Introduction to Accounting

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

What is Accounting?

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today we're diving into the fundamentals of accounting. Can anyone share what they think accounting is?

Isn't it just keeping track of money?

That's a part of it! Accounting is actually the process of recording, classifying, summarizing, and interpreting financial transactions. It's much more comprehensive. It helps stakeholders make informed decisions. How does that sound?

So, it's not just about what comes in and out?

Exactly, it's also about analyzing that data and presenting it in financial statements like balance sheets and profit and loss accounts. Remember: 'Transaction First, Analysis Next.'

Objectives of Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's talk about the objectives of accounting. Can someone name one of its key objectives?

Recording transactions, right?

Correct! The primary objective is to systematically record all financial transactions. Who can tell me why classification is important?

It helps us see the big picture of finances!

Spot on! Classifying helps in organizing data into categories like assets and liabilities. Let’s remember: 'Record, Classify, Summarize.' This helps in decision-making as well.

Branches of Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Moving on, can anyone tell me the branches of accounting?

I think there’s financial accounting?

Yes! Financial accounting focuses on external users. What about others?

There's management accounting for internal insights!

Correct! We also have cost accounting for managing production costs and auditing for checking accuracy. Remember the mnemonic: 'FMC Audits Budgets' for Financial, Management, Cost, and Auditing branches!

The Accounting Process.

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s discuss the accounting process. What’s the first step?

Recording transactions?

Exactly! We record transactions in journals. Then what’s next?

Classifying them into ledgers?

Right again! After classifying, what follows?

Summarizing into financial statements?

Yes! Finally, analyzing these statements helps in interpreting the health of the business. Keep in mind: 'Record, Classify, Summarize, Interpret!'

Basic Accounting Equation.

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Lastly, let’s talk about the Basic Accounting Equation. Can anyone state it?

Assets equals Liabilities plus Owner’s Equity?

That's correct! It shows that what a business owns is funded by debt or equity. Why is this equation important?

It keeps our accounts balanced?

Exactly! Every transaction affects at least two accounts, ensuring balance. A simple way to remember is: 'Assets are financed by Oodles of Loans!'

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Accounting is a critical process for organizations that involves recording and interpreting financial transactions. This section outlines its definition, objectives such as transaction recording and classification, the various branches of accounting, the accounting process, the basic accounting equation, and its importance for decision-making and legal compliance.

Detailed

Introduction to Accounting

Accounting encompasses the comprehensive process of recording, classifying, and summarizing financial transactions of an organization, providing insightful information that aids in decision-making. It is critical not only for internal management but also for external stakeholders like investors and creditors.

Definition of Accounting

Accounting is defined as the systematic record-keeping of financial transactions, leading to the creation of key financial statements such as balance sheets and cash flow statements. The importance of accounting is underscored by its role in ensuring legal compliance and delivering essential financial information to stakeholders.

Objectives of Accounting

The primary objectives include recording transactions, classifying and summarizing financial data, providing information for decision-making, and ensuring compliance with legal regulations.

Branches of Accounting

- Financial Accounting – Prepares financial statements for external users.

- Management Accounting – Provides internal reports for effective management.

- Cost Accounting – Analyzes production costs for better cost control.

- Auditing – Examines financial records for accuracy and compliance.

The Accounting Process

This fundamental process involves recording transactions, classifying them in ledgers, summarizing the data into financial statements, and interpreting results to inform business decisions.

Basic Accounting Equation

Assets = Liabilities + Owner’s Equity, forms the basis of accounting, indicating that all resources owned are funded by either debt or equity.

Concepts and Conventions

Accounting operates on several key concepts, such as the Business Entity Concept and the Going Concern Concept, and adheres to conventions, including Consistency and Full Disclosure.

Importance of Accounting

Accounting is vital for decision-making, legal compliance, tracking financial health, and fostering confidence among investors and creditors.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

What is Accounting?

Chapter 1 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Definition of Accounting

Accounting is the process of recording, classifying, summarizing, and interpreting financial transactions of an organization to provide useful information for decision-making. It involves tracking the financial performance of a business through the preparation of financial statements like the balance sheet, profit and loss account, and cash flow statement.

Importance of Accounting

Accounting provides essential financial information to various stakeholders such as owners, management, investors, creditors, and regulatory authorities. It helps businesses make informed decisions and ensures legal compliance.

