Break-even Point Formulas

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Break-even Point Formulas

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome class! Today, we're diving into the world of break-even point formulas. Can anyone tell me what a break-even point is?

Isn't it the point where a business doesn't make a profit or a loss?

Exactly! At the break-even point, total revenues equal total costs. This is essential for making informed decisions. Now, let's look at how we calculate this! Can someone remind us what fixed costs are?

Fixed costs are the costs that don't change regardless of how much you produce, like rent.

Spot on! Now let’s explore the first formula for calculating the break-even point in units.

Break-even Point in Units Formula

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

To find the break-even point in units, we use the formula: BEP (units) = Fixed Costs / Contribution per Unit. Who can tell me how to find the Contribution per Unit?

It's the Selling Price per Unit minus the Variable Cost per Unit.

Right! Let’s say Fixed Costs are ₹50,000, Selling Price is ₹250, and Variable Cost is ₹150. Can anyone calculate the BEP in units?

Sure! Contribution per Unit is ₹250 - ₹150, which is ₹100. So, BEP in units would be ₹50,000 / ₹100 = 500 units.

Great job! Now we know that selling 500 units covers all costs.

Break-even Point in Sales Value Formula

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s move on to the sales value. The formula is BEP (₹) = Fixed Costs / Contribution Margin Ratio, or CMR. Can someone explain what the CMR is?

CMR is the Contribution per Unit divided by the Selling Price per Unit.

Excellent! Given the same numbers, what would the CMR be?

CMR would be ₹100 divided by ₹250, which is 0.4!

Correct! Now, can anyone calculate the BEP in sales value?

So, BEP in ₹ would be ₹50,000 / 0.4, which is ₹1,25,000.

Well done! Understanding these formulas helps us set financial goals.

Application of Break-even Formulas

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we've learned the formulas, why do you think they are important for businesses, especially startups?

They help in planning how much we need to sell to at least not lose money.

And it guides us in setting prices strategically!

Absolutely! Knowing your break-even point can help decide pricing strategies and assess the impact of changes in costs. It’s a fundamental tool in business.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, students will learn two essential formulas to determine the break-even point: one for calculating the number of units to sell and another for calculating the sales value needed to reach the break-even point. Understanding these formulas is crucial for effective financial planning in business.

Detailed

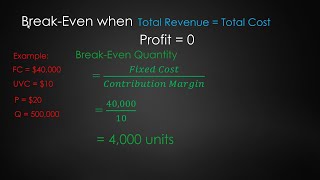

Break-even Point Formulas

In business, the break-even point (BEP) is where total revenues equal total costs, allowing businesses to understand the minimum performance necessary to avoid losses.

Key Formulas for Break-even Point

The break-even point can be calculated using the following formulas:

(a) In Units:

- Formula:

BEP (units) = Fixed Costs / Contribution per Unit

-

Contribution per Unit = Selling Price per Unit − Variable Cost per Unit

(b) In Sales Value:

- Formula:

BEP (₹) = Fixed Costs / Contribution Margin Ratio (CMR)

-

Contribution Margin Ratio (CMR) = Contribution per Unit / Selling Price per Unit

These calculations are crucial for businesses and software projects, especially for BTech CSE students managing tech startups, as they help set sales targets and pricing strategies.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Break-even Point in Units

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

BEP (units) = \( \frac{\text{Fixed Costs}}{\text{Selling Price per Unit} - \text{Variable Cost per Unit}} \) = \( \frac{\text{Fixed Costs}}{\text{Contribution per Unit}} \)

Detailed Explanation

The formula to calculate the Break-even Point (BEP) in units helps determine the number of units a company needs to sell to cover all its costs. It is derived by dividing the fixed costs by the contribution per unit. The contribution per unit is calculated as the selling price per unit minus the variable cost per unit. By knowing this break-even point, businesses understand the minimum output required to avoid losses.

Examples & Analogies

Imagine a lemonade stand where the fixed costs (like the stand rental) are $20, the selling price per cup is $5, and the variable cost (like lemons and sugar) per cup is $2. The contribution per cup would be $5 - $2 = $3. Using our formula, the BEP in units would be 20 / 3 = approximately 6.67 cups. Therefore, the lemonade stand needs to sell at least 7 cups of lemonade to cover its costs.

Break-even Point in Sales Value

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

BEP (₹) = \( \frac{\text{Fixed Costs}}{\text{Contribution Margin Ratio (CMR)}} \)

Detailed Explanation

This formula calculates the Break-even Point in terms of sales value. Here, the Break-even Point in rupees is determined by dividing the total fixed costs by the Contribution Margin Ratio (CMR). The CMR is calculated as the contribution per unit divided by the selling price per unit. This helps businesses understand how much money they need to generate in sales to cover their costs.

Examples & Analogies

Suppose our lemonade stand has fixed costs of $20, and if the selling price is $5 with variable costs of $2, the contribution per cup is $3. The Contribution Margin Ratio would be $3 / $5 = 0.6. Using the formula, we can calculate BEP in sales value as 20 / 0.6 = approximately $33.33. This means the lemonade stand needs to make at least $33.33 in total sales to break even.

Understanding Contribution Margin Ratio (CMR)

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Where: Contribution per Unit CMR = \( \frac{\text{Contribution per Unit}}{\text{Selling Price per Unit}} \)

Detailed Explanation

The Contribution Margin Ratio (CMR) is a critical metric that shows the percentage of each sales dollar that contributes to covering fixed costs and profit after covering variable costs. It is calculated by dividing the contribution per unit by the selling price per unit. A higher CMR indicates that a greater proportion of sales contributes to fixed costs and profits.

Examples & Analogies

Continuing with our lemonade stand example, if the contribution per cup is $3 and the selling price is $5, the CMR is $3 / $5 = 0.6 or 60%. This means for every dollar made in sales, 60 cents goes toward covering fixed costs and contributing to profit. Understanding this ratio helps the owner gauge the financial strength of their pricing.

Key Concepts

-

Break-even Point: The level of output or sales at which total revenue equals total costs.

-

Fixed Costs: Costs that do not change with production levels.

-

Variable Costs: Costs that change with levels of production.

-

Contribution Margin: The difference between selling price and variable costs per unit.

-

Contribution Margin Ratio: The ratio of the contribution margin to the selling price.

Examples & Applications

If fixed costs are ₹50,000, the selling price per unit is ₹250, and the variable cost is ₹150, the break-even point in units would be 500.

Using the above numbers, the break-even point in sales value would be ₹1,25,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

At the break-even line, we balance our cost, / Sell just enough, not a penny lost.

Stories

Once upon a time, a baker needed to know how many cupcakes to sell to cover her costs. She had fixed expenses like rent and variable costs for ingredients. She learned to calculate her break-even point and found confidence in her pricing, ensuring her bakery thrived.

Memory Tools

BEP = FC / (SP - VC) helps me see, How many units to sell successfully!

Acronyms

For BEP, remember F for Fixed costs, S for Selling price, and V for Variable costs.

Flash Cards

Glossary

- Breakeven Point (BEP)

The level of output or sales at which total revenue equals total cost.

- Fixed Costs

Costs that remain constant regardless of production levels.

- Variable Costs

Costs that vary with the level of production.

- Contribution Margin

The selling price per unit minus the variable cost per unit.

- Contribution Margin Ratio (CMR)

The contribution per unit divided by the selling price per unit.

Reference links

Supplementary resources to enhance your learning experience.