Posting from Journal to Ledger

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Posting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's start by exploring what posting involves. Can anyone tell me why we need to post from the Journal to the Ledger?

I think it's to keep track of all our transactions in one place.

Exactly! The Ledger helps us track all individual account balances. Each entry in the Journal is like a story about a financial transaction, and the Ledger is where we compile those stories into chapters. Do you remember what we mean by debits and credits?

Yes! Debits are amounts going into an account, and credits are amounts going out.

Right again! To remember this, think of the acronym 'D.I.C.E.' where D stands for Debits, I for Incoming (to the account), C for Credits, and E for Exiting (from the account).

That's a handy acronym!

I'm glad you think so! Now, what happens to the transactions when we post them?

Debits and Credits Posting Process

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, think about a simple transaction where we received ₹5,000 in cash for a sale. If I write this in the Journal, how should it be posted to the Ledger?

You would record ₹5,000 in the Cash account as a debit and ₹5,000 in the Sales account as a credit.

Perfect! This is a fundamental concept and helps assure that everything balances later on. Can anyone tell me why it's important to ensure that the post is accurate?

If it’s not accurate, then financial statements will show the wrong information, and that can lead to poor decision-making.

Exactly, that's the essence of integrity in accounting. So, to recap, we record debits on the left and credits on the right of the Ledger. Does everyone understand this process?

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, students learn the method of transferring transactions recorded in the Journal to the Ledger. It emphasizes how each debit from the Journal is recorded in corresponding Ledger accounts along with illustrative examples to aid understanding.

Detailed

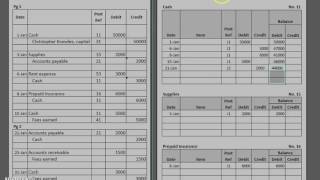

Posting from Journal to Ledger

In accounting, the process of transferring details from the Journal to the Ledger is crucial for maintaining accurate records of financial transactions. This section highlights the following key points:

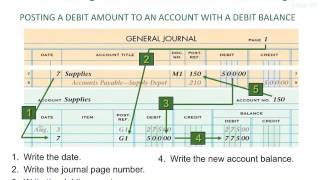

- Debits and Credits: Each debit recorded in the Journal must be posted to the debit side of the respective Ledger account, while each credit goes to the credit side. This ensures that the double-entry bookkeeping system is maintained.

- Example: If a transaction in the Journal states a debit of ₹5,000 to the Cash Account and a corresponding credit of ₹5,000 to the Sales Account, the Ledger will reflect these postings. For example, the Cash account will show an entry for the amount received from sales, and the Sales account will indicate sales revenue generated.

- Understanding this process is essential as it helps classify and summarize all transactions, which later allows for the preparation of the Trial Balance and financial statements.

This foundational knowledge ties into the broader context of how financial data is organized and checked for accuracy as part of the accounting cycle.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Debits and Credits in Posting

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Each debit in the journal is posted to the debit side of the respective ledger account.

Each credit in the journal is posted to the credit side of the respective ledger account.

Detailed Explanation

In the accounting process, when we record transactions in the journal, every entry has a debit side and a credit side. When we say that each debit in the journal is posted to the respective ledger account, it means we take the amount recorded as a debit in the journal and place it on the left side of the associated account in the ledger. Similarly, if there's a credit in the journal, we post that amount to the right side of the appropriate account in the ledger. This systematic posting ensures that all transactions are accurately reflected in the organization's financial records.

Examples & Analogies

Imagine you are keeping a record of your daily expenses and income in a notebook (the journal). When you write down a purchase you made (debit), you also write it in a separate section of the notebook that tracks your expenses (the ledger). Conversely, if you receive money (credit), you note it in your income section of the same notebook. This helps you see both sides of your financial situation at a glance.

Example of Posting from Journal to Ledger

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Example:

Journal Entry:

01/07/2025

Cash A/c Dr. ₹5,000

To Sales A/c ₹5,000

(Being goods sold for cash)

Ledger Accounts:

Cash A/c

Date Particulars Amount (₹)

01/07/2025 To Sales A/c 5,000

Sales A/c

Date Particulars Amount (₹)

01/07/2025 By Cash A/c 5,000

Detailed Explanation

Let's break down this example of posting from the journal to the ledger. On July 1, 2025, a transaction occurs where goods are sold for cash. In the journal, we record this as a debit to the Cash account for ₹5,000 and a credit to the Sales account for ₹5,000. This means that we've increased our cash balance and also registered income from sales. Next, we take this journal entry and post it into the respective ledger accounts. In the Cash account ledger, we show that ₹5,000 comes from sales (indicating an increase in our cash), and in the Sales account ledger, we show the ₹5,000 as coming from the Cash account (indicating the source of the sales income). This action mirrors and reinforces the entries made in the journal, ensuring that financial data is consistent and traceable.

Examples & Analogies

Think of this process like a farmer who sells produce. The farmer writes down in their notebook that they sold ₹5,000 worth of vegetables (the journal entry). Later, when they update their financial records, they note that this amount increased their cash balance in their cash register (the Cash account in the ledger) and also recorded the income in their sales records (the Sales account in the ledger). This keeps the farmer's financial records organized and clear, just like the posting ensures clarity in accounting records.

Key Concepts

-

Posting: The act of transferring journal entries to ledger accounts to maintain structured financial records.

-

Double-entry system: An accounting system that maintains the balance of total debits and credits through every transaction.

Examples & Applications

If a transaction shows ₹5,000 received in cash, it is recorded as a debit in Cash A/c and a credit in Sales A/c both for ₹5,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In the Ledger, left is for gain, Right for loss, that’s the main.

Stories

Imagine a bookshelf where each book is a Ledger. As you write in your Journal, you are placing those book summaries on the shelf, one for each transaction.

Memory Tools

D.A.T.- Debit Apart, Transactions Together - To remember we always post debits first, then credits.

Acronyms

L.J.C. - Ledger Journal Connection - denote the link between journals and ledgers.

Flash Cards

Glossary

- Journal

The primary book of entry in accounting, recording transactions chronologically.

- Ledger

The principal book of accounts, where journal transactions are classified and summarized.

- Debit

An entry recorded on the left side of a ledger account, indicating an increase in assets or expenses.

- Credit

An entry recorded on the right side of a ledger account, indicating an increase in liabilities, equity, or revenue.

Reference links

Supplementary resources to enhance your learning experience.