Detailed Explanation

Accounting serves as the backbone of financial reporting in an organization. It is defined as a systematic process of keeping track of all financial transactions, which includes everything from sales to expenses. By recording these transactions, businesses can summarize and analyze their financial health using key documents such as the balance sheet, which shows what it owns and owes, and the profit and loss account, which indicates profitability over a specific period. The importance of accounting cannot be understated; it provides vital information that various stakeholders rely on to make decisions and ensures that businesses adhere to laws and financial regulations.

Examples & Analogies

Imagine accounting as a health report for a business. Just like a doctor needs to understand the health history of a patient to make informed decisions, businesses need to maintain accurate financial records to gauge their health in terms of profitability and financial stability.

Objectives of Accounting

Chapter 2 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Recording Transactions

The primary objective of accounting is to systematically record all financial transactions that occur within a business, ensuring accuracy and completeness.

Classifying and Summarizing Financial Data

Accounting organizes and classifies financial transactions into categories, such as assets, liabilities, income, and expenses, to present an overview of the financial health of a business.

Providing Financial Information for Decision Making

Accounting helps business owners, managers, and stakeholders make informed decisions based on financial reports and statements.

Ensuring Legal Compliance

Accounting ensures that businesses comply with tax laws, financial reporting standards, and regulations set by governing bodies like the Income Tax Department and the Securities and Exchange Board of India (SEBI).

Detailed Explanation

The objectives of accounting can be seen as a roadmap for accurate financial management. The foremost goal is to record every financial transaction meticulously; this ensures that no financial event, big or small, goes unnoticed. Next, these transactions are classified into clear categories like assets (what you own), liabilities (what you owe), income (money received), and expenses (money spent). This categorization provides clarity on the business's financial situation. Moreover, accounting plays a crucial role in decision-making by supplying relevant information that helps stakeholders evaluate performance and strategize for the future. Lastly, accounting ensures that businesses remain compliant with all legal financial obligations, thus preventing legal disputes and penalties.

Examples & Analogies

Think of accounting objectives like the rules of a board game. Just as you ensure every player understands the rules to keep the game fair and enjoyable, accounting ensures every financial transaction is accurately recorded and categorized, enabling the business to operate smoothly and avoid potential pitfalls.

Branches of Accounting

Chapter 3 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Financial Accounting

Financial accounting focuses on the preparation of financial statements for external users such as investors, creditors, and tax authorities. It deals with historical data and complies with accounting standards.

Key Outputs: Income statement (profit and loss account), balance sheet, and cash flow statement.

Management Accounting

Management accounting is aimed at providing internal users, such as managers and executives, with detailed financial and non-financial information to aid in decision-making, budgeting, and performance evaluation.

Key Outputs: Budgets, cost reports, variance analysis, and performance reports.

Cost Accounting

Cost accounting involves the recording, classification, and analysis of costs incurred in the production of goods or services. It helps businesses manage their costs and improve profitability.

Key Outputs: Cost sheets, cost analysis, and cost control measures.

Auditing

Auditing involves examining financial statements to ensure accuracy, completeness, and compliance with accounting standards and legal regulations.

Types of Audits: Internal audit, external audit, statutory audit, and forensic audit.

Detailed Explanation

Accounting is broadly classified into several branches, each serving distinct purposes. Financial accounting is primarily concerned with generating financial statements directed at external stakeholders, which reflect an organization's past performance and adhere to standardized accounting principles. Next, management accounting focuses on providing insightful reports to internal users like managers, enabling them to make informed decisions regarding budgeting and operational efficiency. Cost accounting dives deeper, dealing with the costs associated with production, allowing businesses to track expenditures and enhance profitability. Lastly, auditing ensures that financial records are accurate and comply with established standards through regular examinations, creating trust among stakeholders.

Examples & Analogies

Think of the branches of accounting as different specialists in a hospital, where each doctor (branch) has specific expertise, be it treating patients (financial statements for investors), managing health (internal reports for managers), monitoring expenses (cost accounting), or ensuring overall compliance and accuracy (auditing). Each plays a crucial role in maintaining the ‘health’ of the business.

The Accounting Process

Chapter 4 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

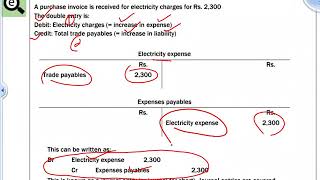

Recording of Transactions

The first step in accounting is to record business transactions as they occur in the books of accounts. This is done through journals, where each transaction is recorded with a debit and a credit entry.

Classifying Transactions

After transactions are recorded, they are classified into specific accounts in the ledger. This helps in organizing financial data and preparing financial statements.

