Units of Production Method

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Basics

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome, everyone! Today, we're going to discuss the Units of Production Method. This method is unique because it depends on how much you actually use an asset, rather than just how long you keep it. Can anyone tell me why that might be useful?

Is it because different assets can wear out at different rates depending on how much they're used?

Exactly! So for heavy machinery that sees a lot of use, this method gives a more accurate reflection of its value. Can anyone summarize how we calculate depreciation using this method?

We subtract the residual value from the cost and divide by the estimated total production.

Great! That’s the formula. It helps ensure that higher usage reflects more depreciation, aligning expenses with actual asset performance.

Application of the Units of Production Method

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let’s dive deeper! When do you think a company would choose the Units of Production Method over the Straight-Line Method?

Maybe when they have machinery that's used more in certain periods and less in others?

Precisely! This method is perfect for those types of assets. Can you think of any industries where this would apply?

Construction! Machines are used heavily on site and less during downtimes.

Excellent example! Understanding how and when to apply these methods enhances accurate financial reporting.

Calculating Depreciation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s do a practical example together. If a machine costs $50,000, has a residual value of $5,000, and the estimated total production is 100,000 units, how would we begin?

First, we subtract the residual value from the cost, so that's $50,000 - $5,000.

Right, and what do you get?

$45,000.

Perfect! Now, dividing that by the estimated total production gives us the depreciation per unit. What’s next?

Now we divide $45,000 by 100,000 units.

And what’s the result?

$0.45 per unit.

Well done! Now, if in one year we produced 20,000 units, what would the annual depreciation be?

We multiply $0.45 by 20,000, which equals $9,000.

Exactly! This hands-on approach helps solidify how we calculate depreciation.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

The Units of Production Method for depreciation is based on the actual output or usage of a tangible fixed asset. This method relates the asset's depreciation directly to its production capabilities rather than a fixed time period, making it ideal for assets whose usage varies significantly.

Detailed

Units of Production Method

The Units of Production Method is a depreciation technique that allocates the cost of a tangible asset based on its actual output during a specific period, rather than time alone. This method is particularly advantageous for machinery and equipment where wear and tear—and therefore depreciation—vary with usage.

Key Concepts:

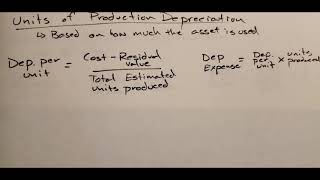

- Depreciation Calculation: The formula uses both the cost of the asset and its estimated residual value against the total estimated production over the asset's lifespan. Specifically:

Depreciation per unit = (Cost - Residual value) / Estimated total production

- Annual Depreciation: This is determined by multiplying the depreciation per unit by the actual units produced in a given period:

- Practical Application: This method suits businesses that experience fluctuating productivity levels, giving a more realistic representation of asset value over time.

Significance:

Understanding the Units of Production Method helps students apply proper accounting practices that enable businesses to accurately reflect asset utilization and costs on financial statements.

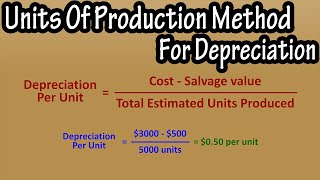

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Overview of the Units of Production Method

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Depreciation depends on actual usage/output of the asset.

Detailed Explanation

The Units of Production Method is a way of calculating depreciation that directly relates to how much the asset is used. Instead of a fixed amount being written off every year, the depreciation expense varies depending on the actual output or usage of the asset. This means that if the asset is used more in one year, it will incur more depreciation expense for that year, reflecting the actual wear and tear based on how much it has been utilized.

Examples & Analogies

Think of a car that you use for ride-sharing. If you drive it 20,000 miles in a year, it will depreciate more than if you only drive it 5,000 miles. The Units of Production Method would account for this difference in mileage when calculating how much value the car has lost due to driving it.

Formula for Units of Production Method

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Formula:

Depreciation per unit = Cost - Residual value / Estimated total production

Detailed Explanation

To determine the depreciation expense using the Units of Production Method, we first calculate the depreciation per unit. This is done by taking the total cost of the asset and subtracting its residual value (the value expected at the end of its useful life). Then, this amount is divided by the estimated total production the asset is expected to generate during its lifetime. This yields the cost per unit of production, which is then multiplied by the actual units produced in a specific year to determine the annual depreciation expense.

Examples & Analogies

Consider a piece of machinery that costs $50,000, has a residual value of $5,000, and is expected to produce a total of 100,000 units over its life. The calculation would look like this:

Depreciation per unit = ($50,000 - $5,000) / 100,000 units = $0.45 per unit.

If in one year, the machine produces 20,000 units, the annual depreciation would be 20,000 units * $0.45 = $9,000.

Calculating Annual Depreciation

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Then, Annual Depreciation = Depreciation per unit × Actual units produced.

Detailed Explanation

After calculating the depreciation per unit, to determine the total annual depreciation expense, simply multiply this figure by the actual number of units produced in that year. This allows the depreciation expense to accurately reflect the wear and tear based on real usage, rather than a set schedule. This approach is particularly useful for assets whose usage significantly varies from year to year.

Examples & Analogies

Imagine you own a printing press that sometimes works overtime for big orders. In one year, you produce 50,000 prints, and the next year only 10,000. If your depreciation per print remains at $0.45, you would account for $22,500 in depreciation for the first year and only $4,500 in the second. This way, your financial statements truly reflect the operational reality of the asset.

Key Concepts

-

Depreciation Calculation: The formula uses both the cost of the asset and its estimated residual value against the total estimated production over the asset's lifespan. Specifically:

-

Depreciation per unit = (Cost - Residual value) / Estimated total production

-

Annual Depreciation: This is determined by multiplying the depreciation per unit by the actual units produced in a given period:

-

Practical Application: This method suits businesses that experience fluctuating productivity levels, giving a more realistic representation of asset value over time.

-

Significance:

-

Understanding the Units of Production Method helps students apply proper accounting practices that enable businesses to accurately reflect asset utilization and costs on financial statements.

Examples & Applications

If a company has a machine costing $60,000 with a residual value of $4,000 and expects to produce 120,000 units, the depreciation per unit would be ($60,000 - $4,000) / 120,000 = $0.4667 per unit.

A car that costs $30,000 and has a residual value of $3,000, expected to have a 150,000 mile life, wages $0.18 per mile in depreciation.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

When the machine's on the run, depreciation counts for the fun.

Stories

Imagine a car that drives miles each day; for each mile, wear and tear shows its way. Thus, we track how much it's used, to see how value can be fused.

Memory Tools

COST - Residual = Units, this is how you see the depreciation fruits.

Acronyms

DPU

Depreciation Per Unit = Cost - Residual / Total Production.

Flash Cards

Glossary

- Units of Production Method

A depreciation method that allocates asset cost over its useful life based on the actual output or usage.

- Residual Value

The estimated value of an asset at the end of its useful life.

Reference links

Supplementary resources to enhance your learning experience.