Sum of Years’ Digits Method

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Basics of the Sum of Years' Digits Method

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are going to discuss the Sum of Years' Digits Method of depreciation. Can anyone explain what depreciation is?

Depreciation is when we reduce the value of an asset over its useful life.

Exactly! Now, the Sum of Years' Digits Method is one way to accelerate this process. It allocates higher depreciation in earlier years. Why do you think this might be beneficial?

Maybe because assets are usually more productive when they are newer?

That's correct! By aligning higher depreciation with higher productivity, we create a more accurate financial picture. Lets move to the formula…

Calculating Depreciation Using the Sum of Years' Digits Method

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let’s look at the formula for calculating depreciation: (Remaining Life of Asset / Sum of Years' Digits) × (Cost - Residual Value). Can anyone give an example of what each part means?

Remaining life refers to the number of years left for the asset, right?

Yes, great! And the Sum of Years' Digits for an asset with a useful life of 5 years would be 15. So, how would you calculate the depreciation for year 1 of a machine that costs $15,000 with a residual value of $3,000?

We would calculate it as (5/15) * ($15,000 - $3,000), which gives us $4,000 for the first year?

Perfect! This shows how more depreciation is captured early on which reflects the asset's usage better.

Benefits and Limitations of the Sum of Years' Digits Method

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's discuss the benefits and limitations of using the Sum of Years' Digits Method. Why would a business choose this method?

It might be because it reflects the actual wear and tear of an asset better.

Exactly! However, can anyone think of a limitation?

It might overstate expenses in the early years, affecting profit.

That’s a good point! It’s important for businesses to balance tax benefits with accurate financial reporting.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section discusses the Sum of Years' Digits Method, which accelerates depreciation by allocating a larger expense in earlier years compared to later years. It includes the calculation formula and explains its significance in reflecting the asset's usage pattern over time.

Detailed

Sum of Years’ Digits Method

The Sum of Years' Digits Method is an accelerated method for calculating depreciation, designed to allocate a greater portion of an asset's cost in the earlier years of its useful life. The method represents a more realistic expense approach for assets that tend to lose value quickly or offer greater benefits when they are newer.

Formula

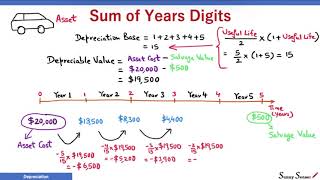

The depreciation expense for a given year can be calculated using the formula:

Depreciation Expense = (Remaining Life of Asset / Sum of Years' Digits) × (Cost of Asset - Residual Value)

Where:

- Summation of Years’ Digits is calculated as:

n(n + 1) / 2, where n is the useful life of the asset in years.

An example can illustrate this; if an asset has a useful life of 5 years, the total of the years' digits would be: 5+4+3+2+1 = 15.

In this method, since the depreciation expenses decrease over time, it better matches the income produced from the asset in its initial years, which is often when the asset is most productive. Businesses may choose this method for assets like machinery and technology that quickly become obsolete, ensuring the depreciation expense aligns with revenue generation from the asset.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Overview of the Sum of Years’ Digits Method

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Accelerated method of depreciation. Formula:

Remaining life of asset

Depreciation= × (Cost−Residual Value)

Sum of years’ digits

Detailed Explanation

The Sum of Years’ Digits Method is an accelerated depreciation technique. This means that a higher amount of depreciation expense is recognized in the earlier years of an asset's useful life compared to later years. The calculation involves taking the remaining life of the asset and multiplying it by the difference between the cost of the asset and its residual value. This value is then divided by the sum of the years' digits, which helps determine how much depreciation to charge during a specific year.

To clarify, the formula includes understanding the total number of years the asset is expected to be used. For example, if an asset has a useful life of five years, you will calculate the sum of the digits from 1 to 5, which totals 15. Each year, the asset will receive a depreciation amount that reflects how much useful life remains, with more depreciation taken in the early years.

