Classifying and Summarizing Financial Data

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding Classification of Financial Data

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, let's explore how we classify financial data. Can anyone tell me why it's important to classify financial transactions?

Is it because it helps in organizing data?

Exactly! Classification organizes transactions into categories like assets, liabilities, income, and expenses. These categories help stakeholders understand the business's financial health.

How does this classification help in decision-making?

Good question! When financial data is organized, stakeholders can easily analyze and interpret it, making informed decisions. For instance, by looking at expenses, businesses can identify areas to cut costs.

The Importance of Summarizing Financial Data

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now that we understand classification, let’s discuss summarization. Can someone explain what financial summarization means?

Is it about creating the financial statements like profit and loss accounts?

Correct! Summarization involves taking classified data and compiling it into financial statements, which provide a snapshot of a company's performance. Why do you think this is helpful?

It helps stakeholders see a big picture of financial health.

Exactly! By summarizing, stakeholders can quickly assess profitability and financial stability.

Linking Classification and Summarization to Decision-Making

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Let’s connect these concepts with decision-making. How does classifying and summarizing data assist managers?

It helps them identify trends and make predictions.

Precisely! By analyzing summarized data, managers can make strategic decisions, like investing or reducing expenses.

What about compliance with regulations—how does that fit in?

Great point! Proper classification and summarization also ensure compliance with legal standards, which is essential for the organization's operations.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

In this section, we delve into the classification and summarization of financial data, emphasizing how these processes facilitate an understanding of a business's financial health. By organizing financial transactions into meaningful categories, accounting aids stakeholders in making informed decisions.

Detailed

Classifying and Summarizing Financial Data

This section focuses on the crucial role of classifying and summarizing financial data within the broader accounting process. Accounting involves not just recording transactions but also categorizing and summarizing them to present a clear financial picture of an organization. This process enhances the interpretability of financial data, enabling stakeholders to assess the financial health of a business effectively and make informed decisions.

Key Points Covered:

- Classification: Financial transactions are categorized into specific groups, such as assets, liabilities, income, and expenses. This organization of data helps simplify complex details into understandable segments.

- Summarization: Once classified, financial data is summarized in financial statements, such as balance sheets and profit/loss accounts. This summarization provides a comprehensive overview of a company’s performance over a specific period.

- Importance: The classification and summarization are vital for accurate decision-making by stakeholders, ensuring legal compliance, tracking financial health, and aiding in future planning.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Importance of Organizing Financial Transactions

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

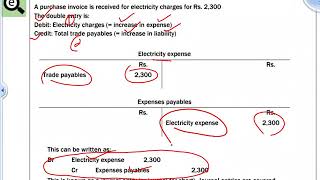

Accounting organizes and classifies financial transactions into categories, such as assets, liabilities, income, and expenses, to present an overview of the financial health of a business.

Detailed Explanation

In accounting, it is crucial to organize financial transactions into distinct categories. This process of classification helps in understanding what different types of financial activities are affecting the business. For example, assets refer to what the business owns, liabilities reflect what it owes, income accounts for the revenue generated, and expenses signify the costs incurred. This categorization allows stakeholders to quickly see where money is allocated or spent, making it easier to assess the overall financial status of the organization.

Examples & Analogies

Imagine a household budget where you track expenses. By categorizing your spending into groceries, utilities, entertainment, and savings, you can get a clear picture of where your money is going each month. Similarly, businesses categorize their financial transactions to ensure they know exactly how much they own, owe, and earn.

Overview of Financial Health

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

To present an overview of the financial health of a business.

Detailed Explanation

After categorizing financial transactions, accounting helps create financial statements that summarize this data. These statements offer a snapshot of the business's financial health at a specific point in time. Stakeholders, such as investors or managers, can use these insights to make informed decisions, such as allocating resources or strategizing future investments.

Examples & Analogies

Consider a student reviewing their semester grades. By summarizing scores in different subjects, they can easily see which areas they're excelling in and where they may need improvement. For businesses, summarizing financial data works the same way, helping leaders identify strong performance and areas that may need attention.

Key Concepts

-

Classification: Organizing transactions into categories for better analysis.

-

Summarization: Compiling classified data into statements like profit/loss accounts.

-

Decision-Making: Utilizing summarized data to make strategic business decisions.

-

Financial Health: The overall financial condition assessed through summarized data.

Examples & Applications

A company classifies expenses into categories such as marketing, research, and development.

The summarization of quarterly data into a profit and loss statement to evaluate business performance.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Classify, categorize, make it neat; Summarize the data to make it complete.

Stories

Imagine a busy bee organizing honey jars. Each jar represents different financial transactions categorized and summarized for easy access—that’s how financial data helps businesses.

Memory Tools

C.S. for Classify and Summarize—think of a chef preparing dishes as they first categorize ingredients before cooking.

Acronyms

CFS

Classify

Financial health

Summarize!

Flash Cards

Glossary

- Classification

The process of organizing financial transactions into specific categories, such as assets, liabilities, income, and expenses.

- Summarization

The process of condensing classified financial data into financial statements like profit and loss accounts and balance sheets.

- Financial Health

A measure of a business's overall financial condition, typically assessed through various financial statements.

- Stakeholders

Individuals or groups that have an interest in the financial performance of a business, including owners, managers, investors, and creditors.

Reference links

Supplementary resources to enhance your learning experience.