Journal

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Journal and Its Definition

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're focusing on the Journal, known as the primary book of entry in accounting. Can anyone tell me why it's important to have a system for recording transactions?

Because it helps keep track of all financial activities in order!

Exactly! The journal records transactions chronologically, meaning it lists them as they happen, which is essential for tracking a business's financial progress. Can anyone name what we call each recorded entry?

A journal entry!

Well done! A journal entry contains critical details A good way to remember this is the acronym DATE: Date, Accounts involved, Transaction description, and Earnings/losses. Let's move on to its features.

Features of the Journal

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

The Journal has several key features that I want us to remember. First, it records transactions in the order of occurrence. Can someone explain why this is beneficial?

It helps maintain a timeline of events!

Exactly! It keeps everything organized. The next feature—complete transaction details—ensures we have all the necessary info about each transaction. Can someone list a couple of things that might be included?

The date, the amount, and what the transaction was for!

Great answers! Also, we follow the double-entry system here, which means every transaction will affect two accounts—one debit and one credit. To remember this, think DEBIT and CREDIT go hand in hand!

Understanding the Journal Format

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand the features, let's look at how to format a journal entry properly. Who remembers the components we must include when writing one?

You need the date, details about the accounts, and the amounts!

Correct! The correct format is crucial to ensure accuracy. Let’s break it down further. The 'L.F.' column denotes the ledger folio. Why might that be useful?

To find where to record it in the ledger quickly?

Spot on! The L.F. makes it efficient for us to organize our accounts in the ledger later. Remembering this can be simplified with the saying, 'Find it to bind it in the Ledger folio!'

Types of Journal Entries

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, we’ll look into types of journal entries. Who can tell me what a simple entry is?

It's when you have one debit and one credit!

Yes! And how does that differ from a compound entry?

A compound entry has multiple debits or credits!

Great! Understanding these different entry types helps us manage more complex transactions easily. Let’s summarize what we’ve learned.

Practical Application

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s connect everything to a practical application. I’ll give an example entry, and you'll help me categorize it. If a business sells goods for ₹5,000, how would we record this in the Journal?

Cash A/c Dr. ₹5,000 and Sales A/c Cr. ₹5,000!

Exactly! Great job! This is how we transition to the ledger next. It’s important for you to practice recording various transactions to feel confident. Remember, practice makes perfect!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Journal serves as the foundational record for accounting, chronologically documenting transactions with details for each entry. Understanding its features and format, including types of entries, is essential for effective accounting practices.

Detailed

Detailed Summary

The Journal is a crucial component of the accounting process, acting as the first point of entry for all financial transactions within an organization. Its primary role is to record these transactions in the order they occur, allowing for chronological tracking. Key features of the journal include:

- Chronological Recording: Transactions are logged as they happen, ensuring that the timeline is preserved.

- Complete Details: Each entry captures essential information such as the date of occurrence, involved parties, amounts, and specific accounts.

- Double-entry System: Every journal entry adheres to the principle of double-entry bookkeeping, where each debit entry has an equal and corresponding credit entry.

- Basis for Ledger Posting: The Journal serves as the source document for postings into the respective ledger accounts.

Format of a Journal Entry

A journal entry includes the following components:

- Date: Indicates when the transaction occurred.

- Particulars: Describes the accounts involved along with a narration to provide context.

- L.F. (Ledger Folio): Specifies the page number in the ledger where the entry will be posted.

- Debit and Credit Columns: Reflect the amounts associated with debits and credits in accordance with the double-entry system.

Types of Journal Entries

Understanding the different types of journal entries is essential:

- Simple Entry: Involves one debit and one credit.

- Compound Entry: Contains multiple debits or credits.

- Opening Entry: Used to record transactions at the beginning of an accounting period.

- Adjustment Entry: Made at the end of an accounting period to account for accrued revenues or expenses and prepayments.

Mastery of journal entries is vital for accurate financial reporting and analysis.

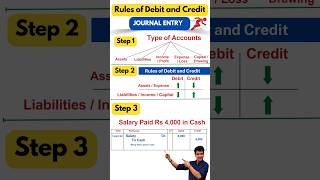

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Meaning of Journal

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The Journal is the primary book of entry in accounting. It records business transactions chronologically (i.e., as they occur). Each entry in the journal is called a journal entry.

Detailed Explanation

The Journal serves as the foundational document in accounting where all business transactions are initially recorded. This means that whenever a financial activity occurs—like a sale or purchase—it is noted in this book as it happens. This chronological order helps in tracking the flow of transactions over time, ensuring that they are captured as they occur. Each individual record within the journal is termed a journal entry, which provides a detailed account of the transaction.

Examples & Analogies

Imagine a diary that someone keeps where they write down their daily activities. Each page represents a different day, and the entries are written in order of when things happened. Similarly, the Journal in accounting records each financial transaction in the order it occurs, helping accountants review the 'daily activities' of a business.

