The Basic Accounting Equation

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Accounting Equation

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we're discussing the accounting equation, which is a key principle in accounting. Can anyone tell me what the accounting equation is?

Isn't it Assets = Liabilities + Owner’s Equity?

Exactly! This equation illustrates the relationship between a company's resources, obligations, and owner's claim. Remember, 'A equals L plus OE' can be a helpful mnemonic.

What do we mean by assets in this equation?

Good question! Assets are what the business owns, like cash, inventory, or property. They are vital for the operations of the company.

And liabilities?

Liabilities are what the business owes to others—think loans or unpaid bills. Understanding both assets and liabilities allows us to assess a company's financial health.

So, owner’s equity is what's left after you take away the liabilities?

That's correct! Owner’s equity represents the owner's stake in the business. This entire equation ensures that our books are always balanced, which is crucial in accounting.

To recap, the accounting equation is vital for double-entry bookkeeping, as it maintains balance in financial transactions.

Double-Entry System Explained

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now let’s discuss the double-entry system. Can anyone explain what that means?

I think it means recording every transaction in two accounts, right?

Exactly! This is critical to ensure that the accounting equation remains balanced. Each transaction affects at least two accounts—this is where the term double-entry comes from.

So every time we buy something, we not only note the asset but also record a liability or decrease in cash?

Exactly! For instance, if you purchase inventory on credit, you increase your assets while simultaneously increasing your liabilities. This systematic approach is fundamental to keeping accurate records.

What happens if we don’t maintain this balance?

If the entries don't balance, it indicates discrepancies in the accounts, which can lead to financial reporting errors. It's a crucial aspect of accounting accuracy.

This makes sense now. It sounds like a safety net for businesses.

Very well said! Let’s summarize: The double-entry system hinges on our accounting equation and ensures accuracy in financial data.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

This section introduces the fundamental accounting equation, which states that assets equal liabilities plus owner's equity. It emphasizes the importance of double-entry bookkeeping, where every transaction impacts at least two accounts to maintain balance in financial records.

Detailed

The basic accounting equation is expressed as Assets = Liabilities + Owner’s Equity. This equation serves as the foundation for the double-entry system of accounting, which ensures that every financial transaction is recorded in at least two accounts, maintaining the integrity and balance of financial statements. Assets represent what a business owns, such as cash, inventory, and property; liabilities represent what a business owes to others, including loans and creditors; and owner’s equity signifies the owner's residual interest after liabilities are deducted from assets. This section is crucial for understanding how financial data is interrelated and underlines the principles of accurate financial reporting in accounting.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Understanding the Accounting Equation

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The accounting equation is the foundation of double-entry bookkeeping, where every transaction affects at least two accounts. The equation ensures that the books are always balanced.

The Basic Accounting Equation:

Assets = Liabilities + Owner’s Equity

- Assets: What the business owns (e.g., cash, inventory, property).

- Liabilities: What the business owes to others (e.g., loans, creditors).

- Owner’s Equity: The owner’s residual interest in the business after liabilities are subtracted from assets.

Detailed Explanation

The accounting equation is crucial for understanding financial accounting. It states that what a company owns (assets) equals what it owes (liabilities) plus what belongs to the owner (owner's equity). This equation is balanced because every financial transaction impacts at least two accounts, ensuring stability in financial records. For instance, if a business purchases new equipment, it increases the assets while also adjusting the liabilities or owner's equity, depending on how the equipment is paid for.

Examples & Analogies

Think of the accounting equation like a seesaw. On one side, you have the assets, and on the other, you have liabilities plus owner's equity. If one side goes up, the other must balance it out. For example, if you use a loan (liability) to buy a car (asset), both sides of the equation increase, keeping the seesaw evenly balanced.

Introduction to the Double-Entry System

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

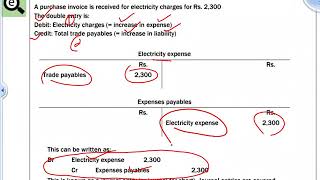

The double-entry system is based on the principle that every financial transaction involves two entries: a debit and a credit. This ensures that the accounting equation remains in balance.

Detailed Explanation

The double-entry system is an essential bookkeeping method where each financial transaction is recorded in at least two accounts: one as a debit and another as a credit. This system supports the accounting equation by maintaining balance. When you buy inventory for cash, inventory increases (debit) while cash decreases (credit), reflecting the dual impact of the transaction on the accounts.

Examples & Analogies

Imagine you're playing a game of tug-of-war. For every player you add to one side, you must equally add a player to the other side to keep the game balanced. In accounting, if you increase an asset (like inventory), you must decrease another asset (like cash) or increase a liability, ensuring everything remains evenly matched.

Key Concepts

-

Accounting Equation: The fundamental equation is Assets = Liabilities + Owner’s Equity.

-

Double-Entry System: Each transaction affects at least two accounts, keeping the equation balanced.

-

Assets: Items of value owned by the business.

-

Liabilities: Financial obligations owed by the business.

-

Owner's Equity: The owner's interest in the business after liabilities are deducted from assets.

Examples & Applications

If a business has $50,000 in assets, $30,000 in liabilities, the owner's equity would be $20,000.

When a company takes out a loan to purchase new equipment, it increases both its assets (the equipment) and its liabilities (the loan amount).

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Assets on one side, Liabilities in hand, Owner’s equity stands strong, that’s how we understand.

Stories

Imagine a business as a ship. The assets are the cargo onboard, the liabilities are what you owe to the dock and the owner’s equity is the captain’s share after all expenses are paid.

Memory Tools

Remember A = L + OE as 'All Lions are Owners' to recall that Assets classified under Liabilities and Owner's Equity.

Acronyms

ALE (Assets, Liabilities, Equity) helps remember the components of the accounting equation.

Flash Cards

Glossary

- Assets

Resources owned by a business that have economic value and can be measured.

- Liabilities

Obligations that a business owes to outsiders, such as debts or loans.

- Owner’s Equity

The residual interest in the assets of the business after deducting liabilities, representing the owner's stake in the company.

- Accounting Equation

A formula stating that assets equal liabilities plus owner's equity, forming the foundation of double-entry bookkeeping.

- DoubleEntry System

An accounting method where each transaction is recorded in at least two accounts to ensure balance.

Reference links

Supplementary resources to enhance your learning experience.