Depreciation Accounting

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Depreciation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Good morning, everyone! Today, we will explore the concept of depreciation. Can anyone tell me what depreciation is?

Isn't it about the reduction in value of assets over time?

Exactly! Depreciation is the systematic allocation of the cost of tangible fixed assets over their useful life. Why do you think it's important?

To ensure that the cost of the asset is matched with the revenue it generates?

Right! This matching principle helps determine true profit or loss. Without it, profits may seem inflated.

So, it presents a more realistic financial statement?

Correct! And also enables companies to set aside funds for asset replacement. Remember: if assets aren’t accounted for accurately, it can mislead decision-making.

What about statutory requirements? Do they make depreciation mandatory?

Absolutely! Compliance with accounting standards necessitates the accounting for depreciation. Great job, everyone!

Causes and Characteristics of Depreciation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's delve into the causes of depreciation. Can anyone name a few?

Wear and tear due to usage?

Yes! Wear and tear is one major cause. Others include obsolescence and the mere passage of time. Let’s not forget depletion from natural resources.

What about accidents?

Great point! Accidents can cause sudden loss in asset value. Now, depreciation has specific characteristics. Who can summarize them?

It applies only to tangible fixed assets, is a non-cash expense, and reduces the book value annually.

Exactly, and remember, it systematically charges depreciation to the profit and loss account—very important!

So it’s crucial for accurate financial reporting?

Absolutely! It reflects a true financial position in statements.

Methods of Depreciation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's move to the methods of depreciation. Who knows one method?

I know the straight-line method where we charge the same amount each year.

That's correct! Its formula is: (Cost of asset - Residual value) / Useful life. Who can mention another method?

The written down value method?

Exactly! It charges depreciation based on the book value at the beginning of the year. Can anyone explain why it might be suited for certain assets?

Because it results in higher depreciation in initial years?

Yes! It’s suitable for assets whose efficiency decreases over time. What about the Units of Production method?

That one’s based on actual usage!

Exactly! It’s all about actual output. Understanding these methods helps in accurate financial planning.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section delves into the necessity and significance of depreciation in accounting, covering its definition, causes, characteristics, methods, and its impact on financial statements. Understanding depreciation is crucial for matching costs with revenue and accurately reporting profit and loss.

Detailed

Detailed Summary

Depreciation accounting is pivotal in representing fixed assets' value over time. Unlike daily expenses, fixed assets such as machinery and buildings provide benefits for many years, yet their value decreases due to wear and tear, obsolescence, and time. This section emphasizes the following key points:

1. Meaning and Need for Depreciation

- Definition: Depreciation is the systematic allocation of a tangible fixed asset's cost over its useful life.

- Necessity: It ensures the matching of costs with revenues, accurate profit/loss determination, realistic financial position representation, asset replacement provisions, and compliance with statutory requirements.

2. Causes of Depreciation

- Key causes include wear and tear, obsolescence, time passage, depletion, and accidents.

3. Characteristics of Depreciation

- Relevant to tangible fixed assets only, it is a non-cash expense that reduces the asset's book value annually.

4. Factors Affecting Depreciation

- Major factors include the asset's cost, residual value, useful life, and depreciation method.

5. Methods of Depreciation

- Several methods exist, including the Straight-Line Method, Written Down Value Method, Sum of Years’ Digits, and Units of Production Method, each with unique calculations and applications.

6. Accounting Treatment of Depreciation

- Depreciation is recorded in journal entries and affects both the income statement and balance sheet.

7. Provisions vs Reserves

- Distinction between provisions for liabilities (necessary) and reserves for strengthening financial positions (not always mandatory).

8. Change in Method of Depreciation

- Organizations can change depreciation methods based on usage patterns, regulations, or estimates.

9. Depreciation under Companies Act & Income Tax

- Specific guidelines are provided for different useful lives and taxation deductibility.

In summary, accurate depreciation accounting reflects an asset’s value loss over time, aiding in revenue and expense matching, thereby supporting informed financial planning.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Introduction to Depreciation

Chapter 1 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

In the world of accounting and finance, depreciation plays a critical role in accurately representing the value of fixed assets over time. Unlike daily expenses, fixed assets such as buildings, machinery, and vehicles provide benefits for many years. However, their value does not remain constant. Wear and tear, obsolescence, and usage diminish their worth. Depreciation Accounting ensures that the cost of these assets is systematically allocated over their useful life.

