Types of Journal Entries

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Simple Entries

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we'll begin with simple entries. Can anyone tell me what a simple entry is?

Is it when only one account is debited and one account is credited?

Exactly! It's the simplest form where you have one debit and one credit. Remember the mnemonic 'One-2-One' for simple entries.

Can you give an example?

Sure! If a company sells goods for cash, the cash account is debited, and sales revenue is credited. That’s an essential example of a simple entry.

So basically, it’s recording one transaction at a time?

"Exactly! Let’s recap:

Exploring Compound Entries

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's discuss compound entries. Who can explain what they are?

Are they when there are multiple debits or credits in one entry?

That's correct! Compound entries arise when a transaction impacts more than two accounts. For example, when a company buys inventory partially in cash and partially on credit.

So we would debit inventory and accounts payable, and credit cash?

Yes! You caught on quickly! Use the acronym 'CIDA' - Compound = Inventory + Debit + Accounts payables.

Could compound entries get complicated, then?

They can, but with practice, you can manage them well. Let's summarize: Compound entries involve multiple accounts and help accurately capture complex transactions.

Focus on Opening Entries

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s shift to opening entries. Who can explain what they are?

Are they for starting balances at the beginning of a period?

Yes, exactly! Opening entries ensure that all account balances are set correctly at the beginning of a new accounting period.

Can you show us an example?

Absolutely! Suppose the cash balance at the start of the period is ₹10,000. We would make an opening entry to debit cash and credit the owner’s equity.

So opening entries help track everything from the start?

Exactly! It’s essential for accuracy in our ledgers. Remember: 'Starting Strong – Open Right!'

Understanding Adjustment Entries

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let’s explore adjustment entries; why are they important?

Are they like corrections made at the end of a period?

Correct! Adjustment entries are made to account for things like accruals and prepayments. They ensure that financial statements are accurate.

Can you give an example of when we use adjustment entries?

Sure! If we have earned revenue but haven’t received payment by period-end, we would debit accounts receivable and credit revenue.

So it’s about matching income and expenses to the right period?

Exactly! That’s the goal of adjustment entries. They fulfill the matching principle. Remember: 'Adjust to Perfect; Make It Right!'

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Understanding the types of journal entries is crucial for accurate financial reporting. This section covers four primary types: simple entries with one debit and one credit, compound entries with multiple debits or credits, opening entries for the start of accounting periods, and adjustment entries for accrued expenses and prepayments at period-end.

Detailed

Types of Journal Entries

In accounting, a journal serves as the first point of record for financial transactions. Different types of journal entries are essential for recording these transactions accurately. The primary types include:

- Simple Entry: This is the most basic form of an entry, where one debit is matched with one credit. For example, if a company receives cash from a sale, a simple entry would record the cash increase and the sales revenue.

- Compound Entry: When more than one debit or credit is involved in a transaction, it forms a compound entry. For example, if a business purchases inventory and pays part in cash while the remaining is on credit, multiple accounts are affected:

- Debit Inventory A/C

- Debit Accounts Payable A/C

- Credit Cash A/C

- Opening Entry: This type of entry is used at the beginning of an accounting period, ensuring that the beginning balances of all accounts are recorded accurately.

- Adjustment Entry: These are necessary at the end of an accounting period to update account balances for accrued income and expenses or prepayments that were recorded during the period.

Understanding these journal entries is vital for ensuring accuracy in the accounting process, facilitating proper ledgers and eventual financial statements.

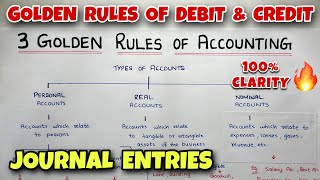

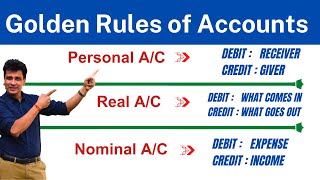

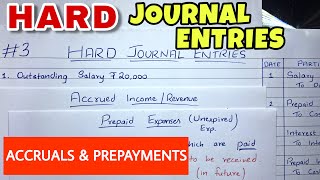

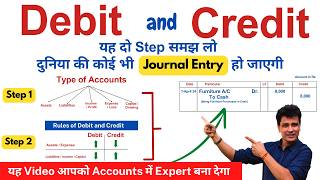

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Simple Entry

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Simple Entry: One debit and one credit

Detailed Explanation

A Simple Entry in accounting records a transaction with one debit and one credit. This is the most straightforward type of journal entry and follows the basic principle of double-entry accounting, where every financial transaction impacts at least two accounts, keeping the accounting equation balanced.

