Decision-Making Using Marginal Costing

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Make or Buy Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's start our discussion today with make or buy decisions. Can anyone tell me what we mean by this term?

I think it means deciding whether to produce something ourselves or have someone else do it.

Exactly! This decision is vital for cost control. We use marginal costing to compare our internal costs with external offers. What factors should we consider in this decision-making process?

Maybe the variable costs of production and the fixed costs associated with it?

Yes, the variable costs are critical when making this decision! An acronym to remember is 'V-C-C' for Variable, Compare, and Costs. Let’s do a quick scenario: if producing in-house costs ₹200 per unit but outsourcing is ₹180, how would we decide?

If we consider the variable cost, outsourcing seems cheaper!

Right! Always compare against variable costs. In essence, if outsourcing is cheaper and does not affect quality, it’s often preferred. Great discussion!

Product Mix Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s move to product mix decisions. Why do you think it’s important for a business to know about product mixes?

So that they can maximize their total profits by selling the right combination of products.

Exactly! When we analyze product mixes, we look at contribution margins - selling price minus variable cost. Can someone explain how we can apply marginal costing to make these decisions?

We’d look for the products with the highest contribution margins to include more in our mix.

Correct! This method ensures we focus our resources on the most profitable products. Remember, assessing profitability is about optimizing our output. Great that we've sorted that out!

Accepting Special Orders

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's discuss accepting special orders now. How can marginal costing guide us in such decisions?

It helps us figure out if the special price they offer is above our variable cost.

Absolutely! It’s crucial that the special order price covers the variable costs. If it does, accepting the order can contribute positively to profits. Can anyone share an example?

If the variable cost is ₹100 and the special order price is ₹120, it’s worth it since it adds ₹20 to profit!

Precisely! Always ensure it's positive above variable costs before accepting. Such considerations are foundational in finance!

Shut Down or Continue Decisions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s examine decisions on whether to shut down or continue operations. What should we consider during financial difficulty?

We need to check if we can at least cover our variable costs.

Exactly! If we cannot cover variable costs, shutting down may be necessary to avoid further losses. What's an acronym to remember this analysis?

Maybe 'C-V-C': Can You Cover Your Variable Costs?

Great mnemonic! Always ask, 'Can we cover our variable costs?' If not, it may be time to reevaluate operations. Summary time: Marginal costing is crucial in making strategic decisions that affect profitability!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section explores how marginal costing can facilitate key business decisions, including make-or-buy analysis, product mix selection, special order acceptance, and continuity decisions during financial downturns. Understanding these concepts is essential for making informed financial choices in various business scenarios.

Detailed

Decision-Making Using Marginal Costing

Marginal costing is a strategic tool in managerial finance that focuses on variable costs to inform various business decisions. It plays a critical role in providing insights necessary for:

- Make or Buy Decisions: This involves assessing whether it is more cost-effective to produce a component in-house or outsource it to another company. Marginal costing helps analyze the additional costs incurred for production against potential savings on outsourcing.

- Product Mix Decisions: Businesses often offer multiple products, and marginal costing aids in identifying the most profitable combination of these products based on their contribution margins.

- Accepting Special Orders: Companies may receive offers to sell products at prices lower than their normal selling price. Marginal costing assists in determining whether such orders should be accepted, as long as the selling price exceeds the variable costs of production.

- Shut Down or Continue Decisions: In times of losses, it becomes essential to evaluate whether to continue operations or halt them. Marginal costing provides insights into whether the company can cover its variable costs and how it might fare if operations are modified or ceased.

In summary, the principles of marginal costing empower managers with the necessary financial information to make crucial decisions that enhance profitability and aid strategic planning.

Youtube Videos

![[#3] Marginal Costing | Applications | Decision Making | Key Factor, Limiting Factor | by kauserwise](https://img.youtube.com/vi/ECmBYR8GmHA/mqdefault.jpg)

![Decision Making in Cost & Management Accounting [For B.Com / CA /CS /CMA]](https://img.youtube.com/vi/kqTIgt85qIc/mqdefault.jpg)

![[#1] Marginal Costing Techniques | Statement | Formulas | PV Ratio | BEP | MOS :- By kauserwise®](https://img.youtube.com/vi/pM0oueHw3ZY/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Make or Buy Decisions

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Marginal costing helps in answering managerial questions such as:

- Make or Buy Decisions: Whether to manufacture a component in-house or outsource.

