Depreciation in Income Tax

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Depreciation in Income Tax

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will discuss how depreciation works in the context of Income Tax. Can anyone tell me why depreciation is considered a tax-deductible expense?

Is it because it helps to lower taxable income?

Exactly, Student_1! Depreciation is vital as it reduces the overall income that gets taxed. Now, who can explain what the Block of Assets method is?

Isn’t it a way to group assets together for calculating depreciation?

Correct, Student_2! By grouping assets into blocks, companies can apply a systematic approach to deducting depreciation. This method simplifies the accounting process and allows for better tax planning.

Does this mean that the depreciation rates for tax purposes can differ from what we use in our accounting statements?

Yes, Student_3! That's a critical point — tax law depreciation often varies from financial accounting depreciation. Remember, understanding this difference can help you strategically manage asset values.

To summarize: Depreciation reduces taxable income and we group assets into blocks for easier management under the Income Tax Act.

Understanding the Block of Assets Method

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s delve deeper into the Block of Assets method. Can anyone explain why grouping assets is beneficial?

Maybe it’s simpler to manage rather than calculating each asset separately?

Exactly! By allowing a fixed rate of depreciation applicable to a group, it saves time and resources. Now, how might the rates prescribed under the Income Tax Rules look?

They vary based on the type of asset, right?

That’s correct! Different assets may have different rates due to their expected lifespans and usage patterns. Understanding these rates can help in planning for replacements. To round off, grouping assets simplifies management while adhering to tax regulations.

Differences Between Tax Depreciation and Financial Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

We need to clarify how tax law depreciation can differ from what we report in financial statements. Can anyone share one key difference?

Maybe the rates used are different?

Absolutely! These discrepancies can influence reported profits. What could be a reason a company might prefer tax depreciation methods over financial accounting methods?

To minimize their tax liability?

Spot on, Student_3! Companies often strategize around these differences for tax benefits, focusing on lowering taxable income. Now, can someone summarize what we learned today?

Depreciation can lower taxable income; the Block of Assets method simplifies management, and tax rates can differ from financial accounting.

Well summarized! Remember these concepts, as they will help you in future asset planning and management.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

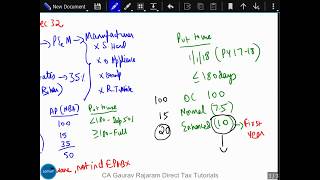

This section discusses depreciation in relation to income tax, detailing how the Income Tax Act permits depreciation deductions and the use of the Block of Assets method. It highlights the differences between tax law depreciation and financial accounting.

Detailed

In this section of the chapter, various aspects of depreciation and its treatment under income tax are explored. According to the Income Tax Act, depreciation serves as a deduction that helps reduce taxable income. The Block of Assets method is a key aspect of this approach, allowing companies to classify assets into groups or blocks, enabling them to apply a fixed depreciation rate specified under tax rules. It is important to understand that the rates and methods prescribed for tax purposes may differ from those used in financial accounting, which can affect financial statements and net profit. This difference is crucial for BTech CSE students in financial management to grasp as they plan for long-term investments and capitalize on tax advantages.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Depreciation Allowance

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Income Tax Act allows depreciation as a deduction.

Detailed Explanation

This chunk explains that under the Income Tax Act, businesses can deduct depreciation when calculating taxable income. This means that the cost of fixed assets can be gradually deducted over time from the income that's being taxed, which helps reduce the overall tax liability for a business.

Examples & Analogies

Think of it like paying for a car. If you buy a car for $20,000, instead of taking that whole amount out of your budget in one year, you spread the cost over several years. By doing so, each year you can deduct a part of the expense, making it feel like you are paying less in monthly expenses, just like you would reduce your tax burdens year by year.

Block of Assets Method

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Block of Assets method is used.

Detailed Explanation

The Income Tax Act adopts the 'Block of Assets' method for calculating depreciation. This means that similar types of assets are grouped together, and the depreciation is calculated on the total block rather than individually for each asset. This approach simplifies the calculation process and ensures that businesses can more easily track their depreciable assets.

Examples & Analogies

Imagine you own a collection of bicycles instead of having unique values for each one. For tax reporting, instead of calculating how much each bike is worth and how much to depreciate, you group them together. If you have 10 bikes worth $1,000 total, it's simpler to treat them as a single $1,000 asset rather than individual bikes.

Prescribed Rates Under Tax Law

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Rates are prescribed under Income Tax Rules.

Detailed Explanation

Different types of fixed assets in a business have specific depreciation rates that are outlined in the Income Tax Rules. These rates are standardized and vary based on the category of assets. Knowing these rates helps businesses correctly apply the depreciation rates to their assets when preparing their financial statements and tax documents.

Examples & Analogies

Consider it like a schedule for a class. Just as teachers may assign different homework to different subjects on set days, the tax authorities set specific depreciation rates for various types of assets. For instance, furniture may depreciate at a different rate than machinery, requiring businesses to follow specific guidelines much like a student's schedule.

Differences Between Tax Law and Financial Accounting

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

• Depreciation under tax law may differ from financial accounting.

Detailed Explanation

The depreciation calculated for tax purposes can often be different from the depreciation calculated for financial accounting. This discrepancy arises due to the different methods and rates allowed by tax laws compared to those used for financial reporting. Businesses often need to reconcile these differences to ensure compliance with both financial regulations and tax laws.

Examples & Analogies

Consider two budgets: one for daily expenses and one for a long-term savings goal. The way you spend money daily may not reflect how you're budgeting for savings. Similarly, a business might have two different figures for depreciation based on tax rules versus its internal accounting practices, which can lead to some confusion if not managed well.

Key Concepts

-

Income Tax Act: Governs taxation rules including depreciation deductions.

-

Block of Assets Method: Groups assets for simplified depreciation calculations.

-

Tax Deductible: Expenses that can lower taxable income.

Examples & Applications

A manufacturing company categorizes its machinery and equipment into a block and applies a fixed depreciation rate as per the Income Tax Rules.

A business recognizes a loss on sale of an asset deducted against income due to the depreciation claimed in previous years.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Depreciation can lower income, a tax break feels like a minimum.

Stories

Imagine a company treasure chest. It slowly empties due to depreciation, like gold coins fading over time, representing lost value.

Memory Tools

Remember 'B.A.D' - Block Assets Deductible for tax simplification.

Acronyms

D.A.R.E - Deduction from Assets Reduces Earnings, a reminder of how depreciation affects taxable income.

Flash Cards

Glossary

- Depreciation

The systematic allocation of an asset's cost over its useful life.

- Income Tax Act

Legislation that governs how income tax is applied, including rules on depreciation.

- Block of Assets Method

A method of grouping assets for simplified depreciation calculation under tax law.

- Tax Deductible Expense

An expense that can be deducted from taxable income to reduce tax liability.

Reference links

Supplementary resources to enhance your learning experience.