Accounting Principles and Concepts

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Meaning of Accounting Principles

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Welcome, everyone! Today, we're delving into accounting principles, which are the backbone of reliable financial reporting. Can anyone tell me what accounting principles entail?

Are they just rules to follow when making financial reports?

Exactly! Accounting principles include accepted guidelines that ensure consistency and reliability. They are categorized into two main types: concepts and conventions. Theoretical ones are known as accounting concepts.

What's the difference between concepts and conventions?

Great question! Concepts are the foundational theories behind accounting practices, while conventions are practical guidelines used for implementation. A good mnemonic to remember that is 'CCVG'—Concepts are for theory, Conventions are about guiding practice.

Need for Accounting Principles

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's discuss why these principles are essential. They help maintain uniformity and comparability in financial statements. Who can explain why that is important?

It helps investors and stakeholders assess different companies fairly.

Exactly! It allows for informed decision-making. Also, it leads to transparency, which builds trust among users of financial statements.

And I guess it also ensures compliance with laws, right?

Yes! Compliance is crucial, especially in a global business environment. Remember, the acronym 'UCTR' for Uniformity, Comparability, Transparency, and Regulatory compliance.

Basic Accounting Concepts

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Moving on to basic accounting concepts, let's dive into them! The first one is the Business Entity Concept. Why is it important?

Is it to keep personal transactions separate from the business transactions?

Absolutely! This principle states that a business is a separate entity from its owner. Can anyone give me an example?

If an owner invests money in the business, it's recorded as a liability?

Right! Now, what about the Going Concern Concept?

Isn’t that the assumption that businesses will continue to operate indefinitely?

Exactly! Memory aid: 'Forever in business' helps remind you of this concept! Let's discuss more concepts.

Important Accounting Conventions

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Some important accounting conventions help shape the application of principles. Who can explain conservatism?

It’s about being cautious and not counting profit until it’s certain.

Exactly! We want to anticipate no profit but prepare for losses. Can someone summarize the importance of maintaining consistency?

So we need to keep using the same accounting methods each year, right?

Precisely! Consistency leads to comparability. Remember 'C for consistency and C for comparison'. Good job, everyone!

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

It discusses various accounting principles and concepts including the meanings, needs, and classifications of accounting principles, such as the business entity, going concern, and matching concepts. Furthermore, their significance for stakeholders and the broader implications for software development in financial contexts are examined.

Detailed

Accounting Principles and Concepts

Accounting forms the core of business operations, enabling entities to systematically record, summarize, and analyze financial transactions. To ensure consistency, reliability, and transparency in financial reports, several standardized accounting principles guide practitioners. This section delves into what these principles entail and their necessity in professional accounting.

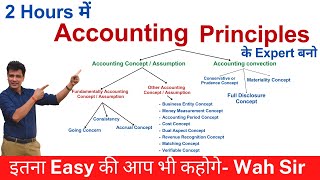

1. Meaning of Accounting Principles

Accounting principles are the foundation for preparing financial statements, ensuring that stakeholders can trust the information presented. These principles are predominantly categorized into two types:

- Accounting Concepts: These are theoretical underpinnings guiding financial accounting.

- Accounting Conventions: These serve as practical guidelines.

2. Need for Accounting Principles

Accounting principles are crucial for:

- Uniformity: Ensures consistent financial reporting.

- Comparability: Allows for comparison across different firms.

- Transparency: Builds trust among stakeholders.

- Regulatory Compliance: Meets national and international standards.

- Automation and Software Design: Informs how financial management systems operate.

3. Basic Accounting Concepts

Key accounting concepts include:

1. Business Entity Concept: Treats the business as separate from its owner.

2. Money Measurement Concept: Only records quantifiable transactions.

3. Going Concern Concept: Assumes businesses will operate indefinitely.

4. Cost Concept: Assets recorded at historical cost.

5. Dual Aspect Concept: Every transaction affects two accounts.

6. Accounting Period Concept: Financials must be reported for specific periods.

7. Matching Concept: Links expenses to the revenues they generate.

8. Realization Concept: Revenue recognized when earned, not upon payment.

9. Accrual Concept: No cash exchange required to record transactions.

10. Objectivity Concept: Financial records must be based on verifiable evidence.

4. Important Accounting Conventions

Accounting conventions inform how principles are applied:

1. Conservatism: Avoids recognizing profits prematurely.

2. Consistency: Maintains consistent accounting methods over time.

3. Full Disclosure: Requires transparent reporting of material facts.

4. Materiality: Focuses on significant information affecting decisions.

5. Relationship Between Accounting Principles and Software Systems

For those in fields like BTech CSE, accounting principles are vital in developing software solutions that align with financial reporting standards.

