Accounting Concepts and Conventions

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Business Entity Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we will discuss the Business Entity Concept. Can anyone tell me what this concept means?

I think it means the business should be seen as separate from its owner.

Right! So if the owner has debts, those won't affect the business finances?

Exactly! This concept ensures that the personal assets of the owner are protected. Remember the acronym **BES**: Business Entity is Separate.

So, if a business owner goes bankrupt, the business itself isn't affected?

Correct, as long as the financial records are kept separate. Always keep in mind, separate = protected.

Can you give us an example?

Sure! If a business owner uses personal credit cards for business expenses, mixing those up could lead to legal issues. So it’s crucial to maintain a clear boundary! Anyone has any questions on this?

Going Concern Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s explore the Going Concern Concept. What do you think it means?

Does it mean that a business is expected to keep operating?

Exactly! It assumes that the business will not stop its operations in the near future, unless there are indicators to suggest otherwise. This leads to the idea of stability. Can anyone think of how this affects financial statements?

I guess if a business is closing, it shouldn't record assets as ongoing investments?

Correct! Financial statements would show a very different picture if we assumed a business was going to close soon. Using the mnemonic **GCO** for Going Concerned Operations can help you remember this concept.

What are some signs that indicate a business might not be a going concern?

Excellent question! Signs can include drastic drops in sales, significant losses, or an inability to pay debts. Always be vigilant and aware of such indicators in financial analyses.

Accrual and Revenue Recognition

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let's tackle the Accrual concept next. What do we mean by revenue and expenses being recorded when they're earned or incurred?

Um, it means you record them when the transaction happens, not when the cash is actually received?

Spot on! This is crucial for accurately reflecting a business's financial performance. Can anyone give an example of this?

If I sell a product on credit, I record the sale now but only get paid next month?

Exactly! Remember the phrase **Earned, Not Received** to stay aligned with the accrual basis. Any questions?

What happens if I record it later when I receive the cash?

That could misrepresent your business financial health as it could show higher profits in one period and lower in another. It disrupts the flow of financial reporting.

Conservatism Principle

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now moving on to the Conservatism concept. What does it mean?

It's about being cautious with accounting, right? Expecting losses more than profits?

Yes! We prefer to avoid overstating revenues—always record potential losses. This means we have to record liabilities when probable and wait to record profits until sure. Can anyone think of how this might affect financial statements?

It could lead to a more realistic view of the financial situation?

Exactly! Use the mnemonic **C-L-P**: Cautious Losses Preferred for remember. It ensures that we present a prudent view to stakeholders.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Accounting concepts such as the Business Entity Concept and the Going Concern Concept guide how transactions are recorded, while conventions like Conservatism and Consistency help maintain integrity in financial statements. Understanding these principles is crucial for effective accounting practices.

Detailed

Accounting Concepts and Conventions

Accounting is grounded in various concepts and conventions that provide a framework for financial reporting. Key accounting concepts include:

- Business Entity Concept: This concept states that the business is a separate entity from its owners, meaning personal finances should not mingle with business finances.

- Going Concern Concept: It assumes that a business will continue to operate indefinitely unless there is evidence suggesting otherwise.

- Money Measurement Concept: Only transactions that can be quantified in monetary terms are recorded.

- Cost Concept: Assets should be recorded at their original cost rather than their market value.

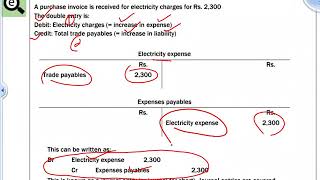

- Dual Aspect Concept: Every transaction has two sides – one that is debited and another that is credited.

Accounting conventions include:

- Conservatism: This principle suggests that accountants should anticipate no profits but provide for all possible losses.

- Consistency: Once an accounting method is adopted, it should be maintained consistently across periods to ensure comparability.

- Full Disclosure: All relevant financial information should be disclosed in financial statements.

- Accrual: This principle states that revenue and expenses should be recorded when they are earned or incurred, regardless of cash transactions.

Understanding these concepts and conventions shapes how financial statements are prepared and ensures they faithfully represent the financial performance and position of a business.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Accounting Concepts Overview

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Accounting Concepts

- Business Entity Concept: The business is treated as a separate entity from its owners. The personal finances of the owner are not mixed with the business’s finances.

- Going Concern Concept: Assumes that the business will continue to operate indefinitely unless there is evidence to the contrary.

- Money Measurement Concept: Only transactions that can be measured in monetary terms are recorded in accounting.

- Cost Concept: Assets are recorded at their original cost, not their market value.

- Dual Aspect Concept: Every transaction has two aspects – one is debited, and the other is credited.

Detailed Explanation

This chunk introduces essential accounting concepts that form the fundamental principles of accounting.

