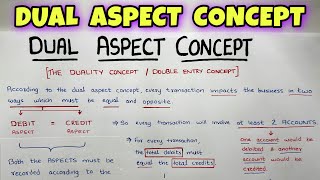

Dual Aspect Concept

Enroll to start learning

You’ve not yet enrolled in this course. Please enroll for free to listen to audio lessons, classroom podcasts and take practice test.

Interactive Audio Lesson

Listen to a student-teacher conversation explaining the topic in a relatable way.

Introduction to Dual Aspect Concept

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Today, we are going to explore the Dual Aspect Concept. Can anyone tell me what comes to mind when we hear about dual aspects in finance?

I think it relates to debits and credits, right?

Exactly! The Dual Aspect Concept emphasizes that every transaction affects two accounts: one account is debited, and another is credited. This maintains the balance in our accounting equation, which is Assets = Liabilities + Capital.

So, how does this apply in real-world transactions?

Good question! Let's say a business buys a vehicle for ₹10,00,000. The vehicle is an asset, so we record it as a debit. But, how do we pay for it? With cash, or by taking a loan, of course; either way, there will be a corresponding entry that keeps the overall balance intact.

Could you explain that with numbers?

"Sure! If the business pays cash, your entry would be:

Understanding Double-Entry Accounting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

As we delve deeper, let’s understand how this concept is applied through double-entry accounting. Why do you think double-entry is essential?

It sounds like a way to ensure accuracy in recording transactions.

Correct! The double-entry system is designed to eliminate errors in financial reporting. When you record debits and credits for every transaction, you create a system of checks and balances. Can someone summarize why it’s called ‘double-entry’?

Because each transaction is entered twice, once as a debit and once as a credit.

Exactly! Remember the phrase ‘Every debit has a corresponding credit’? This principle is crucial in ensuring that nothing gets left unrecorded.

What happens if we don’t follow this system?

Not following it could lead to inaccuracies in financial statements. An imbalance suggests errors that could mislead stakeholders about a company’s true financial health.

So if everything is interconnected, how does that help stakeholders?

It provides transparency and reliability. Stakeholders trust that financial reports accurately represent the company’s operations, which is essential for vital decisions like investments.

Significance in Financial Reporting

🔒 Unlock Audio Lesson

Sign up and enroll to listen to this audio lesson

Now, let's discuss the significance of the Dual Aspect Concept in preparing financial statements. Why do you think accurate reporting is important?

It shows the overall health of the business to its stakeholders.

Correct! Accurate reporting helps both the owners and investors gauge the company’s performance. The dual aspect helps paint a clear picture of financial standing.

What happens if there's a major discrepancy?

Discrepancies can lead to loss of trust from investors, potential legal issues, and damage to the company’s reputation. Maintaining balance is key for sustainability.

So, can you give a real example of how this impacts businesses?

Sure! When a company reports its revenues, the dual aspect ensures that any revenue earned has an exact corresponding entry, reflecting either an increase in cash or receivable debts. This impacts everything from market perceptions to investment potentials, illustrating the real consequences of accurate financial records.

Introduction & Overview

Read summaries of the section's main ideas at different levels of detail.

Quick Overview

Standard

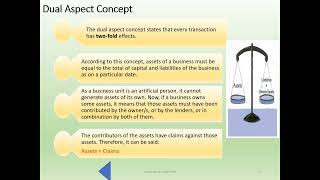

This concept is fundamental to accounting as it states that each transaction affects at least two accounts, reflecting the dual aspect of financial activities. It forms the basis of double-entry accounting, which maintains the integrity of financial reporting.

Detailed

Dual Aspect Concept

The Dual Aspect Concept is a core principle in accounting that states every financial transaction has two aspects: a debit and a credit. This duality ensures that the accounting equation, Assets = Liabilities + Capital, always remains balanced. For example, when a company purchases equipment (asset), it either pays cash (decrease in asset) or incurs a liability (increase in liability) to acquire it. This concept emphasizes the importance of double-entry accounting, where every entry in the ledger requires a corresponding and opposite entry in another account. Understanding the Dual Aspect Concept is crucial as it ensures the accuracy and reliability of financial statements, making it easier for stakeholders to analyze the financial position of the business.

Youtube Videos

Audio Book

Dive deep into the subject with an immersive audiobook experience.

Understanding the Dual Aspect Concept

Chapter 1 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

Every transaction has two aspects—a debit and a credit—which form the basis of the accounting equation:

Assets = Liabilities + Capital

Detailed Explanation

The Dual Aspect Concept is a fundamental principle in accounting that states every financial transaction affects at least two accounts. This means that for every entry made in the accounting system, there is a corresponding and opposite entry to maintain balance. For example, if a business purchases equipment, it records a debit in the equipment account (an asset) and a credit in the cash account (also an asset) which decreases cash. This ensures that the accounting equation, Assets = Liabilities + Capital, remains balanced.

Examples & Analogies

Think of it like a seesaw. If one side goes up by a certain weight (debit), the other side must come down by the same weight (credit) to maintain balance. If you buy a new laptop for your business (adding an asset), you also reduce your bank balance (another asset) by the same amount, keeping everything level.

The Importance of the Dual Aspect Concept

Chapter 2 of 2

🔒 Unlock Audio Chapter

Sign up and enroll to access the full audio experience

Chapter Content

The dual aspect concept is essential in ensuring that the financial statements accurately reflect the financial position and performance of a business, maintaining consistency and integrity in accounting records.

Detailed Explanation

The Dual Aspect Concept helps maintain accuracy in financial reporting. It ensures that all transactions are documented in a way that depicts the true state of the business's financial position. This precision is crucial for stakeholders, such as investors and managers, who rely on these records for making informed decisions. Without this concept, the financial statements could easily misrepresent the company's financial health.

Examples & Analogies

Imagine a sports scoreboard that shows points for both teams. If one team's points increase but the other team's score doesn't reflect the gameplay, viewers would have a distorted view of the match. Similarly, in accounting, if transactions are not recorded with the dual aspect in mind, it could lead to misleading financial statements.

Key Concepts

-

Dual Aspect Concept: Every transaction has two sides, ensuring the accounting equation remains balanced.

-

Double-Entry Accounting: A framework where transactions affect at least two accounts to ensure accuracy.

-

Accounting Equation: Fundamental equation in accounting that states Assets = Liabilities + Capital.

Examples & Applications

Example of purchasing a car: If a business buys a vehicle for ₹10,00,000, it records a debit in the Vehicle Account and a credit in either the Cash Account or Loan Account, representing the cash outflow or liability incurred.

When a service is rendered but payment has not yet been received, this transaction demonstrates both the earned revenue and accounts receivable, showing its dual aspect.

Memory Aids

Interactive tools to help you remember key concepts

Rhymes

Debits and credits, yin and yang, keep the balance, that’s the plan!

Stories

Once upon a time in AccountLand, every transaction had a twin. One debit, one credit, hand in hand, ensuring the books always win!

Memory Tools

DAD: Dual Aspect = Debits And Credits.

Acronyms

DACE

Dual Aspect Concept = Every transaction has an equal impact.

Flash Cards

Glossary

- Dual Aspect Concept

An accounting principle that states every transaction has two equal and opposite effects on the accounting equation.

- DoubleEntry Accounting

A system of accounting where every transaction affects at least two accounts, maintaining the balance of the accounting equation.

- Accounting Equation

An equation stating that Assets = Liabilities + Capital.

Reference links

Supplementary resources to enhance your learning experience.