Recording of Transactions

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Recording Transactions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're going to discuss the recording of transactions, which is the first step in the accounting process. Can anyone tell me why recording transactions is important?

I think it helps keep track of money coming in and going out!

Exactly! Keeping accurate records allows us to see how much profit a business is making. We achieve this through systematic journal entries. So, who can explain how we record a transaction?

We need to make both a debit and credit entry for each transaction?

Right again! This method is known as the double-entry bookkeeping system. Can anyone give me an example of a transaction we might record?

If a company buys new equipment, we would debit the equipment account and credit cash or accounts payable.

Spot on! Remember, the total debits and credits must always be equal. Let's summarize: recording transactions involves documenting each transaction with a debit and a credit, ensuring our books stay balanced.

Importance of Accurate Recording

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Why do you think accuracy is critical in recording transactions?

If we make mistakes, it could show the wrong financial data!

Exactly! Inaccurate records can mislead stakeholders and affect decision-making. What happens if we miss a transaction entirely?

It would lead to incomplete financial statements, right?

Correct! Ensuring all transactions are recorded accurately and on time is fundamental for maintaining financial integrity. Let's recap this point: accurate recordings lead to reliable financial information, which supports sound decision-making.

Journal Entries in Action

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's look deeper into how to create a journal entry. Can anyone tell me the format we use for recording a transaction?

We list the date, then the account debited, and the account credited with the amounts!

Perfect! Let's practice. If a company receives $500 cash from providing services, how would we record that?

We would debit the cash account for $500 and credit the service revenue account for $500.

Excellent! Remember, every entry must maintain balance. This practice helps us ensure that our financial statements remain accurate and compliant.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In the recording of transactions, each business transaction is entered into journals with a debit and credit entry. This systematic approach ensures accuracy and supports further accounting processes, such as classifying and summarizing data for financial reporting.

Detailed

In the accounting process, the recording of transactions is fundamental and forms the basis of the entire accounting system. This step involves documenting all financial transactions promptly and accurately through journal entries, as each transaction is captured with corresponding debit and credit entries. This meticulous recording ensures that all financial activities are tracked, allowing for later classification and summarization in ledgers and financial statements. By adhering to the double-entry bookkeeping principle, the transaction records contribute to maintaining a balanced accounting equation, supporting management in monitoring financial health, meeting legal compliance, and making informed decisions based on reliable financial data.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Purpose of Recording Transactions

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

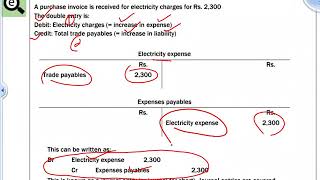

The first step in accounting is to record business transactions as they occur in the books of accounts. This is done through journals, where each transaction is recorded with a debit and a credit entry.

Detailed Explanation

In accounting, recording transactions is crucial because it serves as the foundation for all other accounting processes. Whenever a financial event occurs, it is documented in a journal immediately. This documentation includes both a debit and a credit entry because accounting follows the double-entry system, ensuring that every transaction is balanced. For instance, if a business sells a product, it not only records the revenue from that sale (credit) but also updates its inventory (debit), reflecting the decrease in assets.

Examples & Analogies

Think of recording transactions like writing down notes in a diary every time something important happens. Just like those notes help you remember events later on, recording financial transactions helps businesses keep track of their money and resources accurately.

The Role of Journals

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

This is done through journals, where each transaction is recorded with a debit and a credit entry.

Detailed Explanation

Journals are a critical component in the accounting process. They act as the first point where all transactions are recorded chronologically. Each transaction is documented with both a debit and a credit to represent the dual aspect of every financial exchange. This method not only ensures accuracy but also helps prevent errors. When entries are made in journals, they provide an audit trail, which is important for verifying the transactions later during the accounting process.

Examples & Analogies

Imagine a ledger that tracks every single purchase and sale in a shop, similar to how you might keep a running list of your monthly expenses. Each entry shows what you spent (debit) and what you gained (credit), helping you understand your financial flow.

Key Concepts

-

Recording Transactions: The process of documenting all financial transactions as they occur using double-entry bookkeeping.

-

Journal Entry: An accounting record of a transaction showing which accounts are debited and credited.

-

Debit and Credit: Fundamental accounting terms where 'debit' represents an increase in assets or expenses and 'credit' represents an increase in liabilities or income.

Examples & Applications

Example 1: A company sells a product for $200 cash: Debit Cash $200, Credit Sales Revenue $200.

Example 2: A business purchases equipment for $1,000 by taking out a loan: Debit Equipment $1,000, Credit Notes Payable $1,000.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In accounting land where numbers play, Record them right, don’t let them stray. Debit to the left and credit to the right, Keep your totals in balance, that’s the financial fight.

Stories

Once upon a balance sheet, a company named 'Clear Profits' never got lost in their financial heat, recording every sale complete. Every dollar earned was noted for the town, while every expense, they wrote it down. And that’s how they kept their financial crown!

Memory Tools

D.C. | Debit increases Cash, Credit increases revenue - just remember 'D.C.' for your journal entries.

Acronyms

R.E.C. | Record Every Cash transaction to remember to log all transactions properly.

Flash Cards

Glossary

- Transaction

Any financial event that has a monetary impact on the company's accounts.

- Journal Entry

The record in the journal of a transaction, showing accounts debited and credited along with the amounts.

- Debit

An entry on the left side of an account record, which increases assets or expenses.

- Credit

An entry on the right side of an account record, which increases liabilities or income.

- DoubleEntry Bookkeeping

An accounting system that requires each transaction to be recorded in at least two accounts, ensuring the accounting equation remains balanced.

Reference links

Supplementary resources to enhance your learning experience.