Examples & Analogies

Imagine you purchase a new car for $20,000, expecting to keep it for five years. In the first year, you value the car highly because it’s new and fully functional, so you use the Sum of Years’ Digits Method to account for depreciation. Here, the car's value drops more significantly during the first two years as newer models are released and your car becomes relatively older. This method resembles how a smartphone depreciates faster in terms of value right after it’s released because most people want the latest model.

Understanding Remaining Life and Residual Value

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Remaining life of asset

Depreciation= × (Cost−Residual Value)

Sum of years’ digits

Detailed Explanation

In this method, 'remaining life' refers to how many years the asset is expected to still provide useful service. The 'cost' of the asset is the purchase price plus any additional costs incurred to get the asset ready for use. The 'residual value' is what you expect the asset to be worth at the end of its useful life. By subtracting the residual value from the cost, you determine the total value that will be depreciated over the asset's life.

Consequently, the depreciation expense for each year reflects how much of the asset's value you are recognizing that year based on its usage and age. This approach shows that newer assets lose value faster due to higher utility in their early years.

Examples & Analogies

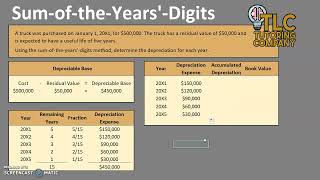

Consider a company that buys industrial machinery for $100,000, with an expected residual value of $10,000 after 5 years. The sum of the digit years would be 1+2+3+4+5 = 15. In the first year, the remaining life is 5 years, so the depreciation would be calculated on 5/15 of the total depreciable amount ($100,000 - $10,000), which allows the company to reflect the higher utility costs of the machine immediately, benefitting from its efficiencies.

Application of the Formula

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Depreciation= × (Cost−Residual Value)

Sum of years’ digits

Detailed Explanation

To apply the Sum of Years’ Digits Method, you first determine the total depreciation amount, which is the cost of the asset minus its expected residual value. Then, you identify the total number of years in the asset's useful life and sum these years together to get a composite number, as indicated in the formula. Each year, you will calculate the fraction of the total depreciation to apply, which is based on how many years of life remain compared to this total sum of the years.

Examples & Analogies

Imagine a company has a truck that costs $50,000 and has a residual value of $5,000 after a useful life of 5 years. The sum of the years is 1 + 2 + 3 + 4 + 5 = 15. In Year 1, the company will apply 5/15 of the depreciable amount ($50,000 - $5,000), receiving a larger deduction sooner. It reflects the truck being more productive and thus, more valuable in its first year of usage.

Key Concepts

-

Accelerated Depreciation: A method that allocates more depreciation expense in the early years of an asset’s useful life.

-

Sum of Years' Digits: The total of the years' useful life of an asset, which is used to find depreciation with the Sum of Years' Digits method.

-

Depreciation Expense: The yearly expense related to the decrease in value of an asset.

Examples & Applications

Example of calculating depreciation using the Sum of Years' Digits Method for a machine with a cost of $20,000, residual value of $5,000, and a useful life of 4 years: In the first year, the depreciation would be (4/10) * ($20,000 - $5,000) = $6,000.

For the same asset in the second year: (3/10) * ($20,000 - $5,000) = $5,500.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Digging years, add up quick, the asset's value dims, tick tock, tick.

Stories

Imagine a new car that drops its value fast in the first few years. The Sum of Years' Digits helps account for that depreciation as the car ages.

Memory Tools

To remember the order: Five Quickly Sings (5, 4, 3, 2, 1).

Acronyms

SOLD - Sum Of Life’s Digits.

Flash Cards

Glossary

- Sum of Years' Digits Method

An accelerated depreciation method that allocates depreciation expense based on the remaining life of an asset.

- Depreciation Expense

The amount charged to an entity’s income statement for the wear and tear of an asset over a specific period.

- Residual Value

The estimated value of an asset at the end of its useful life.

- Useful Life

The period over which an asset is expected to be useful to the owner.

- Sum of Years' Digits

A calculation that represents the total of the number of useful years of an asset into a single value.

Reference links

Supplementary resources to enhance your learning experience.