Detailed Explanation

This chunk introduces the concept of depreciation, highlighting its importance in accounting. Depreciation helps businesses reflect the declining value of fixed assets over time due to various factors like usage and obsolescence. Fixed assets, unlike regular expenses, are long-term investments, and their value must be adjusted to match their actual worth as they age.

Examples & Analogies

Imagine a delivery truck that a company buys for its operations. Over the years, as the truck is used for deliveries, it gets wear and tear and its market value decreases. If the company does not account for this loss in value annually, their financial statements might misrepresent their profits and the worth of their assets.

Meaning and Need for Depreciation

Chapter 2 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Depreciation is the systematic allocation of the cost of a tangible fixed asset over its useful life. It represents the reduction in the value of an asset due to usage, passage of time, or obsolescence.

Detailed Explanation

This chunk defines depreciation as a systematic process. It allocates an asset's cost over its useful lifetime so that each year reflects an expense corresponding to the asset's use. This is crucial for providing users of financial statements with an accurate depiction of a company’s financial performance.

Examples & Analogies

Think of buying a laptop for your studies. You spend a significant amount on it, but as the years go by and new models are released, your laptop's value declines. By tracking depreciation, you can understand how much value the laptop loses each year and plan for future technology upgrades.

Why is Depreciation Necessary?

Chapter 3 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• To match cost with revenue: Depreciation helps in matching the cost of the asset with the income it generates during its useful life.

• To determine true profit or loss: Without accounting for depreciation, profit may be overstated.

• To show the true financial position: Assets shown at depreciated value (book value) present a more realistic financial statement.

• To make provisions for asset replacement: Depreciation allows firms to accumulate funds to replace old assets.

• To comply with statutory requirements: It is mandatory under various accounting standards and legal provisions.

Detailed Explanation

In this chunk, several reasons for the necessity of depreciation are outlined. Matching costs with revenues ensures that a company’s profits are accurately represented, providing a clearer understanding of financial health. Moreover, it signals the reduced value of assets, assisting in financial planning and compliance with laws.

Examples & Analogies

Consider a construction company that buys heavy machinery for a project. As the machinery operates over the years, its value decreases. If they neglect to account for this decrease, they might think they made more profit than they actually did, leading to possible financial mismanagement when they eventually have to replace the machinery.

Causes of Depreciation

Chapter 4 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Wear and Tear: Physical deterioration due to usage.

- Obsolescence: Assets becoming outdated due to technological advancements.

- Passage of Time: Even unused assets depreciate due to time.

- Depletion: Natural resources like mines reduce in value as they are extracted.

- Accidents/Natural Causes: Sudden loss of asset value due to unforeseen events.

Detailed Explanation

This chunk identifies five key causes of depreciation. Each cause reflects different aspects of why tangible assets lose value, from physical wear from use to the natural aging process affecting even unused items. Understanding these causes helps businesses better assess how much to depreciate their assets over time.

Examples & Analogies

A computer is a perfect example of how technology advances lead to obsolescence. If you purchase a computer, after a couple of years, new models with better specifications come in, making your computer seem less valuable even if it still works perfectly. The rate at which that old computer loses value is influenced by how tech-savvy the market is and how frequently new models are introduced.

Characteristics of Depreciation

Chapter 5 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Applies to tangible fixed assets only.

• It is a non-cash expense (does not involve actual outflow of funds).

• Calculated in a systematic manner.

• Charged annually to profit and loss account.

• Reduces book value of the asset over time.

Detailed Explanation

Here, the characteristics of depreciation are described. Key aspects include its application strictly to tangible assets and being categorized as a non-cash expense. This means while the financial statement reflects the reduction in value, no actual cash leaves the business, allowing for better cash flow management.

Examples & Analogies

Think about renting an apartment. If the landlord charges you a fixed rent based on the property’s value, but the actual cash you pay every month is unaffected by the property’s depreciation over time. The rent mirrors the asset's worth as it decreases, even though you do not see a cash outflow related to asset depreciation.

