Objectives of Break-even Analysis

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Minimum Sales Volume

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s begin by discussing the first objective of break-even analysis: determining the minimum sales volume needed to avoid losses. Can anyone explain why knowing this is important for a business?

I think it's to prevent the business from failing by not making enough money?

Exactly! If a business doesn’t know its break-even point, it risks incurring losses. Now, remember the acronym BEP for Break-even Point—this will help you recall this crucial concept. Where do you think this information influences business decisions?

It might affect how many products they decide to make or how they set prices.

Spot on! Understanding the BEP supports planning and pricing strategies effectively.

Assisting in Pricing Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

The second objective is assisting in pricing decisions. How do you think break-even analysis helps businesses set prices?

It helps them see how much they need to charge to cover costs?

Correct! Understanding fixed and variable costs allows managers to establish prices that ensure costs are covered while achieving profitability. Can you think of a situation where this might be really important?

During a product launch, if they set the price too low, they might not cover costs.

Yes, that’s a great insight! Pricing too low can lead to losses, and this analysis provides critical insight.

Assessing Changes in Cost and Volume

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s discuss the third objective: assessing the impact of changes in cost and volume. Why do you think this is significant for a business?

Because if costs go up, they need to know if they can still stay profitable?

Absolutely! Changes in costs or sales volume can affect profitability. If variable costs rise, the BEP shifts. Can you give an example where this might be crucial?

If a supplier increases prices, and they have a lot of sales volume, they might have to raise their prices.

Exactly, and without this analysis, they can miscalculate potential profitability.

Product Mix and Expansion Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, break-even analysis assists in decision-making related to product mix and expansion. What does this entail?

It helps businesses decide which products to focus on and whether to invest in new ones.

That's correct! By analyzing the performance of various products, managers can optimize their offerings. How might a tech startup use this kind of analysis?

By seeing which app features users like most, they could decide to invest more in those areas.

Great example! This objective is all about ensuring that resources are allocated effectively to maximize profits.

Recap of Key Objectives

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

To summarize our discussion on the objectives of break-even analysis, we've highlighted four key objectives: determining minimum sales volume, assisting in pricing decisions, assessing impacts of cost and volume changes, and supporting decision-making for product mix and expansions. Can anyone repeat what BEP stands for?

Break-even Point!

Fantastic! Remember these objectives as they are vital tools for anyone looking to succeed in business.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The objectives of break-even analysis include determining the minimum sales volume required to avoid losses, assisting in pricing decisions, assessing the impacts of changes in costs and sales volumes, and facilitating decision-making related to product mix and expansion strategies. Understanding these objectives is crucial for aspiring business leaders in the tech industry.

Detailed

The objectives of break-even analysis are crucial for effective financial management within a business context. Primarily, it helps determine the minimum sales volume needed to avoid incurring losses, which is essential for any business's sustainability. Additionally, it aids in pricing decisions by showing how different pricing strategies will impact profitability. Furthermore, break-even analysis assists in assessing the effects of changes in cost and sales volume, allowing businesses to proactively adapt to market conditions. Lastly, it supports managerial decisions regarding product mix and expansion efforts, ensuring that resource allocation aligns with financial objectives. For aspiring tech entrepreneurs and managers, grasping these objectives lays a foundation for strategic planning and operational success in a competitive environment.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Determining Minimum Sales Volume

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

To determine the minimum sales volume to avoid losses.

Detailed Explanation

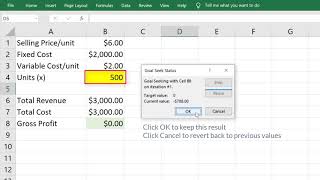

The first objective of break-even analysis is to find out the least amount of sales needed to cover all costs. This means identifying how many units must be sold to ensure that the total income equals both the fixed and variable costs, thus avoiding any financial loss. For example, if a company sells a product for ₹100, and its fixed costs (like rent) are ₹50,000 and variable costs (like materials for each product) are ₹30 per unit, the analysis helps the company understand how many units it needs to sell to at least break even.