6. Limitations of Accounting Principles

Accounting principles are not without flaws. They can include subjectivity, may ignore current market values, and often overlook qualitative factors.

These fundamentals create an essential understanding for all future finance professionals, particularly those integrating accounting with technology.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Meaning of Accounting Principles

Chapter 1 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Accounting principles are the rules and guidelines that companies must follow when reporting financial data. These principles are generally accepted and form the basis of Generally Accepted Accounting Principles (GAAP). They ensure the reliability, consistency, and comparability of financial statements across different organizations and time periods.

There are two major types of principles:

- Accounting Concepts (Theoretical)

- Accounting Conventions (Practical guidelines)

Detailed Explanation

Accounting principles are essential guidelines that organizations follow to produce financial reports. They create a standard format that helps ensure all companies report their financial data consistently and comparably. Principles can be divided into two main categories: theoretical concepts, which provide the underlying logic for accounting practices, and practical conventions, which give detailed instructions on applying those concepts.

Examples & Analogies

Think of accounting principles like the rules of a board game. Just like players must follow the rules to ensure fair play, businesses must adhere to accounting principles to ensure accurate financial reporting, allowing stakeholders to trust the information just like players trust the game's outcome.

Need for Accounting Principles

Chapter 2 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Uniformity: Provides consistency in the preparation and presentation of financial statements.

- Comparability: Enables stakeholders to compare financial statements of different firms.

- Transparency: Enhances trust among investors, creditors, and regulators.

- Regulatory Compliance: Ensures adherence to national and international accounting standards.

- Automation and Software Design: Guides how accounting modules in ERP systems and financial software should be structured.

Detailed Explanation

The need for accounting principles is highlighted through several key aspects. Uniformity ensures all companies present their finances in a similar manner, making it easier to analyze and compare businesses. This comparability is crucial for stakeholders who need reliable insights. Transparency helps build trust with investors and regulators, while adhering to regulations is necessary for legal compliance. Furthermore, accounting principles influence how software systems are designed to manage financial data effectively.

Examples & Analogies

Consider accounting principles as the rules of the road for financial reporting. Just like traffic laws help to ensure everyone drives safely and predictably, accounting principles make financial information clear and trustworthy, enabling businesses and investors to 'navigate' the financial landscape confidently.

Basic Accounting Concepts

Chapter 3 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Business Entity Concept: The business is treated as a separate entity from its owner. All financial transactions are recorded from the business's perspective, not the owner's.

- Money Measurement Concept: Only transactions that can be measured in monetary terms are recorded in the books of accounts.

- Going Concern Concept: It is assumed that the business will continue its operations indefinitely unless stated otherwise.

- Cost Concept: Assets are recorded at their original purchase price (historical cost), not at current market value.

- Dual Aspect Concept: Every transaction has two aspects—a debit and a credit—which form the basis of the accounting equation: Assets = Liabilities + Capital.

- Accounting Period Concept: Financial statements are prepared for a specific period, usually a year, known as the accounting period.

- Matching Concept: Expenses should be recorded in the same period as the revenues they help to generate.

- Realization Concept (Revenue Recognition): Revenue is recognized when it is earned, regardless of when cash is received.

- Accrual Concept: Revenues and expenses are recorded when they are earned or incurred, not when cash is exchanged.

- Objectivity Concept: Accounting records must be based on objective evidence such as invoices, receipts, and bills—not personal opinion.

Detailed Explanation

Basic accounting concepts provide the framework for recording and reporting financial transactions. The Business Entity Concept separates the owner’s finances from the business’s finances. The Money Measurement Concept ensures only transactions that can be quantified are recorded. The Going Concern Concept assumes the business will operate indefinitely. The Cost Concept requires assets to be recorded at purchase price. The Dual Aspect Concept focuses on the idea that each transaction affects both sides of the accounting equation. The Accounting Period Concept emphasizes that financial statements are created for specific periods. The Matching Concept ensures that expenses and revenues are recorded together. The Realization Concept dictates when revenue is recognized, while the Accrual Concept determines when transactions should be recorded. Lastly, the Objectivity Concept stresses that financial records must rely on factual evidence rather than personal views.

Examples & Analogies

Think of the business entity concept like a school where each class is treated as its own entity. Every class has its own budget and spends accordingly. Similarly, the cost concept is like buying a brand-new computer; it’s recorded at the price you paid rather than its current market value. This ensures everyone is on the same page regarding the financial status of each class.