Summarizing Data

After classifying data in the ledger, the information is summarized into financial statements like the profit and loss account and balance sheet.

Interpreting Financial Data

The final step involves analyzing the financial statements to interpret the financial health of the business. This helps in making business decisions and evaluating performance.

Detailed Explanation

The accounting process consists of several critical steps that ensure financial data is accurately recorded and presented. It begins with recording transactions in journals where each entry is marked as either a debit or a credit, which is fundamental to double-entry accounting. Following this, transactions are categorized into accounts within the ledger, making it easier to summarize the data later. When the data is summarized into key financial statements, it can be analyzed for insights into the company’s financial health. This process aids in forming decisions that drive business strategies and actions.

Examples & Analogies

Picture the accounting process as preparing a recipe. First, you gather and measure all ingredients (recording transactions). Next, you categorize them into groups (classifying transactions), then cook and combine them to create a dish (summarizing data), and finally, you taste and adjust seasoning to get the perfect flavor (interpreting financial data). Each step is crucial to ensure you end up with a delicious meal, just as each step in accounting is vital for accurate business reporting.

The Basic Accounting Equation

Chapter 5 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

What is the Accounting Equation?

The accounting equation is the foundation of double-entry bookkeeping, where every transaction affects at least two accounts. The equation ensures that the books are always balanced.

The Basic Accounting Equation:

Assets = Liabilities + Owner’s Equity

- Assets: What the business owns (e.g., cash, inventory, property).

- Liabilities: What the business owes to others (e.g., loans, creditors).

- Owner’s Equity: The owner’s residual interest in the business after liabilities are subtracted from assets.

Double-Entry System

The double-entry system is based on the principle that every financial transaction involves two entries: a debit and a credit. This ensures that the accounting equation remains in balance.

Detailed Explanation

At the core of accounting is the basic accounting equation: Assets = Liabilities + Owner’s Equity. This equation emphasizes that everything a business owns (assets) is funded either through borrowing (liabilities) or by the owner's investments (owner's equity). The double-entry system is crucial in maintaining this balance; for every financial transaction, there are two entries made – one that records what is received (debit) and one that records what is given up (credit) – ensuring that both sides of the equation remain equal.

Examples & Analogies

Imagine the accounting equation as a balancing scale. On one side, you have all the valuable items you own (assets), while on the other side, you place your debts (liabilities) and any money that belongs to you from your business (owner’s equity). The scale must always be flat, representing that everything you own has either been purchased with borrowed money or paid for with your own funds.

Accounting Concepts and Conventions

Chapter 6 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Accounting Concepts

- Business Entity Concept: The business is treated as a separate entity from its owners. The personal finances of the owner are not mixed with the business’s finances.

- Going Concern Concept: Assumes that the business will continue to operate indefinitely unless there is evidence to the contrary.

- Money Measurement Concept: Only transactions that can be measured in monetary terms are recorded in accounting.

- Cost Concept: Assets are recorded at their original cost, not their market value.

- Dual Aspect Concept: Every transaction has two aspects – one is debited, and the other is credited.

Accounting Conventions

- Conservatism: Accountants should anticipate no profits but provide for all possible losses.

- Consistency: Once an accounting method is adopted, it should be used consistently in future periods.

- Full Disclosure: All material facts and financial information should be disclosed in the financial statements.

- Accrual: Revenue and expenses are recorded when they are earned or incurred, regardless of when cash is received or paid.

Detailed Explanation

Accounting relies on fundamental concepts and conventions to ensure that financial information is reliable and comparable. The business entity concept emphasizes that a business is separate from its owner, maintaining clear boundaries in accounting records. The going concern concept assumes the business will continue indefinitely, which affects how assets and liabilities are valued. The money measurement concept dictates that only financially quantifiable transactions should be recorded. Similarly, the cost concept values assets based on their purchase price rather than current market value. The dual aspect concept highlights that every transaction affects at least two accounts. On the convention side, conservatism advises caution in recognizing profits, consistency calls for using the same accounting practices over time, and full disclosure ensures transparency in financial statements. Lastly, the accrual basis of accounting dictates that income and expenses must be recorded when they occur, not when cash changes hands.

Examples & Analogies

These concepts and conventions are like the traffic rules of accounting. Just as rules help maintain order and safety on the road, these principles ensure that financial reporting is consistent, transparent, and credible, guiding businesses in making informed financial decisions.

