Financial Decision-Making in Organizations

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Financial Decision-Making

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are diving into an important aspect of organizational success: financial decision-making. Can anyone tell me what they think is meant by financial decision-making in organizations?

Isn't it about choosing the best ways to use money in a business?

Exactly! It focuses on utilizing financial resources effectively. Financial decision-making encompasses various areas; can anyone name some areas?

Capital budgeting, financing decisions, and dividend decisions?

Great points! Those are indeed central to our discussions. Remember the acronym CFWD: Capital budgeting, Financing, Working capital management, and Dividends.

That’s helpful! I’ll remember CFWD for the exam.

Fantastic. Let’s explore capital budgeting next!

Capital Budgeting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

In capital budgeting, organizations assess long-term investment value. They use methods like NPV and IRR. Does anyone know what NPV is?

Net Present Value, right? It checks if future cash flows are worth the investment now.

Correct! NPV helps gauge the profitability of projects. Can someone explain IRR?

It's the interest rate where the present value of cash inflows and outflows are equal?

Exactly! It illustrates how effectively funds can be invested. Remember, the higher the IRR above the cost of capital, the more attractive the investment!

Financing and Dividend Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let’s look at financing decisions. What factors influence a company's choice between debt and equity?

Cost of capital and risk play a big role.

Exactly! Companies need to weigh the benefits of debt—such as tax deductions—against its risks. And what about dividend decisions?

It's about how much profit to reinvest and how much to return to shareholders.

Spot on! Remember the balance between retaining earnings for future growth and rewarding shareholders. It's vital for healthy company management.

Working Capital Management

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s discuss working capital management. What’s its significance in organizations?

It ensures that a company has enough cash to meet its short-term liabilities.

Exactly! Proper management impacts liquidity and operational efficiency. How can companies manage their working capital effectively?

By managing inventory, receivables, and payables smartly.

Great answer! Efficient management of these elements ensures that businesses can operate smoothly and meet financial obligations.

Tools and Techniques for Financial Decision-Making

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s look at the tools used for these decisions. Besides NPV and IRR, what other tools come to mind?

Break-even analysis and payback period!

Absolutely! The break-even analysis helps companies understand at what point profit starts. How would you apply it in real life?

To figure out how many products we need to sell to cover costs!

Exactly! Remembering these tools will help in making data-driven decisions.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section delves into the key areas of financial decision-making, including capital budgeting, financing decisions, dividend decisions, and working capital management, while highlighting the tools and techniques commonly used to facilitate these decisions in organizations.

Detailed

Financial Decision-Making in Organizations

Financial decision-making is a fundamental aspect of managing an organization’s resources efficiently. This involves a critical analysis and quantifiable approach to various financial activities, including:

Key Areas of Financial Decision-Making

- Capital Budgeting: This involves making decisions regarding long-term investments such as purchasing machinery or expanding infrastructure. The focus is on identifying projects that provide the highest return on investment over time.

- Financing Decisions: Organizations must choose between different sources of financing, mainly debt (loans) and equity (selling stock). The factors that influence this choice include cost of capital and risk assessment.

- Dividend Decisions: Companies face the challenge of deciding the amount of profit to distribute to shareholders as dividends versus what should be retained for reinvestment or reserve.

- Working Capital Management: This refers to managing the organization’s short-term assets and liabilities to maintain adequate liquidity, including inventory, accounts receivable, and accounts payable management.

Tools and Techniques

To facilitate effective financial decision-making, organizations frequently employ several analytical tools:

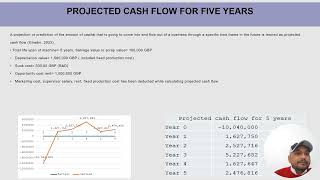

- Net Present Value (NPV): This technique allows firms to determine the value of future cash flows in today's terms, identifying whether an investment is worthwhile.

- Internal Rate of Return (IRR): This is used to evaluate the profitability of potential investments, representing the interest rate at which the present value of costs equals the present value of benefits.

- Payback Period: The time it takes for an investment to generate an amount of income or cash equivalent to the cost of the investment.

- Cost-Volume-Profit (CVP) Analysis: This helps analyze the relationship between costs, sales volume, and profit, allowing managers to make informed decisions about product pricing and sales strategies.

- Break-even Analysis: This determines the sales volume at which total revenues equal total costs, helping organizations understand thresholds for profitability.

Understanding and effectively managing these aspects of financial decision-making is crucial for the overall success and growth of an organization.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Key Areas of Financial Decision-Making

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

In the context of Finance and Accounting, decision-making takes a more analytical and quantifiable approach.

Key Areas

• Capital Budgeting: Decisions on long-term investments (e.g., new machinery, infrastructure).

