Factors Affecting Depreciation

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Cost of the Asset

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are going to look at the first factor affecting depreciation: the cost of the asset. Who can tell me what is included in the 'cost' of an asset?

I think it's just the price we pay for it.

Good start! But it's more than just the purchase price. It also includes installation and delivery costs. So we can remember it as PAC—Purchase, Additional costs, and Costs of delivery. Can you think of an example where we might have additional costs?

Well, if we buy a machine, the cost to install it also matters.

Exactly! All these components combined determine the total cost that will be depreciated over time.

Residual/Scrap Value

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let’s talk about residual value. Why do you think knowing the estimated residual value is important in accounting?

Maybe because it tells us how much we'll get if we sell it later?

Exactly! It's critical because it affects how much we write off the asset's cost over its useful life. Let’s remember it as RUM—Residual Understands Market value. Why do we set these estimates?

To avoid overstating losses when the asset is sold, right?

Correct! Not accounting for this can mislead financial statements.

Useful Life

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next up is useful life. Can anyone tell me why this estimate is crucial?

I suppose it helps us know how long we can use the asset before replacing it.

Exactly! The useful life impacts how we allocate the cost for depreciation. We can use the acronym ULTIE—Useful Life To Impact Expenses—to remember its importance. How can companies miscalculate this?

If they overestimate it, they'll depreciate too little.

Spot on! An inaccurate estimate can lead to significant discrepancies in financial reporting.

Depreciation Method

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let’s discuss the depreciation method. Why is the choice of method so impactful?

Different methods will affect how much expense is recorded each year.

Absolutely! Some methods, like straight-line, spread costs evenly, while others like reducing balance allocate more in the initial years. We can think of it as M3 - Method Method Matters! How might this affect business decisions?

If a company wants to show lower profits at first, they might choose a method that accelerates depreciation.

That's a great point. It's important to understand these methods and how they align with a company’s financial strategies.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, we explore the critical factors that affect the calculation of depreciation for fixed assets, including the asset's cost, its residual value, its useful life, and the specific depreciation method employed. Understanding these elements is essential for accurate financial reporting and effective asset management.

Detailed

Factors Affecting Depreciation

In depreciation accounting, various factors play a significant role in determining how an asset's value decreases over time. These factors include:

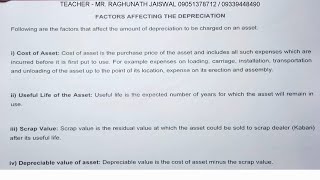

- Cost of the Asset: This encompasses not only the purchase price but also additional expenses related to installation and delivery, which all contribute to the initial value that will be depreciated.

- Residual/Scrap Value: Before calculating depreciation, it's essential to estimate the residual value of the asset—its expected worth at the end of its useful life.

- Useful Life: This refers to the duration for which the asset is expected to be useful to the organization, influencing how the cost will be allocated over time.

- Depreciation Method: The choice of method, whether straight-line, reducing balance, or others, directly impacts how much depreciation expense is recognized each year and can differ significantly in the overall expense calculated.

Understanding these factors is vital for BTech CSE students in making informed decisions about asset management, ensuring precise financial reporting, and contributing to effective long-term investment strategies.

Youtube Videos

![BASIC FACTORS AFFECTING DEPRECIATION | ACCOUNTING | FINANCIAL ACCOUNTING [DEPRECIATION]](https://img.youtube.com/vi/jV9b0A-zEwg/mqdefault.jpg)

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Cost of the Asset

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Cost of the Asset: Includes purchase price + installation + delivery.

Detailed Explanation

The cost of an asset is a crucial factor in determining depreciation. It encompasses not just the purchase price of the asset itself but also any associated costs, such as installation and delivery charges. The total cost forms the basis upon which depreciation is calculated over the asset's useful life.

Examples & Analogies

Imagine you buy a new computer for your business. The purchase price is $1,000, but you also pay $100 for shipping and $50 for setup. Your total cost to account for in depreciation is $1,150, not just the $1,000 for the computer.

Residual/Scrap Value

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Residual/Scrap Value: Estimated value at the end of useful life.

Detailed Explanation

Residual or scrap value refers to the estimated amount that an asset is expected to be worth at the end of its useful life. This value is crucial for calculating depreciation because it's the amount that will not be depreciated. Essentially, depreciation looks at how much value an asset loses over time, and the scrap value represents what remains after it has been fully utilized.

Examples & Analogies

Consider a delivery truck that you purchase for your business. You estimate that after 10 years, the truck will still be worth $5,000. This $5,000 is the residual value; it won't be included in the total depreciation amount, as you expect to get this back when you sell the truck.

Useful Life

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Useful Life: Estimated number of years the asset is expected to be in service.

Detailed Explanation

The useful life of an asset is the period over which it is expected to be productive or usable for its intended purpose. This estimate helps in determining how long the asset's cost should be spread out through depreciation. A shorter useful life results in higher annual depreciation charges, while a longer useful life leads to lower annual charges.

Examples & Analogies

Think about purchasing a laptop for your studies. If you expect to use it for 4 years before needing a new one, that 4-year span is its useful life. If instead you expected to keep the laptop for 8 years, the annual depreciation calculated would be less.

Depreciation Method

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Depreciation Method: The technique used to allocate cost over years.

Detailed Explanation

The method of depreciation chosen affects how much expense is recorded each period. Different methods (like Straight-Line, Written Down Value, etc.) calculate the yearly depreciation differently based on various factors like the asset's cost and useful life. Therefore, the choice of method directly influences the profit and loss statements as well as the book value of the asset over time.

Examples & Analogies

If you were to gradually wear down a pair of shoes over several years, a method like Straight-Line depreciation would allocate an equal amount of expense each year. However, using a method like Written Down Value could mean you'd recognize more expense in the earlier years when the shoes are brand new, reflecting their initial higher value.

Key Concepts

-

Cost of the Asset: Represents the total costs involved in acquiring the asset.

-

Residual/Scrap Value: The anticipated value of an asset at the end of its useful life.

-

Useful Life: The expected operational duration of the asset.

-

Depreciation Method: Various methods influence expense recognition over asset life.

Examples & Applications

A manufacturing company purchases a machine for $10,000, with an additional $1,000 for delivery and $500 for installation, making the total cost $11,500. This total impacts how the asset's depreciation will be calculated.

A vehicle bought for $20,000 with an estimated residual value of $5,000 and a useful life of 5 years will guide the company in its annual depreciation expenses.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When cost you define, consider all it's worth, Not just the price, but the journey on Earth.

Stories

Once upon a time, an accountant named Sam learned about assets. He noted that when buying a new truck, it wasn't just the price he had to pay, but also the delivery and installation fees. Sam discovered that knowing the residual value helped him make better financial decisions!

Memory Tools

Remember PAC (Purchase, Additional costs, Delivery) for asset costs, and RUM (Residual Understands Market value) for residual value!

Acronyms

RUM - Residual Understands Market value, to help recall the importance of estimating scrap values.

Flash Cards

Glossary

- Cost of the Asset

The total expenditure incurred to acquire an asset, including its purchase price, installation, and delivery costs.

- Residual/Scrap Value

The estimated value of an asset at the end of its useful life, after depreciation has been accounted for.

- Useful Life

The duration for which an asset is expected to be functional and generate economic benefits.

- Depreciation Method

The process or technique used to allocate the cost of a tangible asset over its useful life.

Reference links

Supplementary resources to enhance your learning experience.