Types of Errors Not Disclosed by Trial Balance

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Errors of Omission

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're discussing errors that the Trial Balance won't catch. Let's start with errors of omission. Can anyone tell me what that means?

I think it’s when a transaction isn’t recorded at all?

Exactly! An omission means a transaction, like a sale or an expense, wasn't recorded in the Journal. Since it’s missing, it won’t affect the Trial Balance either.

But how does that affect financial reports?

Great question! It can mislead stakeholders about the financial health of the business since those transactions represent real income or costs.

Can you give a simple example?

Certainly! If a ₹10,000 sale is not recorded at all, your income statement will show lower revenues, affecting key decisions. Remember the acronym 'Omit' to recall these errors!

Got it! Omit for omission.

Yes! Let’s summarize: errors of omission are when transactions are left out of records which can significantly impact financial results.

Errors of Principle

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Moving on to errors of principle, who can define this for us?

Isn't that when we use the wrong accounting policies?

Correct! An error of principle occurs when a transaction is recorded in violation of generally accepted accounting principles. Can anyone provide an example?

What about recording a capital expense as a revenue expense?

Exactly right! This misclassification distorts financial statements. Remember to think of 'Capital' when thinking of principle—the mistake lies in recognizing what should be capital vs. revenue.

So, the Trial Balance won’t show that we misplaced these records?

That’s right! The numbers can still balance out, but the meaning behind those numbers may be all wrong. Let's conclude: Errors of principle hurt the relevance of financial reports.

Compensating Errors

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, we have compensating errors. Who feels they can explain this type?

I think it’s when one error cancels out another?

Yes! Two independent errors that offset each other can lead to a balanced Trial Balance. Can someone give an example?

If I understated expenses and understated revenue the same amount?

Exactly! You might not see any discrepancy in the Trial Balance totals even though both accounts misrepresent their true figures. A good way to remember this is 'Compensate'.

So, they are linked but still wrong?

Exactly! The errors can neutralize each other mathematically but may still distort information. Let’s summarize: compensating errors can fool us by making the Trial Balance appear correct.

Errors of Commission

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Lastly, we need to address errors of commission. Who can summarize this type?

Is it when we record transactions in the wrong account?

Well done! This occurs when the correct amount is noted but in the wrong account. Example?

If we credit a Sales account but debit the incorrect Cash account?

Spot on! The Trial Balance would still balance, but the individual accounts are incorrect. To remember, think 'Commission' as in wrong 'position' of accounts.

We make it look correct, but we lose details in categories.

Exactly! Lastly, errors of commission don’t upset the balance, but they may mislead our internal reports. Let’s wrap up: errors of commission are about misallocation, leading to effective misrepresentation of our finances.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Trial Balance serves as a check for arithmetic accuracy but may not disclose all accounting errors. This section details the types of errors—including omission, principle, compensating, and commission—that can remain hidden despite a balanced Trial Balance.

Detailed

Types of Errors Not Disclosed by Trial Balance

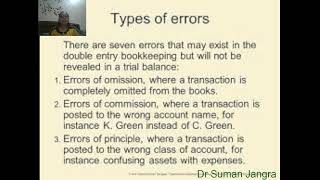

The Trial Balance is a fundamental tool in accounting that ensures the total debits equal the total credits, thus providing a preliminary check for errors in recording transactions. However, it is crucial to understand that a balanced Trial Balance does not guarantee that there are no errors in the accounting records. Several types of errors can occur that will not be detected by the Trial Balance. This section covers these errors in detail:

- Errors of Omission: This occurs when a transaction is completely omitted from the financial records. For instance, if a sale of goods is not recorded in the Journal, it results in neither a debit nor a credit being noted, thus having no impact on the Trial Balance while misleading financial performance.

- Errors of Principle: These errors arise when transactions are recorded in violation of accounting principles. An example would be incorrectly categorizing a capital expense as a revenue expense, which distorts financial statements but does not affect the Trial Balance's arithmetic.

- Compensating Errors: This type of error is characterized by two unrelated mistakes that offset each other, resulting in a balanced Trial Balance. For example, if an expense is understated by ₹100 and a corresponding income is understated by the same amount, the totals may still match, leaving the Trial Balance inaccurate.

- Errors of Commission: If the correct amount of a transaction is entered into the wrong account (though it is entered correctly in terms of debit and credit), this is known as an error of commission. This error does not cause a discrepancy in the Trial Balance total but misrepresents accounts.