Important Accounting Conventions

Chapter 4 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Conservatism (Prudence): Anticipate no profit but provide for all possible losses.

- Consistency: Once an accounting method is chosen (e.g., depreciation method), it should be used consistently year after year for comparability.

- Full Disclosure: All material facts related to financial statements must be fully and clearly disclosed.

- Materiality: Only significant information that could influence decision-making needs to be disclosed.

Detailed Explanation

Accounting conventions provide practical guidelines for applying accounting principles. Conservatism encourages a cautious approach, emphasizing that potential losses should be anticipated while profits should only be recognized when certain. Consistency ensures that once a company chooses a method, it continues to use it, making financial reports understandable over time. Full Disclosure demands that all relevant information is included in financial statements, maintaining transparency, while Materiality focuses on only disclosing information that could influence decisions significantly.

Examples & Analogies

Conservatism is like an athlete not celebrating prematurely; they stay focused and anticipate potential injuries. Consistency is akin to a writer using the same font throughout a novel. If another style is introduced halfway, it could confuse the reader. Full Disclosure is like a doctor providing all medical information to a patient, ensuring they make informed decisions about their treatment.

Relationship Between Accounting Principles and Software Systems

Chapter 5 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

As a CSE student, understanding these principles is crucial when:

- Designing accounting software or ERPs.

- Developing audit automation systems.

- Creating AI models for financial analytics.

- Ensuring compliance in FinTech applications.

Detailed Explanation

For Computer Science and Engineering (CSE) students, grasping accounting principles is vital when creating software solutions that handle financial data. When designing accounting software, these principles guide how systems should capture and manage transactions. Audit automation systems depend on these foundations to ensure compliance and accurate reporting. AI models also leverage these concepts to produce meaningful financial analytics, while FinTech applications must ensure they meet regulatory standards based on these principles.

Examples & Analogies

Imagine a student developing an app to track personal finances. Understanding cash flow principles will help ensure they design features that correctly record incoming and outgoing transactions. This is just like how a chef needs to know cooking techniques to create a delicious meal that meets diners’ expectations.

Limitations of Accounting Principles

Chapter 6 of 6

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

- Subjectivity: Some principles (e.g., conservatism) involve judgment.

- Historical Cost: Ignores current market values.

- Non-Monetary Information Ignored: Qualitative factors like employee morale are excluded.

- Changing Standards: GAAP and IFRS may evolve, requiring system updates.

Detailed Explanation

While accounting principles are fundamental, they are not without limitations. Subjectivity is inherent in some principles, such as conservatism, where management must use their judgment. The Historical Cost principle can become outdated, as it does not reflect current values. Non-monetary information, which can affect a business's performance — like employee morale — is often overlooked. Finally, accounting standards such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) evolve, demanding ongoing adjustments to systems and processes.

Examples & Analogies

Think of subjectivity in accounting like predicting the weather; you can make a forecast based on available data, but it may still be affected by unforeseen circumstances. The limitations of accounting principles remind us that just like life, accounting isn’t always black and white, and it requires flexibility to accommodate new insights and changes.

Key Concepts

-

Accounting Principles: Foundation for reliable financial reporting.

-

Business Entity Concept: Distinction between business and owner.

-

Matching Concept: Expenses matched with the revenues they generate.

-

Consistency: Use the same accounting methods over time.

Examples & Applications

If a business owner invests ₹1,00,000, it's recorded as a liability from the business's perspective.

A machine purchased for ₹5,00,000 is recorded at its purchase price, not current market value.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

In business, don’t mix the meals, Keep owner and company with separate wheels.

Stories

Once there was a shopkeeper who noticed his personal purchases were affecting his store's profits. He started tracking his business expenses separately, realizing he could grow his store without distractions.

Memory Tools

Remember the 'CCVG' principle for accounting needs: Concepts, Consistency, Uniformity, and Governance.

Acronyms

GAAP

Generally Accepted Accounting Principles — A foundation for fair reporting.

Flash Cards

Glossary

- Accounting Principles

Standardized rules and guidelines that govern financial reporting.

- Accounting Concepts

Theoretical foundations that guide accounting practice.

- Accounting Conventions

Practical applications that inform how accounting principles are used.

- Business Entity Concept

The principle that a business is treated as separate from its owners.

- Going Concern Concept

The assumption that a business will continue to operate indefinitely.

- Conservatism

The principle of anticipating no profit but preparing for potential losses.

Reference links

Supplementary resources to enhance your learning experience.