Branches of Accounting

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Financial Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, let's delve into financial accounting. Can anyone tell me who uses financial accounting information?

I think investors and tax authorities use it.

Absolutely! It's essential for external users. Financial accounting focuses on creating statements like the income statement and balance sheet. These documents reflect the historical performance of a business.

What does the income statement show?

Great question! The income statement reveals the company's revenues and expenses over a specific period, showing how much profit or loss was generated. Remember, key outputs in financial accounting are often found in the acronym 'IBS': Income statement, Balance sheet, and Statement of cash flows.

That makes it easier to remember!

Exactly! Now, who can tell me the importance of financial accounting?

It helps with informed decision-making by outsiders.

Correct! Understanding financial accounting gives us the foundation for making strategic choices based on financial stability.

Management Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let's transition to management accounting. What distinguishes it from financial accounting?

Management accounting is aimed at internal users, right?

Exactly! It's tailored for managers to facilitate decisions. Can anyone provide some key outputs of management accounting?

Budgets and performance reports are examples!

Perfect! Management accounting’s outputs like budgets and variance reports help in strategic planning. Remember the acronym 'BVP'—Budgets, Variance reports, and Performance measures?

That helps me remember the key outputs!

Exactly! These tools are vital for evaluating business performance and making informed decisions. How do you think this information impacts organizational strategy?

It helps adjust strategies based on financial performance!

Well said! That's the essence of management accounting.

Cost Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s talk about cost accounting. Why is tracking costs important for a business?

To manage expenses and increase profitability?

Correct! Cost accounting provides vital insights into the costs associated with production. Can anyone tell me about its main outputs?

Cost sheets and cost analysis are part of it!

Exactly! A tip to remember: think 'CC' for Cost Control and Cost Calculation. These reports help businesses identify areas to cut costs and improve efficiency.

How does this influence decision-making?

By knowing the costs, managers can set competitive prices and strategize effectively to maximize profit margins.

Auditing

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Finally, let's discuss auditing. What is its primary purpose?

To ensure accuracy in financial statements.

Correct! Auditing verifies that a company's financial statements are accurate and comply with regulations. What types of audits can we have?

Internal, external, and forensic audits!

Perfect! A way to remember this is 'IEF'—Internal, External, Forensic. Each type serves a distinct role in maintaining financial integrity.

What difference does it make for a business?

It helps build stakeholder confidence, critical for attracting investors. Accurate audits ensure transparency and trust.

So, auditing is crucial for business credibility?

Exactly! Thanks for the participation today, everyone. Let's recap the four branches we discussed.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, we explore the different branches of accounting, detailing the specific functions and outputs of financial, management, cost accounting, and auditing. Each branch serves a unique purpose, targeting different users and requirements.

Detailed

Branches of Accounting

This section delves into the distinct branches of accounting, highlighting their roles and contributions in business finance.

1. Financial Accounting

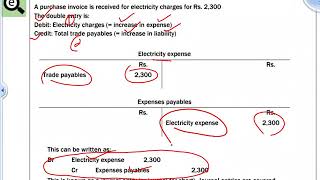

Financial accounting is primarily concerned with preparing financial statements for external stakeholders, such as investors and tax authorities. It provides a clear picture of a company's financial performance using historical data and complies with accounting standards. Key Outputs include: income statements, balance sheets, and cash flow statements.

2. Management Accounting

Management accounting focuses on providing internal users, including managers, with detailed financial and non-financial information for decision-making. This branch aids in budgeting, performance evaluation, and strategic planning. Key Outputs include: budgets, cost reports, variance analysis, and performance reports.

3. Cost Accounting

Cost accounting involves the detailed tracking of costs associated with the production of goods and services. This helps businesses manage their expenses and improve profitability through various reports. Key Outputs include: cost sheets, cost analysis, and cost control measures.

4. Auditing

Auditing is the examination of financial statements to ensure their accuracy, completeness, and compliance with accounting standards and regulations. It includes various types of audits, such as internal, external, statutory, and forensic audits.

Understanding these branches is vital as they provide distinct insights and information necessary for both internal management and external stakeholder decision-making.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Financial Accounting

Chapter 1 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Financial accounting focuses on the preparation of financial statements for external users such as investors, creditors, and tax authorities. It deals with historical data and complies with accounting standards.

○ Key Outputs: Income statement (profit and loss account), balance sheet, and cash flow statement.

Detailed Explanation

Financial accounting is concerned with creating financial statements that reflect the financial activities of a business during a specific period. It provides essential data to external stakeholders like investors and creditors who need to assess the company's financial health. The key outputs of financial accounting include the income statement, which shows the company's profits and losses; the balance sheet, which lists what the business owns and owes; and the cash flow statement, which tracks the inflow and outflow of cash.