Examples & Analogies

Think of it like a school project where you need to sell cookies to cover your expenses: if you need to pay ₹500 for supplies and make ₹10 profit per cookie after costs, you'll need to sell 50 cookies to break even or avoid a loss.

Assisting in Pricing Decisions

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

To help in pricing decisions.

Detailed Explanation

Another key objective is to facilitate better pricing strategies. Break-even analysis helps to understand the relationship between cost, price, and profit. By knowing how many units must be sold to break even, companies can adjust their prices. If the product is priced too low, it may not cover costs; if it's too high, it could deter customers. Thus, companies can use this analysis to find an optimal price that maximizes profitability while remaining competitive.

Examples & Analogies

Imagine you're deciding on pricing for a new phone case. You find that at a price of ₹500, you cover all costs at 100 units sold. If you try to sell it for ₹300, you realize you need to sell 200 units just to break even, which might not be feasible. Hence, this analysis guides your final pricing decision.

Assessing the Impact of Changes

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

To assess the impact of changes in cost and volume.

Detailed Explanation

Break-even analysis allows businesses to evaluate how changes in costs (both fixed and variable) and sales volume affect profitability. For instance, if the cost of materials increases, the analysis will help determine how many additional units need to be sold to maintain profitability. Similarly, if a company decides to lower prices to increase sales volume, break-even analysis can show how that decision impacts overall profit.

Examples & Analogies

Imagine a craft seller who finds that the cost of materials goes up. By using break-even analysis, they can quickly calculate how many more crafts they need to sell at the same price to ensure they don't start losing money as costs rise.

Supporting Decision-Making for Product Mix and Expansion

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

To assist in decision-making related to product mix and expansion.

Detailed Explanation

The final objective discussed is its role in guiding decisions about the product mix and potential business expansion. Companies often have multiple products and must decide which to focus on to maximize profits. By seeing which products have the highest contribution margin and analyzing their break-even points, businesses can prioritize certain products over others. Additionally, if a company is considering expanding its product line, break-even analysis guides the necessary sales volume to justify the expansion and factors in new fixed and variable costs.

Examples & Analogies

Consider a bakery that sells cakes, cookies, and bread. By analyzing which items are easiest to sell and have the best profit ratios, the baker can decide to create more of certain items or even introduce new ones, ensuring that every new product meets the break-even goal and adds to overall profit.

Key Concepts

-

Break-even Point: Critical for determining the sales volume needed to avoid losses.

-

Fixed Costs: Firm costs unaffected by production levels.

-

Variable Costs: Costs that change with production volume.

-

Contribution Margin: Indicator of how much revenue contributes to fixed costs.

Examples & Applications

A restaurant calculates it needs to sell at least 100 meals a day at $15 to cover its fixed costs of $1,500.

A software company determines that it needs to sell its app for $10 after analyzing variable costs to achieve profitability.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To not fall in a deep hole, find your team's sales goal; if you breach that line, in profits you'll shine!

Stories

Once upon a time in a bustling town, a bakery calculated how many loaves they had to sell to break even each day. They learned that if they sold just enough to cover their flour and rent—then any extra was profit!

Memory Tools

Remember 'BEP' for Break-even Point—where sales meet costs and profit's the joint.

Acronyms

BEP

Break-even

Essential Pricing.

Flash Cards

Glossary

- Breakeven Point (BEP)

The sales volume at which total revenue equals total costs, resulting in neither profit nor loss.

- Fixed Costs

Costs that remain the same regardless of the level of production or sales.

- Variable Costs

Costs that fluctuate in line with production volume.

- Contribution Margin

The difference between selling price per unit and variable cost per unit, indicating the contribution to fixed costs and profit.

Reference links

Supplementary resources to enhance your learning experience.