Accounting Period Concept

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Understanding the Need for Accounting Periods

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Good morning, everyone! Today, we're discussing the accounting period concept. Why do you think having a specific period for financial reporting is crucial?

It helps in comparing financial performance over time, right?

Exactly! Establishing these periods allows stakeholders to assess trends. Can someone give me an example of a typical accounting period?

I think the fiscal year, like April to March for many companies in India?

Correct! A fixed accounting period like that enhances consistency in reporting. This also helps in making budgeting decisions. Let’s remember this with the acronym 'FISCAL' - Fixed Interval for Strategic Comparisons and Analysis of Earnings and Loss.

That’s a good way to remember it!

To summarize, the accounting period concept allows for timely assessments of company performance and aids in strategic planning.

Consequences of Not Following the Accounting Period Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, what do you think could happen if a business doesn't follow the accounting period concept?

They might not have accurate financial records?

Yes! Irregular reporting can lead to misunderstandings about a company’s financial position. This impacts investment decisions and may even lead to regulatory issues. Why would that be?

Because stakeholders wouldn’t have current information to rely on, which is critical for audits and compliance.

Precisely! Not having a structured period introduces risks and uncertainty. Remember: 'Periods Protect Profits' for reinforcing how having defined accounting intervals safeguards company data.

That's catchy and easy to recall!

Great! So always remember the necessity of accurate and regular reporting in maintaining trust and clarity in financial statements.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

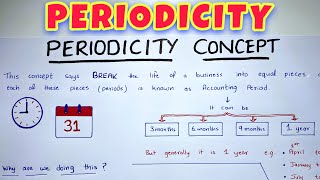

The accounting period concept establishes that businesses prepare financial statements over distinct intervals, typically annually or quarterly. This allows stakeholders to evaluate company performance consistently over the same time frames and make informed decisions based on comparable financial data.

Detailed

Accounting Period Concept

The accounting period concept is foundational in financial reporting. It requires businesses to prepare financial statements for specific periods, like a fiscal year or a calendar year, allowing stakeholders to analyze and compare financial performance over time. By adhering to this concept, organizations can provide regular, timely financial data that is essential in helping managers, investors, and regulatory bodies assess a company's ongoing operations and overall financial health.

Significance of the Accounting Period Concept

- Regular Assessment: By closing accounts periodically, businesses can gauge their performance and make necessary adjustments based on recent financial data.

- Investors and Stakeholders: Provides critical insights into the operational activities and profitability of an organization that facilitates investment decisions.

- Compliance: Ensures adherence to established accounting standards and regulations which often specify reporting periods.

- Budgeting and Planning: Assists in planning future business activities based on historical financial performance.

An example of the accounting period can illustrate its importance. Consider a business that operates on a fiscal year from April 1 to March 31. To evaluate its performance, it must produce a profit and loss statement, balance sheet, and cash flow statement for that period, enabling a thorough analysis of its earnings and expenditures during the year.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Definition of Accounting Period

Chapter 1 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Financial statements are prepared for a specific period, usually a year (fiscal or calendar year), known as the accounting period.

Detailed Explanation

The accounting period is a defined time frame used in accounting to formulate financial statements. It typically spans a year, which can be either a fiscal or calendar year. During this time, businesses record their financial transactions, and at the end of the period, they summarize their financial activity to present a clear picture of their financial health. This helps stakeholders understand the performance of the business over a defined period.

Examples & Analogies

Think of a school year where grades are given at the end of the year. Just as students receive their final report cards summarizing their performance throughout the year, businesses present their financial statements at the end of an accounting period to show their financial performance over that time.

Example of an Accounting Period

Chapter 2 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Example: April 1, 2024, to March 31, 2025 (financial year in India).

Detailed Explanation

This example demonstrates a specific accounting period often used by businesses in India. It indicates that the financial statements prepared would cover transactions occurring between April 1, 2024, and March 31, 2025. By defining this period, it’s easier for stakeholders to assess the company's financial performance and comprehensively analyze trends over this time frame.

Examples & Analogies

Imagine tracking your personal spending. If you decide to monitor your finances over the course of a year, such as from January 1 to December 31, this is similar to how businesses operate. Just like you review your expenses and savings at the end of the year, businesses summarize their transactions in financial statements to evaluate their financial status.

Importance of Reporting in an Accounting Period

Chapter 3 of 3

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Financial statements provide insights into a business's performance during the specified accounting period, allowing for effective decision-making.

Detailed Explanation

By preparing financial statements for a specific accounting period, businesses can provide critical insights into their performance—such as profitability, expenses, and overall financial health. This information is vital for management and stakeholders to make informed decisions regarding future operations, investments, and strategies.

Examples & Analogies

Imagine a farmer who tracks the yield of their crops every season. At the end of each growing season, they assess what worked well and what did not. This seasonal review helps in planning for the next planting cycle. Similarly, businesses review financial statements to evaluate their performance and plan for the next accounting period.

Key Concepts

-

Accounting Period: Refers to a specific timeframe used for reporting financial data.

-

Fiscal Year: The period companies typically use for reporting, which may not align with the calendar year.

-

Stakeholders: Those who utilize financial information, including investors, lenders, and regulators.

-

Comparability: The ability to compare financial statements across different periods or entities.

Examples & Applications

A company reports its financial performance for the accounting period from April 1, 2024, to March 31, 2025.

An organization submitting quarterly reports is adhering to the accounting period concept by evaluating their performance every three months.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

To report on the firm and keep trends in sight, every year we'll close, and everything's right.

Stories

Imagine a student who studies for exams every semester. By focusing on specific periods, they can track their progress and improve, just like businesses need to report results after each accounting period.

Memory Tools

Remember 'CATS' - Closures (for analysis), Assessment (of performance), Timeliness (in reporting), Stakeholders (for whom information is vital).

Acronyms

FISCAL - Fixed Interval for Strategic Comparisons and Analysis of Losses.

Flash Cards

Glossary

- Accounting Period

A specified period, typically a quarter or a year, for which financial statements are prepared.

- Fiscal Year

An annual period that a company uses for financial reporting, often differing from the calendar year.

- Comparability

The ability to compare financial statements of different entities or periods for analysis.

- Stakeholders

Individuals or entities that have an interest in the company's financial performance, such as investors, managers, and regulators.

Reference links

Supplementary resources to enhance your learning experience.