Examples & Analogies

Imagine a small bakery that wants to attract investors to expand its operations. To do this, the bakery prepares its financial statements showing how much it earned in the past year (income statement), what it owns and owes (balance sheet), and how cash moved in and out of the business (cash flow statement). These documents help potential investors see whether the bakery is a good investment based on its financial history.

Management Accounting

Chapter 2 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Management accounting is aimed at providing internal users, such as managers and executives, with detailed financial and non-financial information to aid in decision-making, budgeting, and performance evaluation.

○ Key Outputs: Budgets, cost reports, variance analysis, and performance reports.

Detailed Explanation

Management accounting serves the internal needs of a business by providing detailed and relevant information to managers. This branch of accounting focuses on aiding managers in making informed decisions by presenting budgets (financial plans), cost reports (analysis of expenses), variance analysis (comparing budgeted outcomes with actual results), and performance reports (how well the company or its departments are doing).

Examples & Analogies

Consider a company launching a new product. The management team uses management accounting to create a budget for the project, outline expected costs, and track actual expenses as the project progresses. If they find that actual costs are exceeding the budget, they conduct a variance analysis to understand why and adjust their strategy accordingly.

Cost Accounting

Chapter 3 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Cost accounting involves the recording, classification, and analysis of costs incurred in the production of goods or services. It helps businesses manage their costs and improve profitability.

○ Key Outputs: Cost sheets, cost analysis, and cost control measures.

Detailed Explanation

Cost accounting focuses specifically on the costs associated with producing goods or services. It involves recording and analyzing all expenses incurred in production to understand how to improve efficiency and reduce costs. Businesses utilize cost accounting to create documents like cost sheets (which detail the costs of production), conduct cost analysis (to identify areas to cut costs), and implement cost control measures (strategies to limit expenses).

Examples & Analogies

Think of a manufacturing company that produces furniture. Cost accounting helps this company examine how much each piece of furniture costs to manufacture, including materials, labor, and overhead. By analyzing these costs, the company can identify which products are profitable and which need adjustments, such as changing suppliers or reducing waste, to boost profit margins.

Auditing

Chapter 4 of 4

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

● Auditing involves examining financial statements to ensure accuracy, completeness, and compliance with accounting standards and legal regulations.

○ Types of Audits: Internal audit, external audit, statutory audit, and forensic audit.

Detailed Explanation

Auditing is the process of reviewing a company's financial statements to verify that they are accurate and comply with relevant laws and accounting standards. This ensures that stakeholders can trust the financial information provided. There are different types of audits: internal audits assess the company's internal controls; external audits provide an independent review of financial statements; statutory audits are required by law for certain businesses; and forensic audits investigate potential fraud or financial discrepancies.

Examples & Analogies

Picture a school district that conducts an audit of its finances every year. An external auditor reviews all the school’s financial statements to ensure there are no discrepancies or mismanagement of funds. This audit not only reassures parents and the community that the school is financially responsible but also helps the district find ways to reduce costs in various programs.

Key Concepts

-

Financial Accounting: Focuses on providing external stakeholders with financial statements.

-

Management Accounting: Aims to support internal decision-making through financial insights.

-

Cost Accounting: Manages production costs to enhance profitability.

-

Auditing: Ensures the reliability of financial reporting through examination and review.

Examples & Applications

A company prepares its quarterly income statement to report earnings to its investors, exemplifying financial accounting.

Management accountants create cost reports for manufacturing to help identify inefficiencies.

Cost accountants analyze cost sheets to assess the profitability of individual products.

Internal auditors review financial statements to ensure compliance with internal policies and regulations.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Financials show the profit's gain, management helps strategize the game.

Stories

Imagine a baker who uses financial accounting to show profits to investors, management accounting to decide on a new recipe, cost accounting to analyze ingredient expenses, and auditing to ensure all procedures comply with health regulations.

Memory Tools

Remember 'F-M-C-A' for Financial, Management, Cost, and Auditing.

Acronyms

Use the acronym 'BVP' to remind you of Budget, Variance reports, and Performance—key outputs of management accounting.

Flash Cards

Glossary

- Financial Accounting

The branch of accounting focused on preparing financial statements for external users.

- Management Accounting

The branch of accounting that provides financial and non-financial information for internal decision-making.

- Cost Accounting

The process of tracking, recording, and analyzing costs associated with a company's operations.

- Auditing

An independent examination of financial information to ensure accuracy and compliance with standards.

Reference links

Supplementary resources to enhance your learning experience.