- Business Entity Concept: This principle states that a business is its own separate entity, distinct from its owners. For example, if you own a bakery, your personal savings or debts should not be mixed with the financials of the bakery. This ensures clarity in accounting and allows stakeholders to evaluate the business independently.

- Going Concern Concept: This concept assumes that the business will continue to exist and operate in the foreseeable future unless there is evidence suggesting otherwise. For instance, if a bakery has been in business for years and has no significant issues, we assume it will continue operating.

- Money Measurement Concept: It dictates that only transactions that can be measured in monetary terms are recorded. For instance, while a happy customer experience is valuable for the business, it does not go into accounting books because it cannot be quantified in money.

- Cost Concept: This concept requires that all assets be recorded at their original purchase cost. For example, if you bought an oven for $5,000, it will remain on the books at that value, even if its current market value rises.

- Dual Aspect Concept: This is the basis of double-entry accounting, stating every transaction impacts at least two accounts. For every debit entry, there is a corresponding credit entry.

Examples & Analogies

Imagine you own a restaurant and you kept your personal finances and the restaurant’s finances in the same account. If someone asked you how well your restaurant is doing, you couldn't give an accurate answer because personal expenses might distort the view of the business’s health. By keeping them separate (Business Entity Concept), it’s clear how the restaurant is performing. Just like maintaining separate accounts for your personal and business finances helps you keep track of your business success better.

Understanding Accounting Conventions

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Accounting Conventions

- Conservatism: Accountants should anticipate no profits but provide for all possible losses.

- Consistency: Once an accounting method is adopted, it should be used consistently in future periods.

- Full Disclosure: All material facts and financial information should be disclosed in the financial statements.

- Accrual: Revenue and expenses are recorded when they are earned or incurred, regardless of when cash is received or paid.

Detailed Explanation

In this chunk, we explore the conventions that guide how accounting is practiced to maintain integrity and transparency in financial reporting.

- Conservatism: This principle dictates that when in doubt, accountants should err on the side of caution, meaning they should not overestimate revenues or assets but should account for potential losses. For example, if there's a chance of a customer defaulting on payments, that risk should be recognized in the accounts.

- Consistency: Once a business chooses how it will account for certain items (like how it values inventory), it should stick to that method over time. This way, comparisons between financial periods remain valid. If you changed how you calculated profits every year, it would be hard for investors to assess performance.

- Full Disclosure: This means that all relevant financial information that could influence a user's understanding of the financial statements must be included. For instance, if there is a pending lawsuit that could have a financial impact, it should be disclosed in the company’s financial statements.

- Accrual: In accrual accounting, income is recognized when it is earned, not necessarily when cash is received. For instance, if your restaurant serves a customer on credit (they pay later), you still record that sale as income in the current period rather than waiting until payment is received.

Examples & Analogies

Think of a doctor running a clinic. The doctor often provides services and allows patients to pay later. In terms of the Accrual concept, once the service is provided, the doctor records the revenue even though the cash isn't received immediately. This is similar to how customers might expect quality care now and pay later, but the clinic's financial status reflects that service as income right away, providing a clearer picture of its actual performance.

Key Concepts

-

Business Entity Concept: It keeps the business operations separate from the owner’s finances.

-

Going Concern Concept: Assumes that the business will operate indefinitely.

-

Conservatism: Emphasizes recording potential losses but not anticipated profits.

Examples & Applications

If John owns a coffee shop and takes money from the business for personal use, he risks violating the Business Entity Concept.

A business planning to close soon should not report long-term resources as ongoing assets under the Going Concern Concept.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

If you're a business, tall and grand, keep your finances separate - that's the plan!

Stories

Imagine a woman named Rachel who runs a bakery. She keeps all her receipts and bills in separate drawers, ensuring that her business stays healthy because she follows the Business Entity Concept strictly.

Memory Tools

To remember the concepts: B-G-C: Business separation, Going Concern, Cost valuation!

Acronyms

For Accrual

**EAR** - Earned

Accrued

Recorded.

Flash Cards

Glossary

- Business Entity Concept

The principle that separates the financial dealings of a business from that of its owners.

- Going Concern Concept

The assumption that a business will continue to operate indefinitely.

- Money Measurement Concept

Only transactions that can be expressed in monetary terms are recorded.

- Cost Concept

Assets are recorded at their historical cost rather than their current market value.

- Dual Aspect Concept

Every transaction has two sides: one is debited and the other is credited.

- Conservatism

The principle of anticipating no profits and providing for all possible losses.

- Consistency

The principle that once an accounting method is adopted, it should be used consistently in the future.

- Full Disclosure

The requirement to disclose all important financial information in statements.

- Accrual

The principle that revenues and expenses are recorded when they are earned or incurred.

Reference links

Supplementary resources to enhance your learning experience.