Change in Method of Depreciation

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Circumstances for Changing Depreciation Method

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome, class! Today, we're exploring the reasons why a business might change its method of depreciation. Can anyone think of a reason?

Maybe if the way we use an asset changes?

Exactly! A change in usage patterns is a significant factor that can prompt such a change. What might be another reason?

Regulatory requirements?

Yes! Sometimes businesses need to comply with new laws or accounting standards. Great job, everyone! Let's remember the acronym 'URP' for Usage, Regulations, and Patterns that lead to changes in depreciation.

Accounting Treatment of Change

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's discuss how we treat these changes in accounting terms. Can anyone tell me if these changes are applied retroactively or prospectively?

I think they are applied to future financial statements only.

Correct! They are treated as a change in accounting estimate and are thus applied prospectively. This helps maintain the integrity of past financial reports.

So, we don’t have to go back and change previous statements?

Exactly! This makes it easier for businesses to adapt without revisiting all past data. Let's recap: prospective application ensures clarity and consistency.

Examples of Changes in Depreciation Methods

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Can anyone provide an example of when a company might change its depreciation method?

If they upgraded machinery that’s more efficient, they might want to change how they depreciate it?

Right! Upgrading equipment could mean adjusting the useful life or residual value, prompting a change. Can you all think of other scenarios?

What if regulations change and require companies to adopt a new depreciation standard?

Absolutely! Regulatory changes can significantly impact how a company approaches depreciation. Keep thinking about those practical scenarios as they help solidify your understanding!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Businesses may alter their depreciation methods due to changes in usage patterns, regulatory requirements, or adjustments in estimated useful life or residual value. Such changes are treated as alterations in accounting estimates under relevant accounting standards, applied prospectively rather than retrospectively.

Detailed

Change in Method of Depreciation

Changing the method of depreciation is often necessitated by various factors including a shift in the usage pattern of an asset, updates in regulatory frameworks, or adjustments to the estimated useful life or residual value of the asset. According to Accounting Standard (AS-10) or Ind AS 16, such alterations are classified as changes in accounting estimates. Importantly, when a company decides to modify its depreciation method, it is required to apply this change prospectively, meaning that the adjustment will influence future financial statements rather than revising those of the past. This approach ensures that the financial reports reflect the current reality of the asset's usage while maintaining consistency in accounting practices.

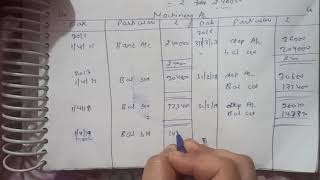

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Reasons for Changing Depreciation Method

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Sometimes businesses change the method due to:

• Change in usage pattern

• Regulatory requirements

• Change in estimated useful life or residual value

Detailed Explanation

Businesses may decide to change their method of depreciation for several reasons. First, a change in usage pattern refers to how the asset is being used; if an asset is used more or less than originally anticipated, it may be more appropriate to switch to a different depreciation method that more accurately reflects its current value decrease. Second, regulatory requirements can necessitate a change; if laws change regarding how assets must be depreciated, companies must comply. Lastly, if the estimated useful life or residual value of the asset changes—for instance, if an asset lasts longer than expected or becomes worth more at the end—it would make sense to adjust the depreciation calculation accordingly.

Examples & Analogies

Imagine you bought a new car intended for personal use but found that you needed it for a ride-sharing service instead. Initially, you assumed you would drive it only occasionally, but now you're using it daily, which accelerates its wear and tear. You might then switch your depreciation method to better reflect the faster loss of value due to the increased usage.

Accounting Standards on Method Change

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Accounting Standard (AS-10 / Ind AS 16):

Change in method is treated as a change in accounting estimate. The effect is applied prospectively, not retrospectively.

Detailed Explanation

According to accounting standards, such as AS-10 and Ind AS 16, when a business changes its method of depreciation, this is viewed as a change in accounting estimate. What this means is that the new method will be applied moving forward, from the point of change, rather than going back and altering past financial statements. This prospective application ensures clarity and consistency in financial reporting, allowing stakeholders to rely on current data without revisiting previous years.

Examples & Analogies

Think of it like changing the rules for a game halfway through. If you decide to change a scoring method during the game, you only apply that new scoring system to future plays. You don't go back and change the scores from earlier; you just report the new scores as they come based on the new rules.

Key Concepts

-

Change in Depreciation Method: A necessary adjustment due to factors like usage pattern or regulatory demand.

-

Accounting Standard AS-10/Ind AS 16: These standards outline the treatment of changes in depreciation methods.

-

Prospective vs. Retrospective Application: Changes are applied prospectively to maintain financial integrity.

Examples & Applications

A company using straight-line depreciation may switch to double declining balance when asset usage significantly increases.

A bus company might change its method from units of production to straight line if it expects a longer operational life for vehicles.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When usage shifts or rules align, change your methods, keep your books fine!

Stories

Imagine a delivery company realizing its trucks are now more efficient. To match this new reality, it shifts depreciation methods, recognizing that its previous approach doesn't reflect current asset values.

Memory Tools

URP: Usage, Regulations, Patterns lead to depreciation changes.

Acronyms

SPARE

Shift

Prospective

Accounting

Regulation

Estimate – the factors in changing depreciation methods.

Flash Cards

Glossary

- Depreciation Method

The technique used to allocate the cost of a fixed asset over its useful life.

- Prospective Application

The accounting treatment where changes are applied to future financial statements only, without altering past statements.

- Accounting Estimates

Approximate assessments of the future, such as the useful life or residual value of an asset.

Reference links

Supplementary resources to enhance your learning experience.