Factors Affecting Depreciation

Chapter 6 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Cost of the Asset: Includes purchase price + installation + delivery.

- Residual/Scrap Value: Estimated value at the end of useful life.

- Useful Life: Estimated number of years the asset is expected to be in service.

- Depreciation Method: The technique used to allocate cost over years.

Detailed Explanation

This chunk lists the factors that influence how depreciation is calculated. Each factor plays a critical role in determining the depreciation expense for each accounting period, helping businesses create a realistic assessment of asset value over time.

Examples & Analogies

Consider a new car you bought. Its total cost includes the price, taxes, and any other fees. When you calculate depreciation, you also consider the car's expected lifespan and how much it might be worth at the end. Understanding these factors helps you realize how various elements impact its depreciation over the years.

Methods of Depreciation

Chapter 7 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Straight Line Method (SLM): Also known as the Fixed Installment Method. The same amount is charged each year.

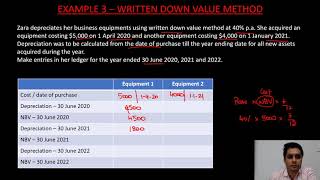

- Written Down Value (WDV) Method: Depreciation is charged at a fixed percentage on the book value of the asset.

- Sum of Years’ Digits Method: Accelerated method of depreciation.

- Units of Production Method: Depreciation depends on actual usage/output of the asset.

Detailed Explanation

This chunk outlines four common methods of calculating depreciation, explaining how each method allocates asset cost over time. Different methods provide varied insights into asset utilization, depending on usage patterns and financial planning goals.

Examples & Analogies

Imagine a smartphone. Using the Straight Line Method, you could assume it loses a fixed amount of value each year, while the Units of Production Method could reflect the fact that if you use the phone intensely for several tasks, its value decreases quicker in those early years due to wear.

Accounting Treatment of Depreciation

Chapter 8 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- When Depreciation is Charged Directly: Depreciation A/c Dr.

To Asset A/c - When Depreciation is Charged through Provision: Depreciation A/c Dr.

To Provision for Depreciation A/c

At the end of the year: Profit & Loss A/c Dr.

To Depreciation A/c

Detailed Explanation

This chunk describes how depreciation is recorded in the financial accounts. Different approaches influence how the financial health of the business is portrayed and how the expenses are tracked over time.

Examples & Analogies

Think of running a café. Each month, you need to account for the depreciation of kitchen equipment. If you record it as a direct expense on your books, it’s straightforward. Alternatively, you might set aside money in a provision account for future replacements, ensuring you have funds for when those machines finally wear out.

Impact of Depreciation on Financial Statements

Chapter 9 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Income Statement (Profit and Loss Account): Depreciation is treated as an expense.

- Balance Sheet: Shown as a reduction in the value of the asset.

Detailed Explanation

This chunk explains how depreciation impacts the financial statements of a business. On the income statement, it reduces net profit due to being classified as an expense. Meanwhile, in the balance sheet, it lowers the recorded value of assets, reflecting their true worth.

Examples & Analogies

If a company sells its products for higher prices, they may see strong profits on the income statement, but when depreciation reduces the reported value of their factory and equipment, investors get a clearer view of what those assets are worth in reality.

Provisions vs Reserves

Chapter 10 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Basis Provision Reserve

Purpose Made to meet a specific liability

Compulsory Yes, in case of depreciation

Accounting Treatment Treated as an expense

Affect on Profit Reduces net profit

Detailed Explanation

In this chunk, the differences between provisions and reserves are discussed, highlighting the specific purpose of provisions in anticipating future liabilities like depreciation. Understanding this helps businesses with financial planning and presentation of their resources.

Examples & Analogies

Think of a family saving for a vacation. They might set aside money each month as a 'provision' for the trip, reducing their current available spending, whereas they could also have some savings as a 'reserve' for emergencies that they don't touch unless absolutely necessary.

Change in Method of Depreciation

Chapter 11 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Sometimes businesses change the method due to:

• Change in usage pattern

• Regulatory requirements

• Change in estimated useful life or residual value

Accounting Standard (AS-10 / Ind AS 16): Change in method is treated as a change in accounting estimate. The effect is applied prospectively, not retrospectively.

