Journal, Ledger, and Trial Balance

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to the Journal

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're diving into what a Journal is in accounting. Can anyone tell me what a Journal does?

Is it where you write down all the business transactions?

Exactly! The Journal records transactions chronologically, meaning it logs them as they happen. Remember, I use the acronym 'CRISP' - Chronological Recording of Important Specifics and Prices. This reminds you that the Journal keeps everything in order!

What are the features of a Journal?

Great question! It includes maintaining complete transaction details, adheres to the double-entry system, and provides a basis for postings to the Ledger.

Can you give an example of a journal entry?

Certainly! For instance, if you sell goods for cash, you would have a journal entry showing cash received as a debit and sales made as a credit. This supports our understanding of 'what happens' and 'where it goes'.

In summary, the Journal is fundamental to tracking transactions accurately, allowing us to record detailed accounting histories.

Understanding the Ledger

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's talk about the Ledger. Why do you think a Ledger is needed after the Journal?

To keep track of different accounts?

Precisely! The Ledger organizes and classifies Journal transactions into specific accounts. Each account, like Cash or Sales, gets its entries. Think of it like sorting a drawer of assorted papers into labeled folders.

What’s the purpose of keeping a Ledger?

The Ledger helps in tracking individual account balances and classifying transactions, which is essential for preparation of financial statements. So, you can see how it leads us to the next step, the Trial Balance.

How do we post from the Journal to the Ledger?

Excellent! You would post each debit to the debit side of the respective ledger account and each credit to the credit side. Let’s remember 'D on the Left, C on the Right' to keep placement in mind.

So remember, the Ledger summarizes all transactions, making it crucial for overall account management.

The Trial Balance

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, we’ll explore the Trial Balance. Can anyone tell me its purpose?

Is it to check if our debits and credits are equal?

Absolutely! The Trial Balance brings together all the balances from various ledger accounts and ensures that the total debits equate to total credits. Think of it as a financial health check-up!

What does it help us with?

It verifies the arithmetic accuracy of ledger postings and helps in preparing financial statements. An important tip to remember is 'Trial before Trust' - we check before trusting our numbers.

What are some errors that a Trial Balance might not catch?

Great question! Some errors like omission, principle errors, compensating errors, or errors of commission might slip through. So, keep an eye out for these during audits!

Therefore, the Trial Balance is an essential tool in accounting, allowing preparers to ensure financial statements reflect accurate information.

Connecting the Three Components

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s connect the dots between the Journal, Ledger, and Trial Balance. Why do we say they are interrelated?

Because you record in the Journal, then post to the Ledger, and finally prepare the Trial Balance?

Exactly! The flow starts with the Journal recording what happened, then transitions to the Ledger for classification, finishing with the Trial Balance checking accuracy. Remember 'J-L-T' for Journal-Ledger-Trial Balance, which shows the sequence!

And what about in computerized accounting?

In computerized systems like QuickBooks, these principles still apply. Journals can be input through forms, and ledgers update in real-time, which enhances accuracy and speeds up financial reporting, making our lives easier!

So, these tools make accounting more efficient?

Absolutely! Mastery of the Journal, Ledger, and Trial Balance is critical for transparency and sound decision-making in business. In summary, understanding each component's role helps reinforce our ability to manage finances effectively.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Understanding the Journal, Ledger, and Trial Balance is essential for capturing and organizing financial transactions. This section details how transactions are recorded chronologically in the Journal, classified into various accounts in the Ledger, and summarized in the Trial Balance to ensure accuracy in financial reporting.

Detailed

Journal, Ledger, and Trial Balance

Accounting serves as the framework for conveying financial health in businesses through the systematic process of recording, classifying, and summarizing transactions. The Journal, Ledger, and Trial Balance are foundational elements of this process.