Features of Journal

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Records transactions in the order of occurrence

Maintains complete transaction details

Follows the double-entry system (every debit has a corresponding credit)

Provides a basis for ledger posting

Detailed Explanation

The Journal has several key features that make it essential for accounting. First, transactions are recorded sequentially, reflecting the actual timeline of financial activities. Each entry is detailed, containing all relevant information needed to understand the transaction. Additionally, it adheres to the double-entry system of accounting, which means each transaction affects two accounts—ensuring that every debit entry has a corresponding credit entry. This creates a balanced record of all transactions. Lastly, the Journal serves as the initial point from which these transactions are transferred to the Ledger for further classification and summarization.

Examples & Analogies

Think of the Journal like a detailed logbook for a ship's journey. Every entry notes the events of the day (the order of occurrences), specifies the crew members involved (complete transaction details), ensures that navigational changes are recorded by both the captain and navigator (double-entry system), and helps prepare the ship's monthly summary report (basis for ledger posting).

Format of a Journal

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Date Particulars L.F. Debit (₹) Credit (₹)

01/07/2025 Cash A/c 101 5,000 5,000

Dr. To Sales A/c (Goods sold for cash)

Detailed Explanation

The Journal follows a specific format for recording transactions. The essential components include the date of the transaction, the particulars which detail the accounts involved, a ledger folio column that indicates the page number in the Ledger where this transaction will be posted, and the amounts reflecting the debit and credit sides of the transaction. The example provided illustrates a situation where cash was received from a sale. Both the cash and sales accounts are affected, showcasing the double-entry principle.

Examples & Analogies

Imagine filling out an official form for a transaction. You would start by noting the date, then clearly specify what the transaction is about, followed by any necessary references (like a case number) and finally, the amounts that represent the change in values. Similarly, the journal's format structures the financial data in a way that's easy to reference and understand.

Types of Journal Entries

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Simple Entry: One debit and one credit

Compound Entry: More than one debit or credit

Opening Entry: Used at the beginning of the accounting period

Adjustment Entry: Made at the end of the period for accruals/prepayments

Detailed Explanation

Journal entries can be categorized into different types based on their structure and purpose. A simple entry includes just one debit and one credit, while a compound entry involves multiple debits or credits in a single transaction. An opening entry is typically recorded at the start of a new accounting period to establish opening balances. In contrast, adjustment entries are made at the end of the accounting period to account for unpaid expenses or unreceived revenues, ensuring that financial records accurately reflect the organization’s financial status.

Examples & Analogies

Consider cooking a dish. A simple recipe might call for just one main ingredient and one spice (simple entry), while a more complex dish could require several ingredients and spices added at once (compound entry). The opening entry could represent the initial ingredients you need to start your cooking journey, and adjustment entries are like correcting any seasoning or ingredient mistakes at the end of the preparation to ensure everything tastes just right.

Key Concepts

-

Journal: The primary book of entry for recording transactions chronologically.

-

Journal Entry: A single instance of recording a transaction in the journal.

-

Double-entry System: Each transaction involves one debit and one credit.

-

Ledger Folio: Indicates where the entry will be posted in the ledger.

-

Types of Entries: Includes simple, compound, opening, and adjustment entries.

Examples & Applications

Example of a Simple Entry: Recording a cash sale of ₹5,000: Cash A/c Dr. ₹5,000 To Sales A/c ₹5,000.

Example of a Compound Entry: Recording a transaction involving cash sale and accounts receivable: Cash A/c Dr. ₹3,000, Accounts Receivable A/c Dr. ₹2,000 To Sales A/c ₹5,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To record transactions, don’t you stress, Write them all clearly, that’s the best!

Stories

Once upon a time, in an accounting kingdom, a wise accountant noted all transactions day by day in his journal, tracking what came in and what went away, keeping everything organized and never in dismay.

Memory Tools

D.A.T.E helps to remember the key components: Date, Accounts, Transaction, and Earnings/Loss.

Acronyms

J.E.R.T (Journal Entry Requires Timing) – always record on time!

Flash Cards

Glossary

- Journal

The primary book of entry in accounting that records transactions chronologically.

- Journal Entry

Each individual record of a transaction in the journal.

- Doubleentry System

An accounting system where every transaction affects two accounts with equal and opposite effects.

- Ledger Folio (L.F.)

The page number of the ledger where the journal entry is posted.

- Debit

An entry recorded on the left side of an account, indicating an increase in assets or expenses.

- Credit

An entry recorded on the right side of an account, indicating an increase in liabilities or income.

- Simple Entry

A journal entry with one debit and one credit.

- Compound Entry

A journal entry that includes more than one debit or credit.

- Opening Entry

A journal entry recorded at the beginning of an accounting period.

- Adjustment Entry

An entry made at the end of an accounting period to adjust for accrued revenues or expenses.

Reference links

Supplementary resources to enhance your learning experience.