a bakery who can decide how many part-time bakers to hire (controllable) but must pay local taxes every year no matter what (uncontrollable).

Memory Tools

Remember 'CU' - Control for the controllable, Unchangeable for the uncontrollable.

Acronyms

CUM - Controllable, Uncontrollable, Managed.

Flash Cards

Glossary

- Controllable Costs

Costs that can be influenced or managed directly by a manager's decisions.

- Uncontrollable Costs

Costs that cannot be influenced by a manager and are fixed by external factors.

Reference links

Supplementary resources to enhance your learning experience.