Detailed Explanation

Make or buy decisions involve determining whether it is more cost-effective for a company to produce a product internally (make) or to purchase it from an outside supplier (buy). With marginal costing, managers look at variable costs associated with in-house production versus the price offered by suppliers. If the variable cost of making the item is lower than buying it, the company should manufacture it.

Examples & Analogies

Imagine a bakery deciding whether to make its bread or buy it from a local supplier. If the bakery calculates that making the bread costs $1 per loaf (marginal cost) and the supplier charges $1.50, the bakery would choose to make its own bread to save on costs.

Product Mix Decisions

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

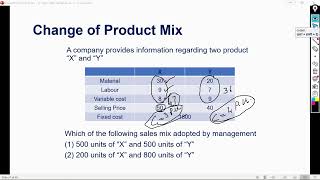

- Product Mix Decisions: Choosing the most profitable combination of products.

Detailed Explanation

Product mix decisions involve selecting the right combination of products to offer based on profitability. Managers analyze contributions per unit from different products, focusing on those that have the highest contribution margin — that is, the difference between selling price and variable cost. The goal is to maximize overall profit by prioritizing high-margin products.

Examples & Analogies

Consider a restaurant that offers various dishes. If spaghetti has a contribution of $5 and lasagna has a contribution of $8 but requires more ingredient costs, the restaurant might decide to offer more lasagna if that maximizes overall profitability, while still serving a well-rounded menu.

Accepting Special Orders

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Accepting Special Orders: If offered below normal price but above variable cost.

Detailed Explanation

When companies receive special order requests that may be priced below the normal selling price, marginal costing allows decision-makers to evaluate whether to accept these orders. As long as the price offered covers the variable costs, even if it doesn’t cover fixed costs fully, it can contribute positively to the company's profit since it does not incur additional fixed costs.

Examples & Analogies

Imagine a clothing manufacturer who usually sells shirts for $20 each. A retailer orders 100 shirts for $15 each. If the variable cost to make each shirt is $10, the manufacturer will still earn $5 per shirt from this special order, which contributes positively to the overall profits even though the price is lower than normal.

Shut Down or Continue Decisions

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Shut Down or Continue: During losses, assess if continuing makes sense.

Detailed Explanation

Companies often face decisions about whether to continue operations when they are incurring losses. Using marginal costing, managers can analyze if the revenue generated is covering variable costs. If the revenue exceeds variable costs, it may be wise to continue operating in the short-term, even if fixed costs aren't being covered, until circumstances improve.

Examples & Analogies

Think of a startup that is losing money but has a product that is gaining traction in the market. If it knows it can make $20,000 in revenue against variable costs of $15,000, it might decide to continue operating to capitalize on future growth, as long as the contribution helps cover fixed costs temporarily.

Key Concepts

-

Marginal Costing: Technique focusing on variable costs for decision-making.

-

Make or Buy Decision: Evaluation of whether to produce in-house or outsource.

-

Product Mix Decisions: Choosing products based on profitability analysis.

-

Special Orders: Evaluate potential acceptance based on covering variable costs.

-

Shut Down or Continue: Decision-making on operations based on variable cost coverage.

Examples & Applications

A company evaluating whether to outsource production of a component calculates that their variable cost is ₹200 per unit, while a supplier charges ₹180. A marginal costing analysis suggests outsourcing is the preferred option.

A business considers two products: Product A has a contribution margin of ₹50 and Product B has a contribution margin of ₹80. Marginal costing directs them to focus on Product B for maximizing profits.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When costs on the rise, check the price, ensure variable costs can suffice!

Stories

Imagine a factory that hesitated to accept orders with lower prices, but they always remembered to check if their costs were lower; in that way, they maximized profits.

Memory Tools

Use 'C-V-C' to remember: Can You Cover your Variable Costs?

Acronyms

Remember 'M-P-S' for Make, Product Mix, and Special Orders when using marginal costing for decision-making.

Flash Cards

Glossary

- Marginal Costing

A costing technique that includes only variable costs for the production of goods and treats fixed costs as period costs.

- Make or Buy Decision

A decision-making process that evaluates whether to manufacture a product in-house or to purchase it from an external supplier.

- Product Mix Decisions

Strategic choices about which products to offer based on potential profitability.

- Special Orders

One-time orders that do not follow normal pricing and production policies.

- Shut Down Decision

The decision of whether to cease operations based on financial analysis.

Reference links

Supplementary resources to enhance your learning experience.