Understanding these types of errors is essential for accountants as it allows them to recognize potential pitfalls and enhance the integrity of financial reporting.

Youtube Videos

![Produce Journal Entries to Correct Errors Not Disclosed by the Trial Balance [§4.2]](https://img.youtube.com/vi/cNdrPaJ5Gz0/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Errors of Omission

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Errors of omission (transaction not recorded at all)

Detailed Explanation

Errors of omission occur when a financial transaction is completely left out of the accounting records. This means that the transaction was never recorded in the Journal or Ledger. Because it doesn't appear in the financial records at all, it cannot be detected by the Trial Balance. Essentially, if you forget to write down a sale, your total revenues will be understated, which can lead to incorrect financial statements.

Examples & Analogies

Imagine you are keeping a diary and you just skip writing down an important event, like a birthday party. When you look back, you won't see that birthday celebration recorded anywhere, just like a missing transaction in the accounting records.

Errors of Principle

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Errors of principle (e.g., capital expense treated as revenue)

Detailed Explanation

Errors of principle occur when transactions are recorded in violation of accounting principles. For example, if a business treats a capital expenditure (like purchasing machinery) as a revenue expense, it misrepresents financial performance. The Trial Balance will still balance mathematically, but the underlying financial statements will be misleading because expenditure has been incorrectly classified.

Examples & Analogies

Think of it like using the wrong ingredients in a recipe. If you decide to use salt instead of sugar in a cake, the cake might still bake and look fine, but it won't taste right. Similarly, the financial statements might balance but will provide a false impression of the business's health.

Compensating Errors

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Compensating errors (two wrongs cancel each other)

Detailed Explanation

Compensating errors happen when two errors offset each other, leading to a balanced Trial Balance. For instance, if a company accidentally understates its expenses by ₹1,000 but simultaneously overstates its revenues by ₹1,000, the errors cancel out, and the Trial Balance appears correct. However, this does not reflect the true financial position, as both errors distort the actual performance.

Examples & Analogies

Consider a situation where you owe someone ₹1,000 but mistakenly believe you owe them ₹2,000 and overpay ₹1,000. Technically, your transaction has balanced (the payment made and the perceived debt), but in reality, you've lost money due to an oversight. Similarly, compensating errors can distort financial accuracy.

Errors of Commission

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Errors of commission (wrong account used, but side is correct)

Detailed Explanation

Errors of commission occur when transactions are recorded in the wrong account but on the correct side. For instance, if a payment intended for the Rent account is accidentally recorded in the Utilities account, the Trial Balance will still balance because the debit and credit sides are correct. However, the financial statements will not accurately reflect the true expenditures, resulting in potential misinterpretation of financial health.

Examples & Analogies

Think of this situation like typing a text message to a friend but accidentally sending it to the wrong person. The message content is correct, but it reached the wrong recipient. In accounting, even if the amounts are accurate, misclassifying accounts can lead to confusion when analyzing financial performance.

Key Concepts

-

Errors of Omission: Transactions not recorded, leading to misleading financial data.

-

Errors of Principle: Misclassification of transactions based on accounting principles.

-

Compensating Errors: Two errors offset each other, not appearing on Trial Balance.

-

Errors of Commission: Correct amount in the wrong account, causing misrepresentation.

Examples & Applications

Example of Errors of Omission: A sales transaction of ₹100,000 is not recorded, resulting in understated revenue.

Example of Errors of Principle: A business incorrectly categorizes an expense like equipment purchase as an operational expense rather than capital expenditure.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Errors like omission lead to confusion, accounting's clarity calls for resolution.

Stories

In an office, a clerk forgot to record a large sale. The numbers looked great until the owner noticed revenue was low. The omitted sale changed everything!

Memory Tools

Use the acronym 'POCC' to remember: Principle, Omission, Compensating, Commission.

Acronyms

Remember COPE for errors

Compensating

Omission

Principle

Error of Commission.

Flash Cards

Glossary

- Errors of Omission

Transactions that are not recorded at all in the accounting records.

- Errors of Principle

Errors that occur when transactions are recorded contrary to accounting principles.

- Compensating Errors

Errors that offset each other, leaving the Trial Balance unaffected.

- Errors of Commission

Mistakes where the correct amount is recorded in the wrong account.

Reference links

Supplementary resources to enhance your learning experience.