Examples & Analogies

Think of a simple entry like a purchase at a store. When you buy a shirt for $20, that's a debit to your clothing account (you received the shirt), and a credit to your cash account (you paid money). Just like how that transaction affects both your cash and clothing accounts, a simple journal entry affects two sides of the accounting equation.

Compound Entry

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Compound Entry: More than one debit or credit

Detailed Explanation

A Compound Entry involves multiple debits or multiple credits—or both—within a single transaction journal entry. This is used when a transaction affects several accounts simultaneously, ensuring that all financial effects are captured within a single entry rather than multiple separate entries.

Examples & Analogies

Imagine you run a catering business and a client pays you $1,000 for a party. You might record a compound entry if you also need to account for a deposit of $200 into your cash and credit your service revenue and supplies expense. Your compound entry would reflect that you have received the payment in cash, and you've also allocated parts of that payment to various categorized expenses, similar to splitting a bill among friends at a restaurant.

Opening Entry

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Opening Entry: Used at the beginning of the accounting period

Detailed Explanation

An Opening Entry is made at the start of an accounting period to bring opening balances into the accounting records. It ensures that the starting point for the new period is accurately reflected in the financial statements, utilizing balances from the previous period’s closing entries.

Examples & Analogies

Consider setting up a new calendar for a year. Your opening entry is like writing down all the important dates (e.g., holidays, birthdays) you already know are coming, ensuring you start the year organized. In accounting, you’re doing the same by recording all the balances from the end of the previous year so you have a clear financial starting point.

Adjustment Entry

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Adjustment Entry: Made at the end of the period for accruals/prepayments

Detailed Explanation

An Adjustment Entry is made at the end of the accounting period to account for transactions that have occurred but have not yet been recorded in the journal. This typically includes accruals (money earned but not yet received) or prepayments (money paid but not yet incurred), ensuring that the financial statements reflect the true financial position of the organization.

Examples & Analogies

Think of an Adjustment Entry like preparing for a big exam at school. You’ve studied and know you’ve learned a lot (accrual), but you haven't taken the test yet, so it’s not recorded with your grades. On the other hand, if you paid for a tutoring session in advance (prepayment) that you will attend next month, you need to recognize that payment now, as it pertains to this current accounting period.

Key Concepts

-

Simple Entry: One debit and one credit for straightforward transactions.

-

Compound Entry: More than one debit or credit for more complex transactions.

-

Opening Entry: Ensures correct recording of balances at the start of the accounting period.

-

Adjustment Entry: Updates account balances to reflect accrued income and expenses at the end of a period.

Examples & Applications

An example of a simple entry: Cash sales of ₹5,000 would be recorded as a debit to Cash A/C and a credit to Sales A/C.

A compound entry example: Purchasing inventory worth ₹6,000, paid ₹3,000 cash and ₹3,000 on credit, would debit Inventory A/C and Accounts Payable A/C and credit Cash A/C.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Simple entries are so neat, one debit, one credit can't be beat!

Stories

Imagine a store making a sale; they get cash and record it right away. That's a simple entry, clear as day!

Memory Tools

For compound entries, think 'Many' – Multiple accounts need to be sandy!

Acronyms

OCA for Opening Entries – Opening balances, Correctly and Accurately recorded!

Flash Cards

Glossary

- Simple Entry

An accounting journal entry involving one debit and one credit.

- Compound Entry

A journal entry that involves more than one debit or credit.

- Opening Entry

An entry made at the beginning of an accounting period to record opening balances.

- Adjustment Entry

An entry made at the end of a period to adjust accounts for payments and expenses that have occurred.

Reference links

Supplementary resources to enhance your learning experience.