Accounting Treatment of Depreciation

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Charging Depreciation Directly

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to discuss the accounting treatment of depreciation, starting with how we charge depreciation directly to asset accounts. Can anyone tell me what happens when depreciation is charged?

Isn't it that we debit the depreciation account and credit the asset account?

Exactly! This means we recognize depreciation as an expense right away. The journal entry would look like this: Depreciation A/c Dr. to Asset A/c. Can anyone explain why we do this?

It's to reflect the decrease in the value of the asset over time.

Correct! This recording is important for accurate financial reporting. Remember, the book value of the asset decreases. Let’s summarize: When we charge depreciation directly, we debit the depreciation account, reflecting it in expenses, and reduce the asset’s value on our balance sheet.

Charging Depreciation through Provision

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's switch gears and discuss how depreciation can be charged through provision accounts. What is this method, and why is it used?

I believe it means we create a provision account that holds the depreciation amount instead of reducing the asset directly, right?

That's right! The journal entry for this would be: Depreciation A/c Dr. to Provision for Depreciation A/c. This entry creates a reserve to account for depreciation without impacting the asset's value immediately. Why do we want to do this?

It makes our balance sheet look better since we aren’t directly lowering our asset values yet!

Exactly! It allows for a clearer view of financial health. Remember, we will eventually debit the Profit & Loss A/c and credit the Depreciation A/c at year-end to reflect the expense accurately.

Impact on Financial Statements

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s discuss how these journal entries affect our financial statements. Can someone tell me how depreciation shows up in the income statement?

It appears as an expense, which reduces net profit.

Correct! What about the balance sheet?

It’s shown as a reduction in the value of the assets!

Right, and if we use provision, it deducts from the gross asset value. This ensures our statements are accurate and reflect the real value of our assets. Let’s recap: depreciation is an expense, reducing profits on the income statement, and reduces asset values on the balance sheet.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section outlines the journal entries for recording depreciation, either charged directly or through provision accounts, and highlights the impact of these entries on financial statements, providing essential guidelines for proper accounting practices.

Detailed

Accounting Treatment of Depreciation

In accounting, the treatment of depreciation is crucial for accurately representing an asset's value over time. This section addresses how depreciation is recorded through journal entries.

- When Depreciation is Charged Directly:

-

Journal Entry:

- Debit: Depreciation A/c

- Credit: Asset A/c

This entry directly reduces the value of the asset by recognizing the depreciation as an expense.

- When Depreciation is Charged through Provision:

- Journal Entry:

- Debit: Depreciation A/c

- Credit: Provision for Depreciation A/c

At the end of the financial year, the general entry for recognizing this expense in the financial statements is:

- Journal Entry:

- Debit: Profit & Loss A/c

- Credit: Depreciation A/c

These entries ensure that depreciation is recorded correctly within the financial books, impacting both the income statement, where it appears as an expense, reducing net profit, and the balance sheet, where it reduces the asset's carrying amount. Accurate accounting treatment of depreciation is vital for reflecting an organization's true financial position.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Charging Depreciation Directly

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- When Depreciation is Charged Directly:

Depreciation A/c Dr.

To Asset A/c

Detailed Explanation

This journal entry is used when a company decides to directly account for depreciation against the asset itself. The entry 'Depreciation A/c Dr.' records the depreciation expense, showing that it is increasing. Meanwhile, 'To Asset A/c' indicates that the book value of the asset is being reduced by the amount of depreciation charged. This method highlights that the asset's value is declining over time due to its usage.

Examples & Analogies

Imagine you own a car that you purchased for $20,000. Each year, as you use the car, it loses value. If you set aside $2,000 each year to reflect this loss, you can think of that $2,000 as directly reducing the value of your car on your financial records.

Charging Depreciation through Provision

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- When Depreciation is Charged through Provision:

Depreciation A/c Dr.

To Provision for Depreciation A/c

Detailed Explanation

In this approach, depreciation is recognized leading to the creation of a separate account called 'Provision for Depreciation.' The entry 'Depreciation A/c Dr.' once again reflects the expense incurred, whereas 'To Provision for Depreciation A/c' indicates that the provided amount is reserved for future depreciation needs, without immediately impacting the asset's account directly.

Examples & Analogies

Think of it like setting up a savings account for future purchases. You might not spend the money right away, but you recognize that you will need it in the future to maintain or replace your car. Similarly, a company sets aside funds in anticipation of depreciation.

End-of-Year Adjustment

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

At the end of the year:

Profit & Loss A/c Dr.

To Depreciation A/c

Detailed Explanation

This entry is made at the fiscal year's end to close out the depreciation account. 'Profit & Loss A/c Dr.' indicates that the total depreciation expense is accounted for in the profit and loss statement, thus reducing the overall profit for the year. 'To Depreciation A/c' represents the settling of the depreciation account, reflecting that the expense has been acknowledged and the accounts are balanced.

Examples & Analogies

Consider a restaurant that uses its equipment throughout the year. At the year-end, they recognize how much equipment has depreciated, adjusting their profit accordingly so that stakeholders understand the equipment's current value and the impact on profits.

Key Concepts

-

Charging Depreciation Directly: Recognizing depreciation as a direct expense to reduce asset value.

-

Provision for Depreciation: Holding account to account for depreciation expenses without affecting asset values immediately.

-

Impact on Financial Statements: Depreciation reduces net profit on the income statement and decreases asset values on the balance sheet.

Examples & Applications

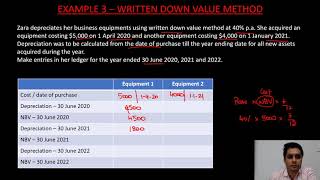

Example 1: A company purchases machinery for $10,000 with a residual value of $1,000 and a useful life of 5 years. If using straight-line depreciation, the annual depreciation expense would be ($10,000 - $1,000) / 5 = $1,800.

Example 2: A firm has an asset valued at $20,000, charging 10% depreciation. The journal entry at the end of the year would be: Depreciation A/c Dr. $2,000, Asset A/c Cr. $2,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

With every year, our assets wear, depreciation reduces their fair.

Stories

A company visionary built a fleet of trucks; as time went on, they saw their value reduced – this is depreciation in action.

Memory Tools

D.A.P.E. – Depreciation Account, Provision account, Expense account.

Acronyms

P.A.I.R. – **P**rovision, **A**ccount, **I**ncome statement, **R**educe value.

Flash Cards

Glossary

- Depreciation Account

An account that records the depreciation expense for fixed assets over time.

- Asset Account

An account that reflects the purchase cost of an asset less accumulated depreciation.

- Provision for Depreciation

An account created to record the depreciation of fixed assets without reducing their book values directly.

- Profit & Loss Account

A financial statement that summarizes revenues and expenses, showing the net profit or loss.

Reference links

Supplementary resources to enhance your learning experience.