Management Accounting

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Management Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome to our discussion on management accounting. Can anyone tell me what management accounting is?

Isn’t it just like regular accounting but focused on management?

That's a great start! Management accounting indeed focuses on supplying internal managers with knowledge for better decision-making. It includes budgeting, cost reports, variance analysis, and performance reports.

Why are these reports so important?

These reports help managers understand financial health and strategic goals. They are tailored specifically to meet internal needs and guide operational decisions.

Can you explain one of these reports, like variance analysis?

Certainly! Variance analysis is a method where we compare the budgeted costs and revenues against the actual figures to identify variances. For instance, if the actual expenses are higher than anticipated, it prompts a review for corrective actions.

So, it’s about understanding what went wrong?

Exactly! It's all about analyzing differences to make informed decisions moving forward. Let's summarize: management accounting provides insights through budgets, cost reports, variance analysis, and performance reports.

Budgets and their Role

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Next, let's dive deeper into budgets. What do you think a budget accomplishes for a manager?

I think it helps in allocating resources properly!

Exactly! Budgets help in resource allocation and setting performance targets. They also aid in predicting financial outcomes.

How often should budgets be reviewed?

Good question! While budgets can be set annually, they're often reviewed quarterly or bi-annually to ensure that they remain relevant amid changing business conditions.

So a budget is both a plan and a benchmark?

Correct! It provides a financial roadmap but also serves to measure performance. Remember, discussing budgets reinforces the importance of planning in management.

Cost Reports and Variance Analysis

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's talk about cost reports. Why do you think they matter?

They probably help in observing which areas we’re overspending?

Exactly! Cost reports provide detailed insights into expenditures, helping to pinpoint inefficiencies in various departments.

How is variance analysis different from that?

Variance analysis focuses on the differences between expected results and actual outcomes, while cost reports detail current spending. Both are integral in assessing and improving financial performance.

Can you give us an example of utilizing variance analysis?

Certainly! For instance, if a marketing campaign budgeted $10,000 but actually spent $15,000, the marketing team would analyze why that occurred. This could lead to discussions on future budget allocations and strategies.

So it encourages proactive management?

Absolutely! To sum up, cost reports and variance analysis are essential tools in monitoring and enhancing management efficiency.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

Management accounting provides key insights for internal users, particularly managers, aiding them in the strategic functions of planning, budgeting, and controlling organizational activities. This branch emphasizes creating detailed reports that facilitate performance evaluations and informed decision-making.

Detailed

Management Accounting

Management accounting is a crucial branch of accounting focused on delivering financial and non-financial information specifically for internal use within an organization. Its primary goal is to support managers in making informed decisions regarding operational efficiency, budgeting, and overall performance evaluation. Unlike financial accounting, which prepares standardized statements for external stakeholders, management accounting tailors reports to meet the specific needs of management, enabling better strategic decisions.

Key Components of Management Accounting:

- Budgets: These are detailed financial plans outlining expected revenues and expenditures over a specific period, allowing managers to set financial goals and benchmarks.

- Cost Reports: These reports provide insights into the costs associated with various departments or projects, helping managers identify areas for improvement and cost-control measures.

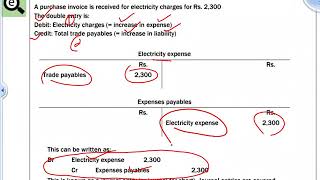

- Variance Analysis: This involves comparing budgeted figures against actual performance to assess discrepancies, understand their causes, and guide corrective actions.

- Performance Reports: These reports measure the effectiveness of different departments or initiatives against predefined criteria, encouraging accountability and strategic adjustments.

By making use of these tools, management accounting plays an essential role in strategic planning and operational control, leading to improved financial performance and competitiveness in the marketplace.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Purpose of Management Accounting

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Management accounting is aimed at providing internal users, such as managers and executives, with detailed financial and non-financial information to aid in decision-making, budgeting, and performance evaluation.

Detailed Explanation

Management accounting focuses on delivering information that is specifically useful to the people who run an organization. Unlike financial accounting, which serves external stakeholders, management accounting equips internal users, mainly managers and executives, with the necessary data they need to make strategic decisions. This includes both financial data, like costs and revenues, as well as non-financial data, which could encompass metrics such as employee satisfaction or customer feedback. The key purpose of this branch of accounting is to facilitate informed decision-making, efficient budget preparation, and thorough performance evaluations.

Examples & Analogies

Imagine you are the captain of a ship. Just as you would use a detailed map and weather reports to navigate through the waters, managers rely on management accounting to find their way through the complexities of business operations. They need precise information about their 'course' (business strategy) and ‘weather conditions’ (market conditions) in order to steer the company towards success.

Key Outputs of Management Accounting

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Key Outputs: Budgets, cost reports, variance analysis, and performance reports.

Detailed Explanation

Management accounting produces several critical outputs that help managers monitor and guide their organization's performance. These include:

- Budgets: These are financial plans that project future income and expenses, allowing management to allocate resources effectively.

- Cost Reports: These reports provide detailed insights into the costs associated with operations, helping to identify areas where expenses can be reduced.

- Variance Analysis: This process compares budgeted figures to actual financial performance, allowing management to understand where discrepancies arise and make informed adjustments.

- Performance Reports: These summarize the outcomes of different departments or projects, giving managers a clear picture of how effectively resources are being utilized.

Examples & Analogies

Think of a coach preparing a basketball team for a season. They would develop a budget for travel, training, and equipment (budgets), analyze how much each game costs them (cost reports), examine how the team’s scores compare against their goals (variance analysis), and review player performances after each game (performance reports). Each of these outputs helps the coach optimize the team's performance and make strategic decisions.

Key Concepts

-

Management Accounting: Focuses on providing internal stakeholders with necessary financial insights.

-

Budgets: Financial plans that guide resource allocation and performance measurement.

-

Cost Reports: Essential tools for assessing departmental expenditures.

-

Variance Analysis: Key method for comparing actual performance against budgeted figures.

-

Performance Reports: Used to evaluate the effectiveness of operations.

Examples & Applications

A company prepares a budget to forecast its revenues and expenses for the next fiscal year to appropriately allocate resources.

A manager utilizes variance analysis to determine why their department's spending was 15% over the budget and plans corrective actions.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Budgets are plans, in finance they reign; control spending to keep profits from pain.

Stories

Imagine a ship's captain needing to know exactly how much food to stock. Budgets are the maps, guiding the journey of each dollar to ensure no wastage.

Memory Tools

B-C-V-P: Budgets, Cost reports, Variance analysis, Performance reports are the key components of management accounting.

Acronyms

B-C-V-P helps in Remembering 'Big Cats Value Performance'.

Flash Cards

Glossary

- Management Accounting

A branch of accounting that provides financial and non-financial information for internal stakeholders to assist in decision-making.

- Budgets

Financial plans that outline expected revenues and expenditures for a specific period.

- Cost Reports

Reports detailing the costs incurred by various departments and projects.

- Variance Analysis

The process of evaluating the differences between budgeted and actual financial performance.

- Performance Reports

Reports measuring the effectiveness of departments or initiatives against set criteria.

Reference links

Supplementary resources to enhance your learning experience.