Detailed Explanation

This chunk discusses the conditions under which businesses might change their depreciation methods, emphasizing regulatory compliance and reassessment of asset values. Knowing how to adapt to these changes is crucial for accurate accounting.

Examples & Analogies

Imagine a tech company that releases a new version of its software annually. If the usage pattern changes significantly after an upgrade, such as customers using faster cloud services, the company may need to reassess how they depreciate their older machines.

Depreciation under Companies Act, 2013 (India)

Chapter 12 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Schedule II of the Act specifies useful lives of assets for calculation of depreciation.

• Companies can use different useful life if justified.

Detailed Explanation

This chunk highlights specific legal requirements tied to depreciation in India, showing how companies have some flexibility while being guided by the Companies Act. This ensures consistent reporting while allowing for adjustment based on asset use.

Examples & Analogies

Think of it like guidelines for school projects. While teachers might suggest a timeframe for submission, students can illustrate how their projects fit within a different timeline if they provide justification, much like companies justifying their asset valuations.

Depreciation in Income Tax

Chapter 13 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Income Tax Act allows depreciation as a deduction.

• Block of Assets method is used.

• Rates are prescribed under Income Tax Rules.

• Depreciation under tax law may differ from financial accounting.

Detailed Explanation

In this chunk, the intertwining of depreciation and tax law is discussed. It explains how depreciation can reduce taxable income and how different rules apply in tax versus financial accounting, essential for sound financial planning.

Examples & Analogies

Imagine a small business where you buy equipment for recipes. The tax authorities allow you to deduct depreciation from taxable income, reducing your tax burden. Yet, you need to present financial records using different depreciation rules to show investors the business's performance.

Conclusion

Chapter 14 of 14

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Depreciation is not merely a financial adjustment—it’s a reflection of the economic reality that assets lose value over time. Accurate depreciation accounting ensures proper matching of revenues and expenses, helps maintain capital, and presents a true and fair view of financial statements.

Detailed Explanation

The conclusion reinforces the importance of understanding depreciation, summarizing how it affects overall financial health, decision-making, and transparency in financial reporting. Proper depreciation accounting is indispensable in managing both short-term and long-term strategies.

Examples & Analogies

Just as we consider the depreciation of a vehicle when planning for a new car purchase, businesses must track asset values to invest wisely and prepare for the future, ensuring they can afford replacements and upgrades when needed.

Key Concepts

-

Matching Principle: The concept of aligning expenses with generated revenue.

-

Non-Cash Expense: Depreciation does not involve an actual outflow of cash.

-

Accelerated Depreciation: Methods like Written Down Value charge more depreciation in the earlier years of an asset's life.

Examples & Applications

A company purchases machinery for $100,000 with a useful life of 10 years and a residual value of $10,000. Using the Straight Line Method, annual depreciation would be ($100,000 - $10,000) / 10 = $9,000.

A vehicle purchased for $30,000 with a useful life of 5 years and a 20% depreciation rate under WDV will have depreciation calculated as $30,000 x 20% = $6,000 in the first year.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

For depreciation to be fair, wear and tear we must declare.

Stories

Imagine a bakery that buys an oven for $10,000. Over time, the oven wears down, leading to less bread baked. This is depreciation. It helps the bakery plan for a new oven when the old one can’t produce enough bread.

Memory Tools

Remember 'WOAR': Wear and tear, Obsolescence, Accidents, Resources—causes of depreciation.

Acronyms

D-MAP

Depreciation

Methods

Accounting treatment

Provisions.

Flash Cards

Glossary

- Depreciation

The systematic allocation of the cost of a tangible fixed asset over its useful life.

- Wear and Tear

Physical deterioration of an asset due to usage.

- Obsolescence

Reduction in the value of an asset due to advancements in technology.

- Residual Value

Estimated value of an asset at the end of its useful life.

- Depreciation Method

Techniques used to allocate the cost of an asset over its useful life.

- Straight Line Method

A method of depreciation where the same amount is charged each year.

- Written Down Value Method

A method of depreciation based on the fixed percentage applied to the book value.

- Units of Production Method

A method where depreciation is calculated based on actual usage.

Reference links

Supplementary resources to enhance your learning experience.