• Financing Decisions: Choosing between debt and equity sources.

• Dividend Decisions: Determining how much profit to distribute vs retain.

• Working Capital Management: Managing liquidity, inventory, receivables, and payables.

Detailed Explanation

Financial decision-making focuses on several key areas that influence an organization's financial health.

- Capital Budgeting involves making decisions about long-term investments. For example, a company may decide to purchase new machinery to increase production efficiency, which requires careful analysis of costs and potential returns.

- Financing Decisions deal with choices of how to fund operations and growth, specifically whether to use debt (loans) or equity (selling stock).

- Dividend Decisions revolve around how much of the profit a company decides to keep for reinvestment versus how much to distribute to shareholders as dividends.

- Working Capital Management relates to short-term financial health and involves managing the company's liquid assets, such as cash, inventory, and accounts receivables or payables, to ensure it can meet its short-term obligations.

Examples & Analogies

Think of a small business owner considering whether to buy a delivery van (capital budgeting). They must analyze how much that van will cost, how much more efficient their business could be, and how long it will take to earn back the investment. For financing, they might wonder if it’s better to take out a loan or to ask friends and family for investment. Deciding whether to give out dividends might involve considering their kids' future or choosing to reinvest those profits into the business. Just like managing personal finances, they need to keep an eye on cash flow, ensuring they have enough money each month to pay bills and keep the business running smoothly.

Tools and Techniques

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Tools and Techniques

• Net Present Value (NPV)

• Internal Rate of Return (IRR)

• Payback Period

• Cost-Volume-Profit (CVP) Analysis

• Break-even Analysis

Detailed Explanation

Financial decision-making employs various analytical tools and techniques to evaluate potential investments and projects:

- Net Present Value (NPV) helps determine the value of an investment by calculating the difference between the present value of cash inflows and outflows over time. A positive NPV indicates a profitable investment.

- Internal Rate of Return (IRR) is the interest rate at which the NPV of all cash flows equals zero, effectively measuring the profitability of an investment.

- Payback Period measures how quickly an investment can generate cash flows sufficient to recover its initial cost. Shorter payback periods are generally preferred.

- Cost-Volume-Profit (CVP) Analysis examines how changes in costs and volume affect a company's operating income and net income. It helps in pricing decisions.

- Break-even Analysis identifies the sales volume at which total revenues equal total costs, indicating no profit or loss, helping businesses understand the minimum performance required.

Examples & Analogies

Imagine you are deciding whether to open a café. You project costs and income to use NPV, figuring out how much you will earn after turning your investment into cash over several years. With IRR, you find out how high profits must climb each year to justify your investment. The payback period tells you how fast you recover your startup costs, which helps evaluate risk. Then, using CVP analysis, you can determine the pricing of your specialty lattes to ensure that sales cover your costs and help you reach that breakeven point quickly.

Key Concepts

-

Capital Budgeting: The evaluation of long-term investments.

-

Financing Decisions: Options for acquiring funds (debt or equity).

-

Dividend Decisions: Balancing profit distribution and retention.

-

Working Capital Management: Managing cash and short-term assets.

-

Net Present Value (NPV): Assessing the value of future cash flows.

-

Internal Rate of Return (IRR): Interest rate of investment profitability.

Examples & Applications

A company evaluating whether to invest in a new production line using NPV analysis.

A business deciding to issue new shares to raise capital instead of taking a loan.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In making choices for funds to invest, consider NPV, you’ll see it’s the best!

Stories

A local bakery must decide whether to buy a new oven. After analyzing costs and potential cash flows, they use NPV to understand if it’s worth the investment.

Memory Tools

For financial decisions, think ‘CFWD’ - Capital budgeting, Financing, Working capital, Dividends.

Acronyms

Remember DCF for Discounted Cash Flows to determine NPV.

Flash Cards

Glossary

- Capital Budgeting

The process of planning and managing long-term investments in projects.

- Financing Decisions

Choices made regarding the sources of funding, such as debt or equity.

- Dividend Decisions

Determining what portion of profits should be distributed to shareholders.

- Working Capital Management

Management of short-term assets and liabilities to ensure liquidity.

- Net Present Value (NPV)

The difference between the present value of cash inflows and outflows.

- Internal Rate of Return (IRR)

The discount rate that makes the net present value of all cash flows equal to zero.

- Payback Period

The time required to recover the cost of an investment from its cash flows.

- CostVolumeProfit (CVP) Analysis

A method to analyze how changes in costs and volume affect a company's operating income.

- Breakeven Analysis

Determining the sales volume at which total revenues equal total costs.

Reference links

Supplementary resources to enhance your learning experience.