Margin of Safety (MoS)

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Margin of Safety

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we'll discuss the Margin of Safety, often abbreviated as MoS. Can anyone tell me what happens when actual sales fall below the break-even point?

The company starts to incur losses!

Exactly! The MoS helps us understand how much cushion we have before that happens. So, can someone explain how to calculate MoS?

Is it Actual Sales minus Break-even Sales?

Correct! And we can also express it as a percentage. Why do you think having a higher MoS is beneficial?

It means the business is less vulnerable to losing profits.

Right! Let's summarize: MoS indicates how much sales can drop before we reach the break-even point, giving a measure of financial security.

Applications of Margin of Safety

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we know what MoS is, how do you think a startup might use this information?

They might use it to set sales targets.

Precisely! A higher MoS can guide them in making strategic decisions, especially in pricing. Can anyone think of other scenarios where MoS would be vital?

What about during economic downturns? A high MoS would help a company survive.

Absolutely! Businesses with a good MoS have more room to maneuver, especially in uncertain markets. Remember, a higher MoS indicates greater security against unexpected drops in sales.

Calculating Margin of Safety

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

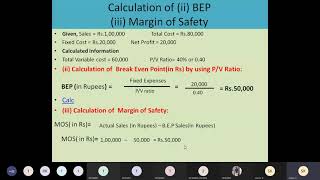

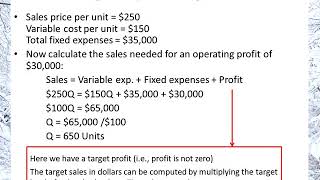

Let's do a quick calculation together. Suppose a company has Actual Sales of ₹80,000 and a Break-even Sales of ₹60,000. How do we calculate the MoS?

MoS would be ₹80,000 minus ₹60,000, which is ₹20,000.

Good! Now, how do we calculate the MoS percentage?

It would be (₹20,000 / ₹80,000) times 100, which is 25%.

Exactly! So, we have a MoS of ₹20,000 or 25%. This means the company can lose sales of up to ₹20,000 before hitting the break-even point.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Margin of Safety (MoS) is a crucial metric in financial analysis that shows how much actual sales can drop before causing a loss to the business. It is calculated as Actual Sales minus Break-even Sales, with a higher MoS providing greater security for businesses.

Detailed

Margin of Safety (MoS)

Margin of Safety is a vital concept in financial analysis that helps businesses assess their risk by indicating the buffer between actual sales and the break-even point (BEP).

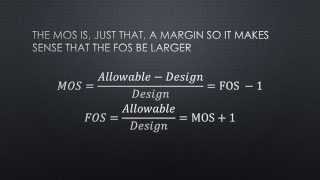

The formula for calculating MoS is:

- MoS (in Sales) = Actual Sales - Break-even Sales

- MoS (%) = (MoS / Actual Sales) × 100

A higher MoS reflects a more secure position for the business, implying that it can withstand a decline in sales before entering the loss zone. Understanding MoS is particularly useful for decision-making, as it allows businesses to gauge the risks associated with fluctuations in sales.

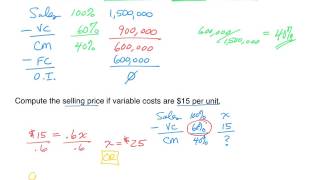

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of Margin of Safety

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Margin of safety shows how much sales can drop before the business reaches its break-even point.

Detailed Explanation

The Margin of Safety (MoS) is a financial metric that indicates the cushion of sales levels a company has before it starts incurring losses. It highlights the difference between actual sales and break-even sales—where the company covers all its costs but makes no profit. The greater the MoS, the longer a business can withstand a decline in sales before it starts losing money.

Examples & Analogies

Imagine you own a coffee shop that has set its break-even sales at ₹10,000 per month. If you make ₹15,000 one month, your margin of safety is ₹5,000. This means if your sales drop by ₹5,000—e.g., due to bad weather or reduced foot traffic—you still cover your costs for that month. It’s like having a safety net that allows you to operate even when times get tough!

Margin of Safety Formula

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

MoS=Actual Sales−Break-even Sales (MoS ) MoS %= ×100 Actual Sales

Detailed Explanation

The Margin of Safety can be calculated in two ways. The basic formula is the difference between Actual Sales and Break-even Sales. It can also be expressed as a percentage: the Margin of Safety percentage indicates how much of your actual sales is above the break-even point. This percentage is calculated by dividing the Margin of Safety by Actual Sales and multiplying by 100. It provides a clearer picture of how secure a business is against sales fluctuations.

Examples & Analogies

Continuing with the coffee shop example, if your actual sales for the month are ₹15,000, and your break-even sales are ₹10,000, your MoS is ₹5,000. To find the percentage, you would divide ₹5,000 by ₹15,000 and multiply by 100, yielding a 33.33% MoS. This means 33.33% of your total sales is a safety margin before you start incurring losses, akin to having a buffer while driving—allowing you to slow down before reaching the edge!

Importance of a Higher Margin of Safety

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

A higher MoS indicates greater security.

Detailed Explanation

A higher Margin of Safety is crucial for business stability. It suggests that the company has a larger buffer before sales reach the break-even level. A high MoS provides confidence to management and investors, as it indicates resilience against downturns in sales or unexpected expenses. A company with a strong MoS is generally considered to be in a healthier financial position.

Examples & Analogies

Think of MoS as the amount of water a boat can take on before it sinks. If the boat can handle up to 100 liters of water without sinking, but currently has only 20 liters on board, it has an 80-liter margin of safety. If the boat hits a wave and takes on 30 liters, it’s still afloat. This is similar to a business with a high MoS—allowing for some challenges without immediately facing losses.

Key Concepts

-

Margin of Safety (MoS): A metric indicating how much sales can fall before a loss occurs.

-

Calculation of MoS: MoS is calculated as Actual Sales minus Break-even Sales.

-

Importance of MoS: A higher MoS reflects greater financial security for a business.

Examples & Applications

If a business has Actual Sales of ₹100,000 and Break-even Sales of ₹80,000, its MoS is ₹20,000, indicating it can withstand a ₹20,000 drop in sales.

A software startup with an MoS of 35% is better positioned to survive market fluctuations compared to one with only 10% MoS.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Margin of Safety gives me peace, it shows how much sales can decrease!

Stories

Once there was a company named Safe Sales, which always knew its MoS. One day, sales dropped, but thanks to its high MoS, the company weathered the storm without worry!

Memory Tools

Remember the M.O.S: Measure Of Safety! Ensures you don't lose, helps you navigate profit gain.

Acronyms

MoS = Margin of Safety, Minimum Operating Security!

Flash Cards

Glossary

- Margin of Safety (MoS)

The amount by which sales can drop before a business reaches its break-even point.

- Breakeven Point (BEP)

The level of output or sales at which total revenues equal total costs.

- Actual Sales

The total sales currently achieved by the business.

- Breakeven Sales

The sales level at which the business covers all its costs.

Reference links

Supplementary resources to enhance your learning experience.