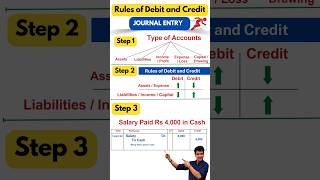

16.1 Journal

The Journal acts as the primary book where transactions are recorded in chronological order, with each record known as a journal entry. Key features include:

- Chronological Record: Transactions are logged as they occur.

- Double-entry System Compliance: Every transaction maintains balance with corresponding debits and credits.

- Basis for Ledgers: Information gathered here feeds directly into the Ledger.

Journal entries come in various formats: simple, compound, opening, and adjustment entries, each serving specific needs in accounting.

16.2 Ledger

The Ledger collects all account information from the Journal for classification and summarization. Primarily used for:

- Balance Tracking: Monitoring individual account balances.

- Transaction Classification: Organizing various transactions.

- Financial Statement Preparation: Serving as the base for compiling financial reports.

Posting from the Journal to the Ledger involves transferring debit and credit information to the appropriate T-shaped ledger format.

16.3 Trial Balance

A Trial Balance summarizes all the balances from the Ledger to verify that total debits equal total credits. It plays a critical role in ensuring accounting accuracy by allowing for error detection. Additionally, some errors may still go unnoticed by this process.

16.4 Relationship Between Journal, Ledger and Trial Balance

The flow of information proceeds from the Journal (recording) to the Ledger (classification) and finally to the Trial Balance (verification), emphasizing the importance of these components as interconnected steps in accounting.

16.5 Importance in Computerized Accounting

In modern software accounting systems, similar principles persist, with automated generation of journals, ledgers, and trial balances, enhancing accuracy and efficiency.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Introduction to Accounting Components

Chapter 1 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Accounting is often called the language of business. To understand the financial health of an organization, we must record, classify, and summarize financial transactions systematically. This is done through three essential accounting components: Journal, Ledger, and Trial Balance. This chapter introduces these foundational elements of accounting. You will learn the process of recording business transactions in the Journal, classifying them into Ledgers, and then compiling them into a Trial Balance for verification and analysis. These are essential for understanding how raw transaction data becomes financial information used in decision-making.

Detailed Explanation

Accounting serves as the essential means of communicating a business's financial situation. By systematically capturing and organizing financial events (transactions), we gain insights into the company's performance. The Journal is where these transactions are first recorded in chronological order. Then, these entries are classified into various accounts in the Ledger. Finally, a Trial Balance is prepared to verify whether the debits and credits align correctly, ensuring that our financial records are accurate. This systematic process is crucial for informed decision-making by stakeholders.

Examples & Analogies

Think of accounting like a library. Just as books are cataloged and stored for readers to access information, every transaction is like a book entry. The Journal is the library's entry log listing books as they are added, the Ledger is like shelves organized by genre (account type), and the Trial Balance is akin to a complete inventory check to ensure everything is in its right place.

Meaning of Journal

Chapter 2 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The Journal is the primary book of entry in accounting. It records business transactions chronologically (i.e., as they occur). Each entry in the journal is called a journal entry.

Detailed Explanation

The Journal plays a critical role in accounting as it is where all business transactions are initially recorded. By keeping a chronological record, it becomes easier to track the financial activities of a business over time. Each transaction entered is termed a 'journal entry' and includes details such as the date, accounts affected, and amounts. This chronological approach helps ensure accuracy and provides a clear timeline of events.

Examples & Analogies

Imagine writing in a diary. Every day, you jot down what happens in your life—like going to the store or meeting a friend. Similarly, in accounting, the Journal captures events of a business as they happen, creating a factual timeline of transactions for later reference.

Features of Journal

Chapter 3 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Records transactions in the order of occurrence

• Maintains complete transaction details

• Follows the double-entry system (every debit has a corresponding credit)

• Provides a basis for ledger posting

Detailed Explanation

The Journal includes several important features that enhance its effectiveness. First, it maintains the chronological order of transactions, which helps in tracking financial activities seamlessly. Second, it captures all relevant details of each transaction, ensuring that no context is lost. The Journal also adheres to the double-entry accounting system, meaning that every financial transaction affects at least two accounts (a debit and a credit). Lastly, the records in the Journal serve as the basis for transferring information to the Ledger, where accounts are classified and summarized.