Importance of Accounting in Business

Chapter 7 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Helps in Decision-Making

Accounting provides essential information that helps managers, investors, and stakeholders make informed decisions about investments, business strategies, and financial management.

Legal Compliance and Taxation

Accounting ensures compliance with legal regulations, helping businesses calculate taxes, file returns, and avoid legal issues.

Tracking Financial Health

Accounting helps businesses track their financial position, profits, losses, and cash flow, which is essential for sustainable growth and development.

Investor and Creditors’ Confidence

Well-maintained accounting records increase the confidence of investors, creditors, and financial institutions, helping businesses secure funding and investment.

Detailed Explanation

The importance of accounting in a business context cannot be overstated. First, accurate accounting provides valuable insights into the company's financial performance, which aids managers and stakeholders in making strategic decisions regarding resources, investments, and actions. Second, by maintaining proper records, businesses can comply with laws and regulations, thus avoiding legal liabilities and fines concerning tax filings. Additionally, having a clear understanding of their finances allows businesses to monitor their economic health, paving the way for informed planning and sustainable growth. Finally, transparent and accurate accounting builds trust with investors and creditors, making it easier to secure financing.

Examples & Analogies

Consider accounting as the navigational system for a ship. Just as a navigator uses charts and data to steer the ship safely through waters and avoid obstacles, accurate accounting allows businesses to navigate the competitive market, avoiding pitfalls and steering towards success.

Conclusion

Chapter 8 of 8

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Summary of Key Points

Accounting is an essential function in business that helps in recording, summarizing, and interpreting financial transactions to provide useful information for decision-making. It involves various branches, including financial accounting, management accounting, and cost accounting, each serving a different purpose. The basic accounting equation and concepts like dual aspect, consistency, and conservatism are foundational to accounting practices.

The Future of Accounting

With the advent of technology and automation, the field of accounting is evolving. Computerized accounting and the use of accounting software have made the process more efficient and accurate.

Detailed Explanation

In summary, accounting is a vital part of any business operation, facilitating a comprehensive understanding of financial data. It encompasses various branches that cater to different stakeholders, making it a versatile tool for financial management. The basic accounting equation acts as a foundation for recording and sharing financial information, while fundamental concepts ensure consistency and reliability. Looking ahead, the accounting field is rapidly transforming due to technology and automation, making accounting processes faster and more accurate, which enhances the overall decision-making process within businesses.

Examples & Analogies

Think of accounting as the blueprint of a building. Without a blueprint, constructing a building would be chaotic and inefficient. Similarly, accounting provides the necessary structure for any business to operate efficiently and sustainably, and as technology progresses, this blueprint will adapt and evolve to incorporate new tools and methods.

Key Concepts

-

Accounting Definition: The practice of recording financial transactions.

-

Importance: Essential for stakeholders for decision-making.

-

Objectives of Accounting: Record, classify, provide information, ensure compliance.

-

Branches of Accounting: Financial, Management, Cost, Auditing.

-

Accounting Process: Record, classify, summarize, interpret.

-

Basic Accounting Equation: Assets = Liabilities + Owner's Equity.

Examples & Applications

Recording a sale of a product in the sales journal as a transaction.

Preparing a balance sheet to show financial health at year's end.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Accounting's a friend, helps track income and spend!

Stories

Imagine a baker who tracks each ingredient cost and every cupcake sold. That way, they know their profit and can make smart decisions about their bakery.

Memory Tools

Remember: 'RECS' - Record, Classify, Summarize - the accounting process steps!

Acronyms

BEM - Balance Equation Matters - to keep accounting serious!

Flash Cards

Glossary

- Accounting

The process of recording, classifying, summarizing, and interpreting financial transactions.

- Financial Statements

Reports that summarize the financial status of an organization.

- Balance Sheet

A financial statement that shows a company's assets, liabilities, and owner’s equity at a specific point in time.

- Profit and Loss Account

A financial report showing revenues and expenses during a specific period.

- Cash Flow Statement

A financial document that provides aggregate data regarding all cash inflows and outflows a company receives.

- DoubleEntry Bookkeeping

An accounting system that requires every financial transaction to be recorded in at least two different accounts.

- Auditing

The process of reviewing financial statements to ensure accuracy and compliance.

- Cost Accounting

Accounting that focuses on capturing a company's production costs.

- Financial Accounting

Branch of accounting concerned with the preparation of financial statements for external users.

- Management Accounting

Branch of accounting that provides internal financial information to help management with decision-making.

Reference links

Supplementary resources to enhance your learning experience.