Examples & Analogies

Think of the Journal as a police report for a crime scene. Each report details what happened, when, and who was involved. Just as each incident creates an entry with complete details, every transaction in the Journal captures important information for accurate financial reporting.

Format of a Journal

Chapter 4 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Date Particulars L.F. Debit (₹) Credit (₹)

01/07/2025 Cash A/c 101 5,000 5,000

Dr. To Sales A/c (Goods sold for cash)

Detailed Explanation

The format of the Journal is structured to clearly present each entry's details. It starts with the date of the transaction, followed by a column for particulars where the accounts involved and the nature of the transaction are described. The Ledger Folio (L.F.) indicates the page number in the Ledger where the entry will be posted. The amounts are then divided into two columns: Debit and Credit—reflecting the two aspects of the double-entry system.

Examples & Analogies

Imagine filling out a form at a bank. You provide your information in a structured format - where each piece of information has its own space. Similarly, the Journal's format organizes transaction specifics for clarity and easy viewing.

Types of Journal Entries

Chapter 5 of 5

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Simple Entry: One debit and one credit

• Compound Entry: More than one debit or credit

• Opening Entry: Used at the beginning of the accounting period

• Adjustment Entry: Made at the end of the period for accruals/prepayments

Detailed Explanation

There are several types of journal entries you may encounter. A Simple Entry involves one debit and one credit, keeping transactions straightforward. A Compound Entry has more than one debit or credit, reflecting more complex transactions. Opening Entries are critical as they mark the start of a new accounting period, while Adjustment Entries occur at the end of the period to account for accruals (revenue or expenses incurred but not yet paid) or prepayments (expenses paid in advance). Understanding these types helps in accurately recording various business events.

Examples & Analogies

Consider ordering groceries online. A Simple Entry is like adding one item to your cart, while a Compound Entry would be adding multiple items at once. When the month starts, that’s like making an Opening Entry, and checking your prepaids or overdue items at the end constitutes Adjustment Entries.

Key Concepts

-

Journal: Records transactions chronologically as they occur.

-

Ledger: Classifies and summarizes transactions from the Journal into specific accounts.

-

Trial Balance: Ensures that the total debits equal the total credits to verify accounting accuracy.

-

Double-entry System: Every transaction involves a debit and a credit, maintaining balance in accounts.

Examples & Applications

An example of a journal entry would be recording a sale: 01/07/2025, Cash A/c Dr. ₹5,000 To Sales A/c ₹5,000.

An example of posting to the ledger would involve taking the above journal entry and reflecting it in both the Cash A/c and Sales A/c ledgers accordingly.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Journal, Ledger, Balance - in this financial dance,

Stories

Once, a young accountant named Alice was tasked to manage her town's bakery finances. She recorded each sale in her Journal, categorizing different expenses in the Ledger, and confirmed accuracy with a Trial Balance. This process not only kept her books clean but also helped Alice make better decisions about her business.

Memory Tools

Use 'J-L-T' to remember the flow: Journal logs, Ledger organizes, Trial Balance verifies!

Acronyms

Remember 'DCR' - to note that each Journal entry includes Date, Credit, and Debit details!

Flash Cards

Glossary

- Journal

The primary book of entry in accounting where transactions are recorded chronologically.

- Ledger

A book of accounts that contains all the accounts that classify and summarize transactions.

- Trial Balance

A statement showing the balances of all ledger accounts to verify that total debits equal total credits.

- Journal Entry

A record of a financial transaction in the Journal.

- Doubleentry System

An accounting system that requires every entry to have a corresponding opposite entry.

Reference links

Supplementary resources to enhance your learning experience.